The BBC has said journalists were not allowed to work for several hours during the three-day tax survey at the broadcaster’s offices in Delhi and Mumbai, contesting the income-tax department’s claim that the “operation was conducted in a manner so as to facilitate continued regular media/ channel activity”.

BBC Hindi said on Saturday that the tax officials and police personnel “misbehaved with some journalists”. In a report put out a day after the IT department issued a statement on the survey, the broadcaster said journalists’ computers were searched and they were made to deposit their phones and were questioned about their reporting methods.

“Journalists in the Delhi office were stopped from writing anything about the survey,” BBC Hindi said.

Even when work was allowed to resume following repeated requests from senior editors, Hindi and English-language journalists were prevented from working for some time, it said. Journalists in these two languages were allowed to work when it was close to transmission time, the report said.

Media personnel outside the BBC office in New Delhi on Wednesday. PTI picture

The income-tax department had launched a “survey” at the Delhi and Mumbai offices of the global broadcaster at 11.30am on Tuesday, and it continued till about 10pm on Thursday.

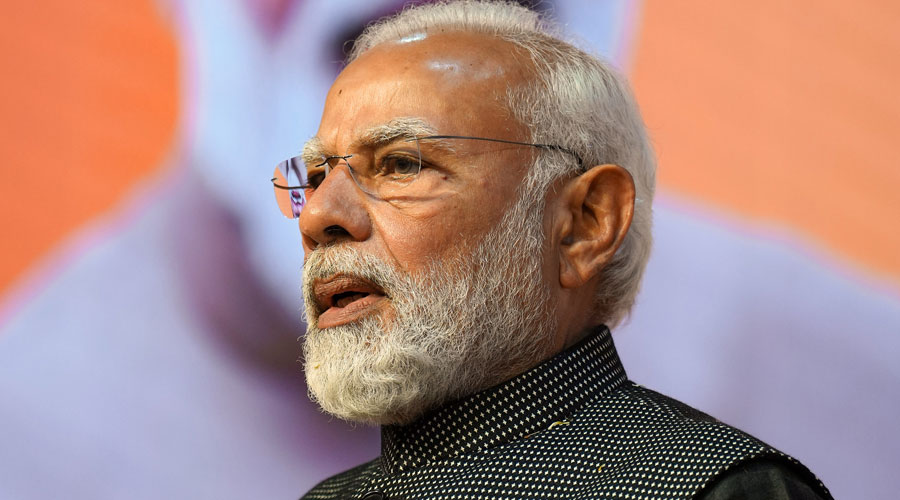

The survey came weeks after the Narendra Modi government invoked emergency powers to block, on social media platforms in the country, a BBC documentary critical of Modi. The film, India: The Modi Question, was shown by the BBC only in the UK.

On Friday, the tax department issued its first official statement on the searches. It did not name the BBC but said a survey was carried out at the business premises of a prominent international media company.

“It is pertinent to state that statements of only those employees were recorded whose role was crucial including those connected to, primarily, finance, content development and other production-related functions,” the tax department’s statement had said.

“Even though the department exercised due care to record statements of only key personnel, it was observed that dilatory tactics were employed including in the context of producing documents/ agreements sought. Despite such stance of the group, the survey operation was conducted in a manner so as to facilitate continued regular media/ channel activity.” The tax department’s statement was short on specifics — it did not spell out the assessment year the survey pertained to, nor did it quantify the extent of the purported tax violation.