The stimulus gun merely popped on Sunday with finance minister Nirmala Sitharaman announcing a Rs 40,000-crore increase in the rural employment guarantee scheme, scuppering hopes that the Narendra Modi government would provide salve to the destitute travellers streaming out of cities and industrial towns to face an uncertain post-Covid future at their homes in the hinterland.

But Sitharaman caused more political tremors with her angry sideswipe against Congress leader Rahul Gandhi for his roadside conversation on Saturday with tired migrant workers even as she set the stage for a bitter war of words with the states over a conditional increase in their borrowing requirements.

The finance minister triggered a small earthquake in the corporate world by announcing plans to shrink the landscape of India’s public sector companies through privatisation and mergers while permitting private players to break into the forbidden realms of space, atomic energy and most railway operations — the three areas normally flagged as strategic sectors.

“Atmanirbhar Bharat needs a coherent industrial policy,” she said while announcing that the Modi government had decided to throw open all the sectors to private enterprise.

The government will soon notify a policy for the strategic sectors. “To minimise wasteful administrative costs, the number of enterprises in the strategic sectors will ordinarily be only one to four. There will be at least one public sector enterprise in the strategic sectors,” she added.

“The others will be privatised, merged or brought under holding companies.”

In all other sectors, the government plans to privatise the public sector enterprises but this will be subject to feasibility and timing. There will be no more than four PSUs in a notified sector, she said.

The announcement sparked fears that this would lead to a consolidation of public-sector banks, especially after Sitharaman refused to categorically rule out the banking sector from the ambit of the rejig exercise.

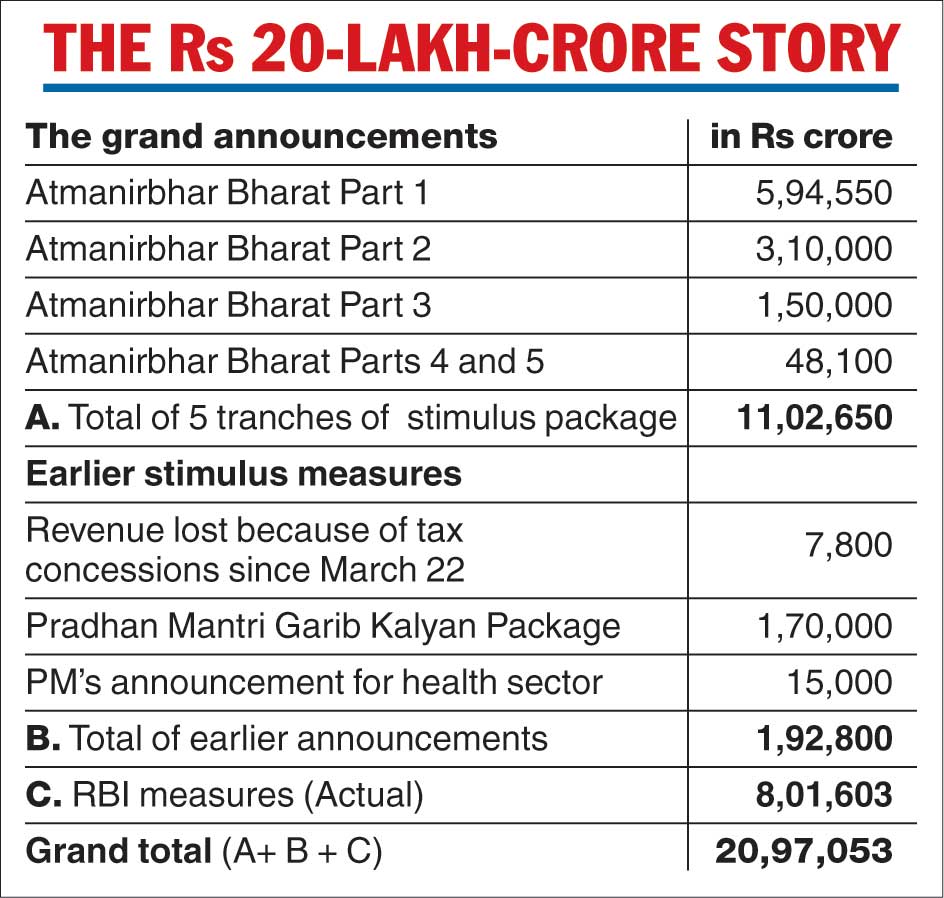

The finance minister refused to spell out what impact the Rs 20-lakh-crore stimulus package would have on the Centre’s fiscal deficit, which has been capped at 3.5 per cent of the GDP — or Rs 7.96 lakh crore — in this year’s budget.

The government has already announced a Rs 4-lakh-crore increase in its gross borrowings but it isn’t clear how much of this will go towards papering over the deficit.

“Obviously we are borrowing; we have given a new borrowing programme,” she told reporters after her final presentation. “So, you know where the money is coming from. Focus on where the money is going; we are not splurging.”

And the cat was finally out of the bag: the Centre will be counting the effects of the Reserve Bank of India’s monetary measures to beef up its stimulus package.

The Centre estimated the actual contribution from the liquidity-enhancing measures of the RBI at Rs 8.01 lakh crore. Sitharaman said the RBI had estimated it much higher -- at over Rs 9 lakh crore --- but there has never been any official word from Mint Street on this.

A quick EY analysis said the cost of the Rs 20.97-lakh-crore stimulus package would increase the Centre’s budget commitments by Rs 2.02 lakh crore. A sum of Rs 17.89 lakh crore would come from outside financing sources.

