The Congress on Tuesday asked Prime Minister Narendra Modi whether he had transferred Indian taxpayers’ money to private Indian companies that fund his political activities, referring to certain reported Russian deals involving Gautam Adani.

The party also asked: “Are the Adani group and other business houses involved in a global kleptocratic network to channel public funds into the coffers of politically connected leaders in India?”

Since the Adani controversy broke, the Congress has asked the government 45 questions, mostly relating to national security, crony capitalism and transparency in governance.

“The Adani Group has done several related-party transactions using Russia’s VTB Bank, which has faced international sanctions for several years,” Congress communications chief Jairam Ramesh said.

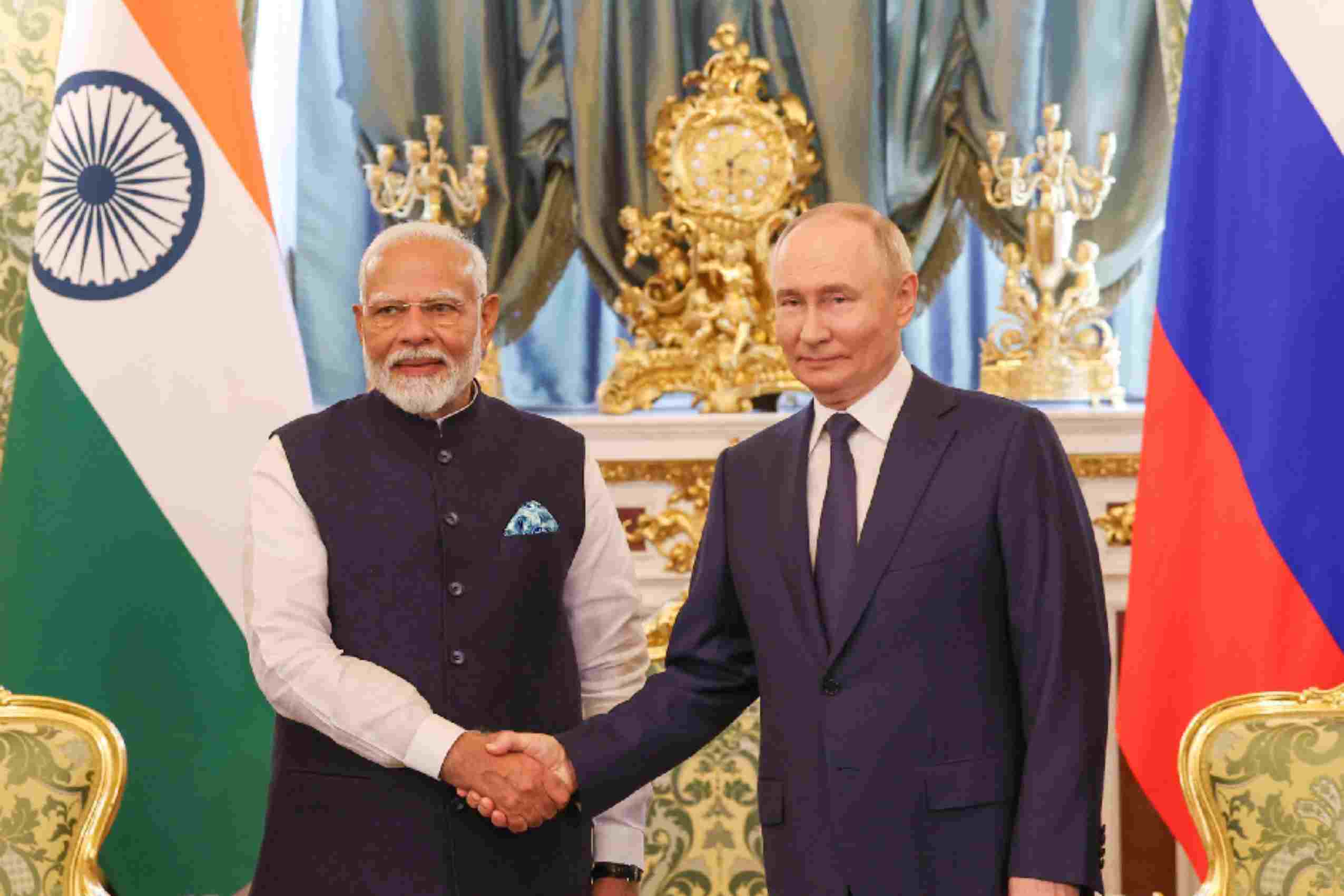

“VTB also makes an appearance in the Rosneft Oil purchase of an Essar-owned port and refinery in Gujarat for $13 billion on 14 October, 2016, which, it was widely reported, Russian President Vladimir Putin and Prime Minister Narendra Modi played a critical role in finalising. However, a Russian analyst report stated that ‘we have estimated that Rosneft has agreed to pay at least twice as much as Essar Oil is worth’.”

Ramesh added: “Curiously enough, between September 4, 2015, and October 28, 2016, public sector firms ONGC, Oil India, Indian Oil and Bharat PetroResources together bought a 49.9 per cent stake in the Rosneft Oil subsidiary Vankorneft for $4.23 billion, in which VTB may also have been involved.

“Given the continuously falling production at Vankorneft and a lack of management control over the asset, the former Russian deputy minister of energy, Vladimir Milov, stated that ‘the Indian companies have clearly overpaid for the Vankor stakes’.”

Alleging foul play, Ramesh said: “This is a suspicious pattern in which public sector units overpay a Russian firm for an oil asset, which in turn overpays a politically connected private Indian firm for another energy asset. Given your (Modi’s) direct involvement in the Essar transaction, did you transfer Indian taxpayer(s’) money to the pockets of private Indian companies to help finance your political activities?”

On the alleged kleptocratic network, Ramesh said: “New Leaina is a Cyprus-based entity, 95 per cent of whose investments have been in Adani group companies (adding up to $420 million). The ‘ultimate beneficial owners’ of this fund are linked to the financial services firm Amicorp.”

Ramesh said: “Amicorp is believed to have set up at least seven Adani entities, 17 offshore shell companies linked to Gautam Adani’s brother Vinod and three Mauritius-based offshore investors in the Adani group stock.”

Ramesh added: “Amicorp is notorious for its involvement in the ‘1MDB’ scam in which $4.5 billion from Malaysia’s sovereign wealth fund ‘1Malaysia Development Berhad’ were embezzled by senior political figures.

“One of the Amicorp entities implicated in that scam was until recently a shareholder in New Leaina. Are the Adani group and other business houses involved in a global kleptocratic network to channel public funds into the coffers of politically connected leaders in India?

“New Leaina appears guilty of ‘stock parking’, in which a third party holds shares to conceal the actual owner’s ownership or control before regulators. Since we know that Sebi has had these firms on its radar for some time now, what is the status of the investigation into the illegal practice of stock parking by shells and entities related to the Adani group? Are the firm’s deep global links inhibiting a proper investigation?”