The Odisha government has asked public sector units and state government departments to be “very careful” while keeping deposits in “any bank” and said the authorities concerned would be personally held responsible for such deposits.

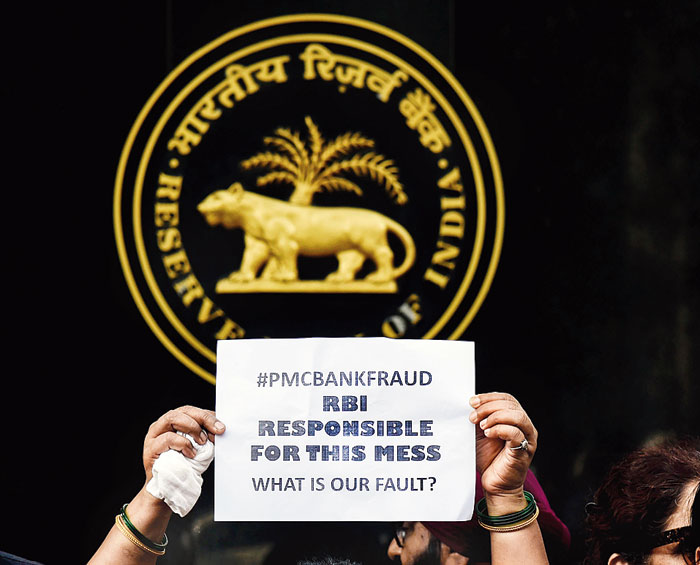

The directive from the state finance department, under the head “precaution to be taken when depositing government funds in banks”, comes at a time the deposits of lakhs of people have been locked up in the PMC Bank in Maharashtra following a scam.

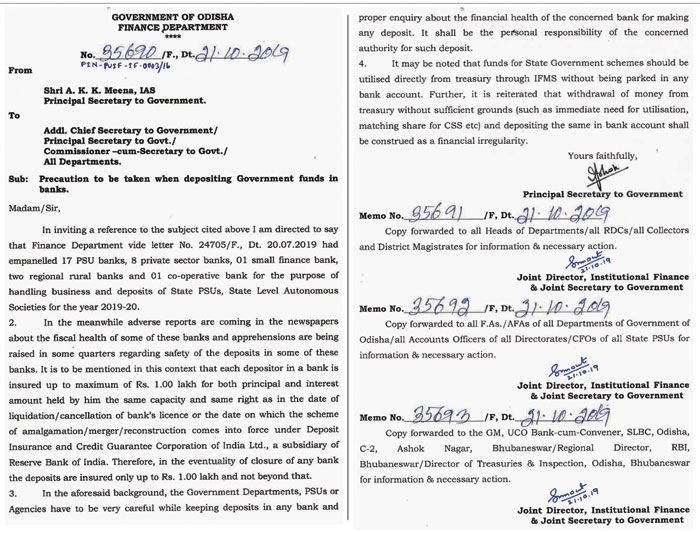

The full content of the Odisha directive, issued by principal secretary to the government A.K.K. Meena, reflects concerns among ordinary citizens about the banking system that used to be one of the most trusted financial intermediaries in the country since the late 1960s.

PMC is a cooperative bank. No scheduled commercial bank has collapsed in the country in the recent past. When Global Trust Bank, a private bank, ran into financial trouble, it was merged with the public sector Oriental Bank of Commerce and depositors did not lose money.

But the post-demonetisation atmosphere, coupled with the economic downturn and lack of data transparency, has turned many citizens nervous.

The Odisha government has reminded the PSUs, departments and agencies that the funds for state-run schemes should be used “directly from treasury through IFMS (integrated finance management system) without being parked in any bank account”.

A state government official told this newspaper that “withdrawal of funds from the treasury and parking them in banks is neither permissible nor desirable in any case”.

The government has now reminded officials of that norm, given the concern about the banks.

Meena’s letter “reiterated that withdrawal of money from treasury without sufficient grounds (such as immediate need for utilisation…) and depositing the same in bank account shall be construed as a financial irregularity”.

The backdrop of the directive was a decision by the Odisha government in July to empanel 17 PSU banks, eight private banks, two regional rural banks, a cooperative bank and a small finance bank for handling business and deposits of state PSUs and autonomous societies.

The letter issued by AKK Meena, principal secretary to the Odisha government, to senior officials and all state government departments on Monday Sourced by the correspondent

Dated October 21 (Monday), the directive from Meena says: “In the meanwhile, adverse reports are coming in the newspapers about the fiscal health of some of these banks and apprehensions are being raised in some quarters regarding safety of the deposits in some of these banks.”

The note echoes a concern that has gained traction since curbs were imposed on withdrawals from PMC Bank although bankers have tried to calm the fears.

The Odisha principal secretary’s letter says: “It is to be mentioned in this context that each depositor in a bank is insured up to maximum of Rs 1 lakh for both principal and interest amount held by him the same capacity and same right as in the date of liquidation/ cancellation of banks’ licence or the date of which the scheme of amalgamation/ merger/ reconstruction comes into force under deposit insurance and credit Guarantee Corporation of India Limited, a subsidiary of Reserve Bank of India.

“Therefore, in the eventuality of closure of any bank the deposits are insured only up to Rs 1 lakh and not beyond that.”

The ceiling of Rs 1 lakh had been put in place long ago, and there have been demands that the insured amount should be raised.

Meena’s directive adds: “In the aforesaid background, the government departments, PSUs or agencies have to be very careful while keeping deposits in any bank and proper enquiry about the financial health of the concerned bank for making any deposit. It shall be the personal responsibility of the concerned authority for such deposit.”