Others assessed it somewhat lower. “We estimate that the actual fiscal impact on the budget will be only Rs 1.5 lakh crore (0.75 per cent of the GDP), based on our calculations and assumptions made during the series of announcements,” said Barclays’ chief India economist Rahul Bajoria.

Raw deal for states

The borrowing limits for the states will be raised to 5 per cent of their gross state domestic product (GSDP) from 3 per cent at present but it will come with the tough conditionality of pushing reforms in four areas: implementation of the one-nation, one-ration-card plan; ease of doing business, power distribution and transparency in the revenues of urban local bodies.

The states are likely to balk at some of these demands. Sitharaman did not spell out what she meant by ease of doing business except to briefly mention the need to amend the states’ Agriculture Produce Market Committee Acts. The Centre is trying to break the hegemony of the country’s 2,400 primary mandis to try and create a national common market for agricultural commodities.

Trinamul Congress leader Partha Chatterjee said in Calcutta: “We sought a moratorium from debt-servicing, because we are a debt-stressed state for no fault of our own. Instead, the Centre is showing states the way to more debt. That is very sad for the state.”

He added: “The announcements (of Sitharaman) clearly show that the BJP-led Centre wants to make the most of the calamity and fulfil its pending political agenda. The people of this nation could not imagine such indifferent cruelty even at this hour.”

Two other “reform areas” that could turn into points of friction in federal-state relations include an attempt to force the states to provide guarantees for Rs 90,000 crore worth of fresh loans to power distribution companies in order to bail them out of a financial mess. The other is a plan to force rich municipal corporations to divulge their sources of revenues, which too could turn into a casus belli.

The increase in the borrowing limit to 5 per cent of the GSDP will give the states extra resources worth Rs 4.28 lakh crore. At present, their collective borrowings are capped at Rs 6.4 lakh crore.

The government has decided to give the states an automatic increase of 0.5 per cent of the GSDP without tagging any conditions. The next 1 percentage point increase will be linked to the four areas of reform, Sitharaman said. The final 0.5 per cent will be given as an incentive if the states meet measurable milestones in at least three of the four areas of reform, she added.

Sitharaman claimed the states had been pressing the Centre to raise their borrowing limit but had not raised more than 14 per cent of their current limits.

She said the states had been allowed in March to raise 75 per cent of their current borrowing limits. “Let me put it on record that 86 per cent of the authorised limit remains unused,” she said.

Brickbats fly

A torrent of criticism flowed against the government’s stimulus package from industry and economists.

“Like all serials, the Nirmala serial is also finally over. It has done what the GoI (Government of India) had not done so far, namely rubbing salt in the wounds of the poor,” tweeted former finance minister Yashwant Sinha and one-time fellow traveller of the BJP.

“One could call it a reform policy package as it did not have significant fiscal stimulus measures,” said N.R. Bhanumurthy of the National Institute of Public Finance and Policy.

“The liquidity-enhancing steps certainly indicate the warning expressed by global rating agencies that the (fact that the) sovereign rating is under close watch has been playing on the minds of the policy makers,” he added.

Economist Pronab Sen said: “Most of the package consists of supply-side measures and will not stoke demand. These are not fiscal stimulus measures as most of it is providing liquidity. The policy measures should have addressed both the supply and the demand side. But that has not been achieved.”

Industrialists were equally scathing and said the stimulus package did not address the real problems in the economy.

“Most disappointed at lack of bold measures in stimulus packages -- don’t think demand will be created n consequently economic activity will be stifled… Rs 20 lakh crore was a huge amount n it was meant to stimulate economic revival n growth…. Healthcare sector has been short-changed. No stimulus for hospitals which have to bear increased operating costs due to Covid-related protocols. Their non-Covid patient footfalls have dropped 80 per cent. So much for our heroes of COVID-19… Patients will have to pay more,’’ said Biocon executive chairperson Kiran Mazumdar-Shaw.

Sangita Reddy, joint managing director of the Apollo Hospitals Group and President of the Federation of Indian Chambers of Commerce and Industry, said the private healthcare sector had suffered a loss of around Rs 12,000 crore.

“Many private players r working tirelessly with govt 2 serve public. I hope the govt recognizes this & extends some stimulus 4 the health of the nation… it’s critical 2 support healthcare,” she tweeted.

The Confederation of All India Traders (CAIT), which represents the large community of retail traders and has been a strong supporter of the BJP in the past, expressed “deep disappointment and resentment” against the government on behalf of the seven crore traders in the country. It claimed that the stimulus package had completely ignored their interests.

CAIT national president B.C. Bhartia and secretary-general Praveen Khandelwal said the entire trading community was extremely upset with the government for its step-motherly treatment.

The Retailers’ Association of India (RAI) too expressed disappointment with the Atmanirbhar Bharat economic stimulus, saying the emergent issues facing retailers had not been addressed.

Other measures

The Centre also announced plans to decriminalise most of the sections of the Companies Act and raise the number of compoundable offences that can be tried under an internal adjudication process to 58 from 18 in order to “decongest” courts.

The government said it would stop fresh insolvency proceedings under the bankruptcy resolution process for one year. Small and medium businesses will be largely able to escape bankruptcy proceedings as the threshold for default that triggers an IBC referral has been raised to Rs 1 crore from Rs 1 lakh.

Companies have been permitted to directly list their securities in overseas jurisdictions.

The finance minister announced that companies listing their non-convertible debentures on stock exchanges would not be regarded as “listed companies” – raising the possibility that they may be able to duck the tough disclosure requirements of the bourses. Several companies have defaulted on their NCD repayments, raising concerns about another looming area of financial crisis.