The Centre on Wednesday defended the 2016 demonetisation policy, saying “the withdrawal of the legal tender character of a significant portion of total currency value was a well-considered decision” taken after extensive consultations with the RBI.

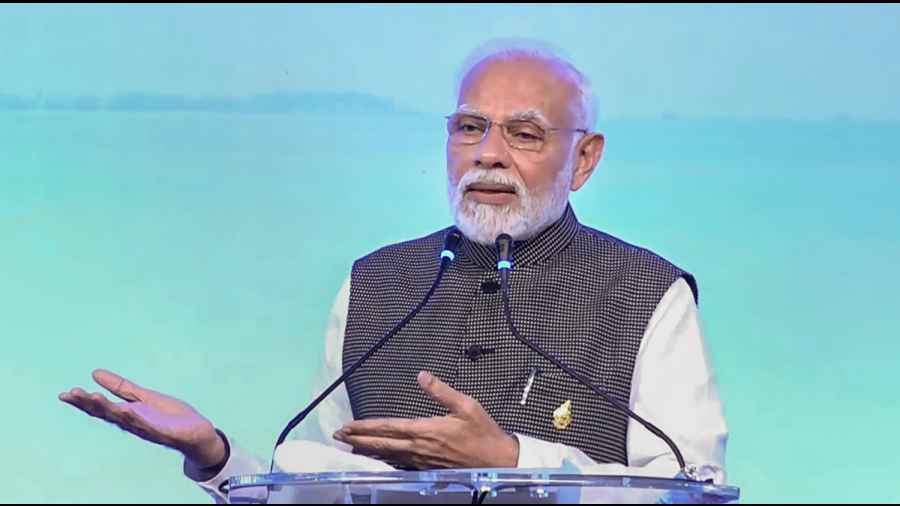

The decision was kept closely guarded to root out the menace of black money, money laundering, tax evasion and other illegal activities, the Narendra Modi government said in an affidavit filed on Wednesday evening in the Supreme Court.

The Union finance ministry has pleaded that a five-judge constitution bench desist from scrutinising a purely “economic policy” and cited the apex court’s earlier decisions that courts should not interfere with the fiscal policies of the government.

The affidavit has been filed in response to the bench’s recent directive to file one justifying the demonetisation.

A batch of PILs had assailed the demonetisation decision. In the affidavit, the government said the decision “was taken after extensive consultations with the RBI and advance preparations”.

“The then finance minister had stated in Parliament, in response to the debate on the Specified Bank Notes (Cessation of Liabilities) Bill, 2017, that the government’s consultations with the RBI began in February 2016; however, the process of the consultation and the decision-making were kept confidential,” it added.

“Moreover, in this case, changes were made to the design and specifications of the new banknotes introduced for the supply of currency into the economy.

“The preparations, therefore, included the finalisation of new designs, development of security inks and printing plates for the new designs, change in specifications of printing machines and provision of stock with RBI…,” said the affidavit, filed through finance ministry deputy secretary Rajiv Ranjan Singh.

The Centre has cited the following ”perceptible benefits” from the demonetisation:

- The number of fake currency notes and their value came down significantly, both in terms of the detection in the banks and seizures by the security agencies.

- The volume of digital payment transactions increased many-fold from 1.09 lakh transactions (valued at Rs 6,952 crore) in the entire 2016 to more than 730 crore transactions (valued at more than Rs 12 lakh crore) in a single month of October 2022.

- Information about the deposits made into the bank accounts from November 9, 2016, to December 30, 2016, enabled the income tax authorities to detect a significant amount of unaccounted income and has nudged the public to be compliant. As a result, the number of Permanent Account Numbers (PAN) returns and persons paying income tax increased significantly.

- Enrollment with the Employees Provident Fund Organisation and the Employees State Insurance Corporation has seen a much larger increase than in the past.

The affidavit added: “lt is respectfully submitted that... this Hon’ble Court may not be persuaded to further engage on dealing with the legality of the notification....

“This Hon’ble Court has generally refrained from judicial review of decisions in the realm of economic policies.”

“That notification was not a standalone or isolated economic policy action. As such, the withdrawal of the legal tender character should not be seen or scrutinised in isolation from the rest of all connected economic policy measures,” the government pleaded.