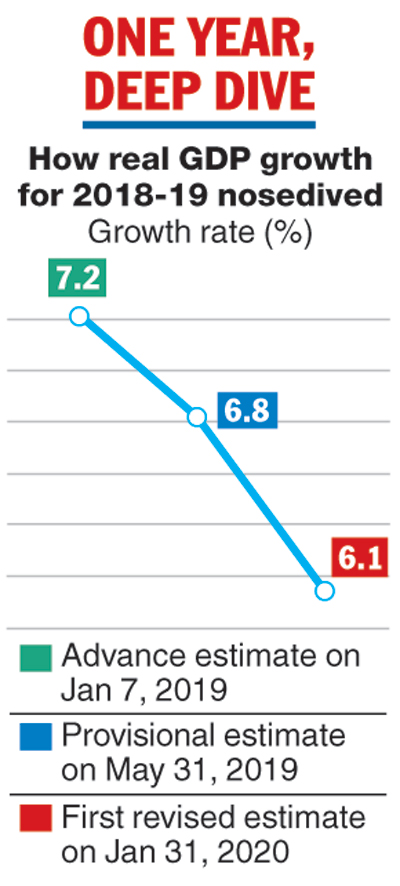

The first revised estimates of the national income in 2018-19 show that the real GDP growth a year ago had crumbled to 6.1 per cent, piling more misery on finance minister Nirmala Sitharaman who will present her second budget on Saturday.

In May last year, the National Statistical Office (NSO) had placed GDP growth in 2018-19 at 6.8 per cent in its provisional estimate. The latest revision, announced by the NSO on Friday, was attributed to a deceleration in the mining, manufacturing and farm sectors. There will be two more rounds of revised estimates.

The GDP growth for 2017-18 was also revised downwards to 7 per cent from 7.2 per cent earlier. The revised figure for 2018-19 (the general election year) shows a steeper fall.

The NSO release came just a few hours after Sitharaman had tabled the Economic Survey for 2019-20 in the Lok Sabha, which reaffirmed that growth this year would come in at a mere 5 per cent –- the lowest in a decade.

The Economic Survey, prepared by chief economic adviser Krishnamurthy Subramanian, also forecast the GDP growth in 2020-21 in a range of 6 to 6.5 per cent -– which takes a lot of the shine off the Indian economy which was once touted as the world’s fastest-growing.

Last July, Subramanian said in his Economic Survey for 2018-19: “To achieve the objective of becoming a $5 trillion economy by 2024-25… India needs to sustain a real GDP growth rate of 8 per cent.”

The following are some of the factors that stood out in the Economic Survey:

- The fiscal deficit target may have to be eased to revive growth.

- A concept called “Thalinomics” (the economics of a plate of food in the country) has been mentioned, probably with an eye on grabbing headlines, to analyse food affordability.

- The Economic Survey has also sourced some data from Wikipedia, the free online encyclopaedia created and edited by volunteers around the world. The site is not a usual source for official data. The survey also quotes from the Shrimad Bhagavad Gita, Rig Veda, Adam Smith’s An Inquiry into the Nature and Causes of the Wealth of Nations, Kautilya’s Arthashastra and Tamil saint and philosopher Thiruvalluvar’s treatise, The Thirukural, adds PTI.

- A pitch for wealth creation. But the stress appeared to be on the rise of the indices on the stock markets, which had continued to boom -– creating notional paper wealth for investors -– while the economy stuttered with growth tumbling to its lowest level since 2009 after the global financial crisis.

The chief economic adviser has one suggestion for Sitharaman ahead of her budget: the urgent priority of the government is to revive growth in the economy and, therefore, the fiscal deficit target (set at 3.4 per cent in 2019-20) may have to be relaxed for the current year.

“In order to boost the sluggish demand and consumer sentiments, counter-cyclical fiscal policy may have to be adopted to create additional fiscal headroom,” the survey said.

The Telegraph

The survey said the uptick in growth in the second half of 2019-20 was predicated by “10 positive factors”: the increase in the Nifty India Consumption Index for the first time this year, an upbeat secondary market, higher foreign direct investment flows, build-up of demand pressure, positive outlook for rural consumption, a rebound in industrial activity, steady improvement in manufacturing, growth in merchandise exports, higher build-up of foreign exchange reserves, and positive growth rate in GST revenue collections.

Not everyone was as upbeat as Subramanian. “The survey’s projected FY21 growth of 6-6.5 per cent may prove to be optimistic unless backed by a strong fiscal stimulus in the forthcoming budget and the meeting of investment targets specified in the National Infrastructure Plan (NIP) both by the central and state governments,” said D.K. Srivastava, chief policy adviser at EY India.

Wealth creation

Subramanian has clearly changed tack this year with wealth creation becoming the overarching theme of the latest Survey.

“The ultimate measure of wealth in a country is the GDP of the country,” says the Survey and contends that the exponential rise in India’s GDP since it embraced economic liberalisation in 1991 has coincided with wealth generation in the stock markets.

“During much of India’s economic dominance, the economy relied on the invisible hand of the market for wealth creation with the support of the hand of trust,” says the survey, which speaks virtuously about the blow-out rise in the Sensex since 1991 -– especially since 2014 when the Modi government began structural reforms.

It is during that phase, says the survey, that the “Sensex jumped from the 30,000-mark to the 40,000-mark in just two years” even as it claimed that the stock market “captures the pulse of any economy”.

The survey, however, did not attempt to explain the dichotomy between the stock market boom and the fall in economic growth.

In this two-handed game of wealth creation -– between the invisible hand of the markets and the hand of trust -– the government must play the role of referee, the survey said.

“The referee’s job is to not just report but also detect opportunistic behaviour if people are not playing by the rules. Wilful defaults, malpractices such as financial misreporting and market manipulation need to be detected early because they are termites that eat away (the) investor’s faith in financial markets, diminishes portfolio investments, and crowd out important national investments,” the survey added.

Jobs and GDP

Job creation has been a pain point for the Modi government and the Survey suggested that the government could meld two schemes -– Assemble in India for the world with the Make in India programme -– in order to create 4 crore well-paid jobs by 2025 and 8 crore by 2030. It said such a strategy would enable India to raise its export market share to about 3.5 per cent by 2025 and 6 per cent by 2030.

The survey has devoted an entire chapter to arguing that the concerns about an overestimation of India’s GDP are unfounded.

Former chief economic adviser Arvind Subramanian had argued last June that India’s GDP had been overestimated by 2.5 percentage points and claimed the Indian economy had grown at an average of 4.5 per cent between 2011-12 and 2016-17.

“Using careful statistical and econometric analysis that does justice to the importance of this issue, no evidence of mis-estimation of India’s GDP growth is found,” the survey said.

It added that the models that incorrectly overestimate GDP growth by over 2.77 per cent for India post-2011 “also mis-estimate GDP growth over the same time period for 51 other countries by anywhere between +4 per cent to -4.6 per cent”.