Former RBI governor Raghuram Rajan had asserted in his book I Do What I Do: “At no point during my term was the RBI asked to make a decision on demonetisation.”

Rajan stepped down as RBI governor on September 4, 2016, at the end of his threeyear term. The demonetisation was announced a little over two months later on November 8, 2016.

The economist’s account in his book, released in September 2017, assumes fresh significance in light of the Narendra Modi government’s insistence that it had been in consultations with the central board of directors of the Reserve Bank of India for six months before the announcement on November 8, 2016.

Monday’s Supreme Court verdict that upheld the constitutional validity of the demonetisation revealed some details about how the RBI’s consent was obtained — and raises certain questions about the independence of the central bank.

“The record would reveal that the matter was under active consideration for a period of six months between the RBI and the Central Government,” the verdict says.

That is not how the former RBI governor recalled it. There has always been a lot of speculation on whether Rajan and his team knew about the government’s move to impose the demonetisation and, if so, whether they approved of it.

In the introduction to his book, Rajan gives his version.

“I was asked by the government in February 2016 for my views on demonetisation, which I gave orally. Although there might be long-term benefits, I felt the likely short-term economic costs would outweigh them, and felt there were potentially better alternatives to achieve the main goals. I made these views known in no uncertain terms,” Rajan writes.

Rajan stepped down in September. It appears the consultations between the RBI intensified in the two months before the November 8 announcement.

Rajan went on to add: “I was then asked to prepare a note, which the RBI put together and handed to the government. It outlined the potential costs and benefits of demonetisation, as well as alternatives that could achieve similar aims. If the government, on weighing the pros and cons, still decided to go ahead with demonetisation, the note outlined the preparation that would be needed, and the time that preparation would take. The RBI flagged what would happen if preparation was inadequate.

“The government then setup a committee to consider the issues. The deputy governor in charge of currency attended these meetings. At no point during my term was the RBI asked to make a decision on demonetisation.”

Consent process

The verdict also explains the process through which consent from the RBI was obtained.

It becomes clear that the Centre had asked the RBI’s central board to consider the issue and recommend demonetisation -– which raises some questions about how independent the central bank’s decision-making really is.

“Merely because the Central Government has advised the Central Board to consider recommending demonetisation and that the Central Board, on the advice of the Central Government, has considered the proposal for demonetisation and recommended it and, thereafter, the Central Government has taken a decision, in our view, cannot be a ground to hold that the procedure prescribed under Section 26 of the RBI Act was breached,” the court verdict said.

Sections 22, 24 and 26 of the RBI Act say that in various matters pertaining to currency, the course of action is to be taken by the central government on the recommendation of the Central Board.

It cannot be disputed that the final say with regard to economic and monetary policies of the country will be with the central government. However, in such matters, it has to rely on the expert advice of the RBI.

“An element of interaction/consultation in such important matters pertaining to economic and monetary policies cannot be denied to the RBI and the Central Government,” the court said on Monday.

After Rajan

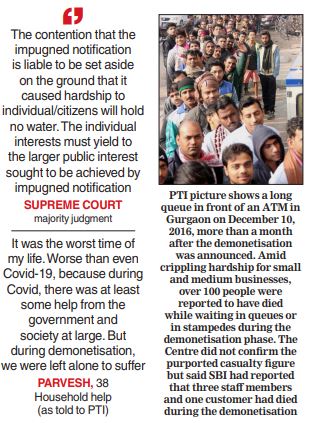

Later, it was reported that the RBI Central Board had met hours before the demonetisation announcement, and although it had recommended the decision, it had cited at least two objections to the rationale behind the move. It had said that a large part of black money was held not in cash but through assets like real estate and gold. The board had also said that the percentage of counterfeit notes was not very significant.

At the helm of the RBI, Rajan was succeeded by Urjit Patel who resigned on December 11, 2018, nine months before his term was to end. The premature stepdown prompted many to ask whether the central bank was an independent body. The then deputy governor, Viral Acharya, had said on October 26, 2018: “Governments that do not respect central bank independence will sooner or later incur the wrath of financial markets, ignite economic fire, and come to rue the day they undermined an important regulatory institution.”