The Narendra Modi government has virtually squelched India Inc’s demand for a fiscal stimulus package to kick-start a faltering economy, just a week after extensive consultations with industry shoguns that had raised the prospects of comprehensive pump-priming measures.

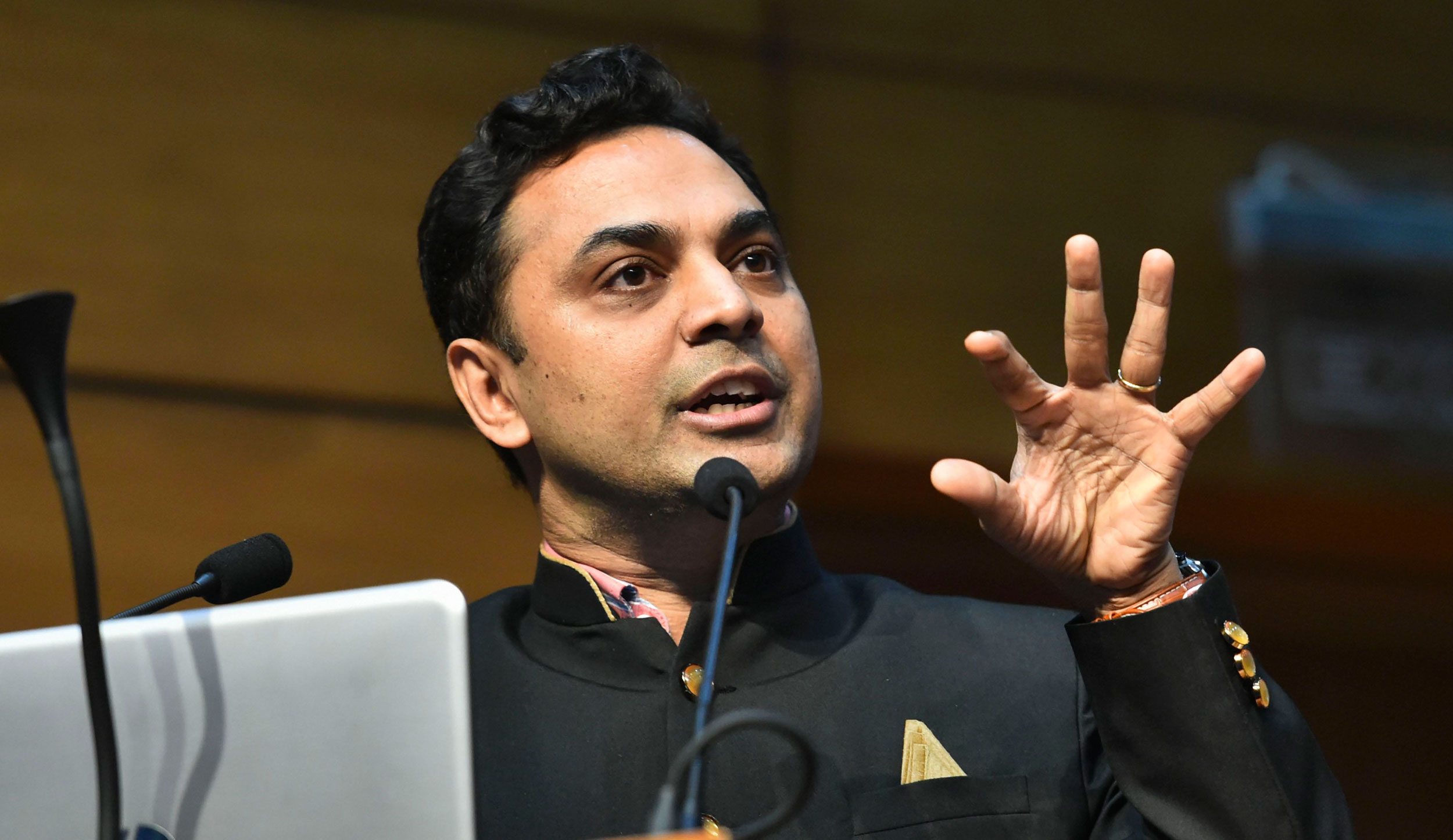

Chief economic adviser K.V. Subramanian swatted the idea of a bailout package for stressed sectors of the economy, arguing that this would raise the issue of “moral hazard” and would be seen as anathema to the very principle of a market economy.

“Since 1991 we are a market economy. And in a market economy, there are sectors that go through a sunrise and then go through a sunset phase,” he said at an event in Delhi.

“If we basically expect the government to use taxpayers’ money to intervene every time when there are some ‘sunsets’, then I think you introduce possible moral hazards from (the concept of) ‘too big to fail’ as well as the possibility of a situation where profits are (treated as) private and losses are socialised which is basically an anathema to the way the market economy functions,” he said.

The chief economic adviser’s comment sent a wave of panic through the markets and investors scurried to cover their positions. As a result, the 30-share BSE Sensex – the bellwether index — tumbled 587.44 points, or 1.59 per cent, to close the day at 36,472.93.

The rupee plunged to the day’s low of 71.97 against the US dollar before clawing back slightly to close at an eight-month low of 71.81. The rupee plumbed its lowest closing level since December 14 when it had touched 71.90.

The government’s refusal to cobble together a stimulus package comes at a time when automobile companies have started cutting back production and laying off workers, consumer goods companies have reported an alarming fall in sales, and the real estate sector has been saddled with a rising pile of unsold apartments.

Reports suggest that Japanese carmaker Toyota and South Korea’s Hyundai are the latest in a string of companies that have halted production at plants to combat slumping sales.

The Centre’s ability to finance a stimulus package is badly strained by poor tax collections and sharp spending cuts designed to cap the fiscal deficit at 3.3 per cent of the GDP this year.

The government has tried to pass the buck to the Reserve Bank of India, pressuring it to cut interest rates to revive the economy even though past experience doesn’t show that such a strategy works. The RBI has cut the policy interest rate — the repo — four times this year by a total of 105 basis points to 5.40 per cent. Banks have been slow to respond with lending rates in tandem with the policy rate cut — muffling the flow of benefits from monetary policy transmission.

But this hasn’t stopped the government from piling pressure on the central bank to cut rates further. On Thursday, power secretary Subhash Chandra Garg said the reduction in interest rates and the availability of credit to the private sector were better tools rather than providing fiscal stimulus.

The UPA government had famously provided a Rs 1.86 trillion fiscal stimulus in the aftermath of the global meltdown in 2008 that included a mix of duty cuts and government spending.

Earlier this week, former RBI governor Raghuram Rajan had also discounted the effectiveness of a fiscal stimulus, saying that it isn’t “useful in the longer-term, especially given the very tight fiscal situation that we have”.

Rajan added: “We instead need bold reforms, well thought out, not jumping off the cliff… in a variety of areas which energise the Indian people, energise the Indian markets and energise Indian business.”

The chief economic adviser said there was a need for second-generation reforms, including the pushing of divestment and labour laws, that would help promote investment in the country.