The Telegraph puts five questions to students of some of the country’s top B-schools. The questions were:

1) How do you rate the budget on a scale of 1-10?

2) What is the budget’s big idea?

3) Where has the FM scored?

4) Where has she failed?

5 ) Does the budget have enough measures to kickstart the economy?

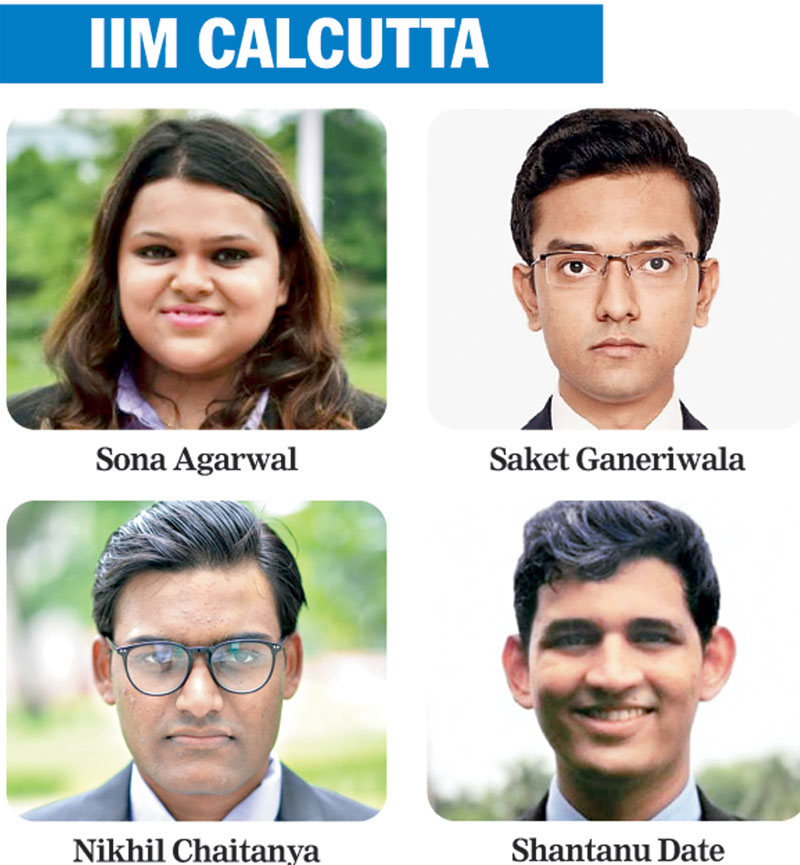

The Telegraph

(1) 6

(2) Focus on water sustainability by allocating Rs 3.6 lakh crore to Jal Jeevan mission can be a game changer. Faster claims settlements for exporters via Nirvik scheme and investment clearance cell for entrepreneurs are also positive steps to boost exports and the entrepreneurship ecosystem in the country.

(3) New tax slabs and slashed income tax rates. Bank deposit insurance cover increased to Rs 5 lakh. The audit threshold limit for MSME increased to Rs 5 crore. Allocation of Rs 99,300 crore for education and Rs 69,000 crore for healthcare sector and setting up of hospitals in Tier-2 and Tier-3 cities. Kisan Rail and Krishi Udan initiative for quickly transporting farm goods.

(4) Fiscal deficit for FY20 is pegged at 3.8%, significantly higher than the target of 3.3% set in the previous budget. Further slashing of corporate tax rate to 22%, overhaul of personal tax slabs and scrapping of DDT will put additional stress on government revenues making achieving the FY21 target of 3.5% an uphill task.

(5) Most tax benefits are focused on the middle class which primarily drives consumption. With these benefits, disposable income would increase to then increase overall demand. Public spending of Rs 103 lakh crore via national infrastructure pipeline, national logistic policy, etc, would also increase demand indirectly by generating employment.

The Telegraph

(1) 6.5

(2) The objective was to boost incomes and increase purchasing power of the citizens. A 16-point agenda (including adopting solar energy and balanced use of fertilisers) was laid down to revive the slowing agrarian economy. Abolition of DDT (dividend distribution tax) and introduction of tax amnesty scheme have been some of the big ideas.

(3) Some good measures have been suggested to boost consumer demand by leaving more money in the hands of consumers. The FM has been able to contain the fiscal deficit for the current financial year to 3.8%. She has also focused on education, skill development and health care which will ultimately lead to a higher standard of living.

(4) The Budget has failed to provide a clear roadmap to achieve the ambitious target of $5 trillion economy by 2025. While the Budget was expected to address reducing investment and unemployment, the whole narrative was only a visionary one with no short-term plans. Most of the infrastructure projects are introduced through a public-private partnership model, the implementation of which seems difficult given the current reluctance of private investors.

(5) The Budget touched upon reforms for a lot of sections of society but lacked the depth required to revitalise the stagnating economy. The big-bang reforms required to bring the economy back on course were clearly missing.

The Telegraph

(1) 5.5

(2) India has a massive demographic dividend in terms of its educated and innovative youth and the newly announced bid to reap this dividend by involving fresh engineering graduates in urban local bodies will go a long way in reinforcing execution on ground. The 16-point action plan will benefit agriculture and horticulture.

(3) The move to enhance insurance coverage on bank deposits to Rs 5 lakh will embolden confidence of depositors. Deferment of tax incidence on ESOPs up to five years will support talent acquisition for new-age businesses which are currently in nascent stage.

(4) The chink in India’s armour is on the demand side where the government has again failed to cheer up with lacklustre restructuring of tax slabs. Financial markets that meet the huge capital needs of corporate India have been left astray with no restructuring of capital gains tax and a half-hearted elimination of DDT which will now be taxed from individual taxpayers.

(5) The budget was clearly a tightrope walk for the FM. However, allocation of carrots seems amiss with important sectors such as realty falling through the cracks. A major opportunity to change sentiments and alleviate the economy has been underplayed.

The Telegraph

(1) 4.75

(2) The budget focused on aspirational India, economic development for all, and a caring society. The big idea was to present a populist policy with an aim to spur consumption with as little loss to the exchequer as possible but most of the policies contained a rider that decreased their effectiveness for the middle class that they are aimed at.

(3) Maintaining the fiscal deficit within the targeted range (3.8%) through disinvestments in LIC and IDBI is a prudent move. Sovereign funds have been wanting to invest in infra in India and the budget has given them a good incentive to invest. The electronic manufacturing scheme will encourage domestic manufacturing of mobile phones, electronics and medical devices.

(4) To provide economic relief to the real estate sector. Rather than simplifying compliance, the new direct tax regime has complicated it with multiple slabs. What needs to be seen in the fine print are the details of how the revenues and expenses for FY21 have been calculated to establish the feasibility of achieving the fiscal deficit target of 3.5%.

(5) No. The stock market was down 2.43% in the absence of much-needed economic relief to boost the economy. Also failed to give any hope to sectors facing a tough time.