Kerala chief minister Pinarayi Vijayan has written to Prime Minister Narendra Modi seeking withdrawal of the budget proposal to tax NRIs who spend more than 120 days a year in India, saying it would hurt the state’s expatriates in the Gulf countries.

“Presently, Indian citizens or persons of Indian origin are treated as residents if they stay for 182 days or more in India. The amendment proposes to reduce this to 120 days with effect from April 1, 2021. For a resident, her/his global income is subject to tax in India,” Vijayan wrote.

“We record our strong disagreement with the move in the Finance Bill, 2020, brought in under the guise of checking tax abuse but (which) is in reality going to hurt those who toil and bring foreign exchange to the country.”

The Centre on Sunday clarified that the proposed tax on NRIs will not apply to bona fide Indians working in tax-free foreign countries and is intended to tax only those seeking to escape tax by exploiting their non-resident status, a PTI report said. (See Business)

About 3 million Malayalis work in the Gulf countries, and the state accounts for 20 per cent of the $80 billion that comes to India in remittances from expatriates across the world.

Vijayan emphasised that most of these expatriates work in the Gulf to support their families and not to evade income tax in India.

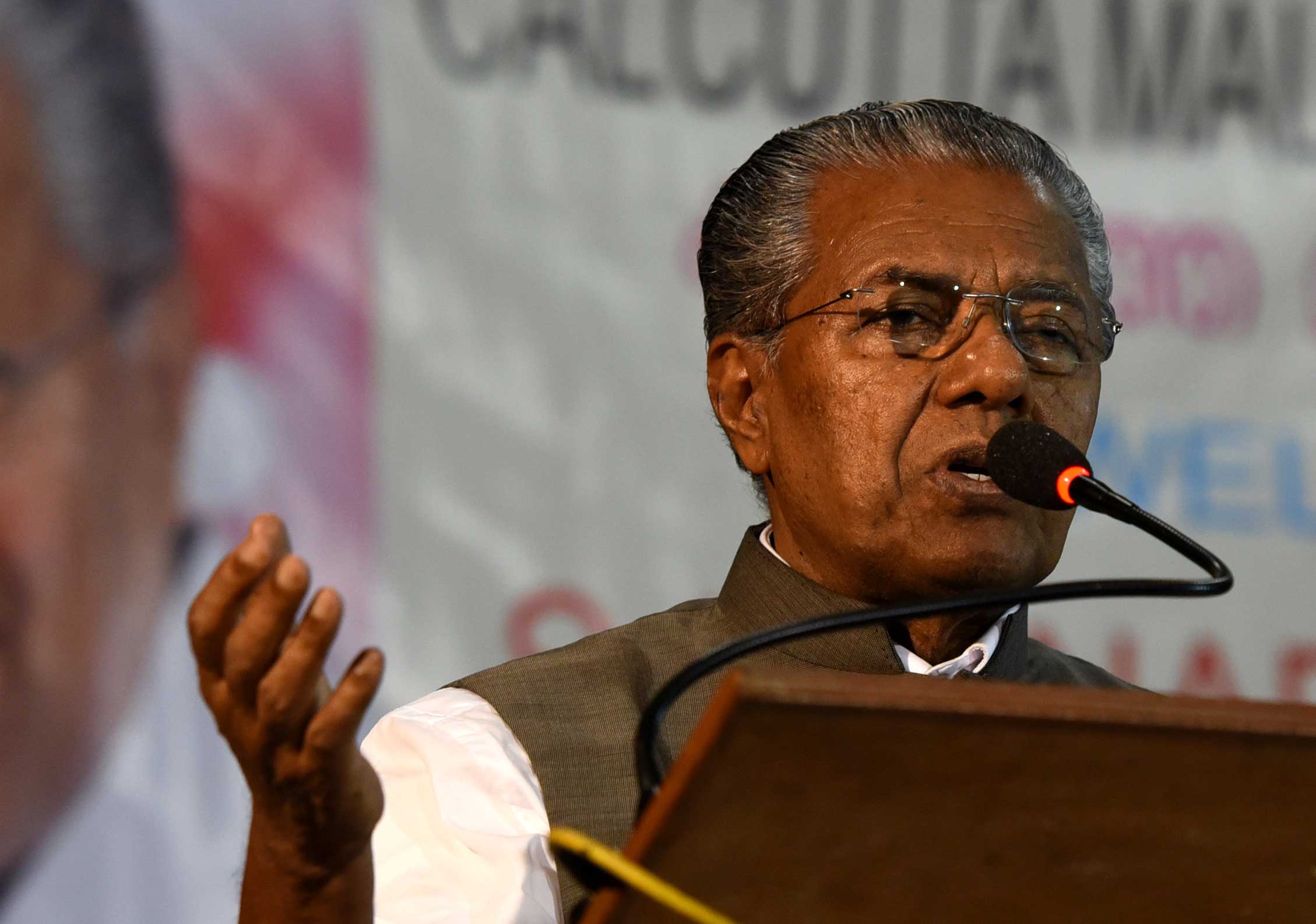

Prime Minister Narendra Modi addresses the media on the opening day of the winter session of the Parliament in New Delhi on November18, 2019. (AP)

“A large number of persons who do not fall even remotely in the category of tax evaders will be put to great hardship (because of) this proposed amendment,” he wrote.

“Persons from Kerala working in (the) Middle East and doing medium-scale businesses there have the responsibility of taking care of their families who are here. Such persons will be hard hit by the amendment.”

Vijayan also objected to “another amendment to Section 6 of the Income Tax Act, 1961, which stipulates that ‘an individual being citizen of India, shall be deemed to be resident in India in any previous year, if he is not liable to tax in any other country or territory by reason of his domicile or residence, or any other criteria of similar nature’”.

“Kerala’s economy, which is substantially supported by remittances, especially from those in the Gulf countries, will be severely adversely affected by this amendment,” Vijayan wrote in his letter.

Vijayan supported any measure to stop tax dodgers from stashing money in tax havens but added a rider.

“Here too, persons working in countries of the Gulf region which have no personal income tax will be hit. Most such persons are not in the economic upper crust,” he said.

“They need to be excluded from the ambit of this proposed amendment as they are mostly middle income people who bring to our country a part of their hard-earned income.”

Irudaya Rajan, a professor with the Centre for Development Studies in Thiruvananthapuram, said the proposal reflected how desperately the Centre was trying to mop up tax revenues.

“We are in a serious economic crisis and the government is looking to mop up every bit from wherever possible,” Rajan told The Telegraph.

He said that even if the amendment was passed, tax dodgers “are smart enough to circumvent the clause by staying for less than 120 days”.