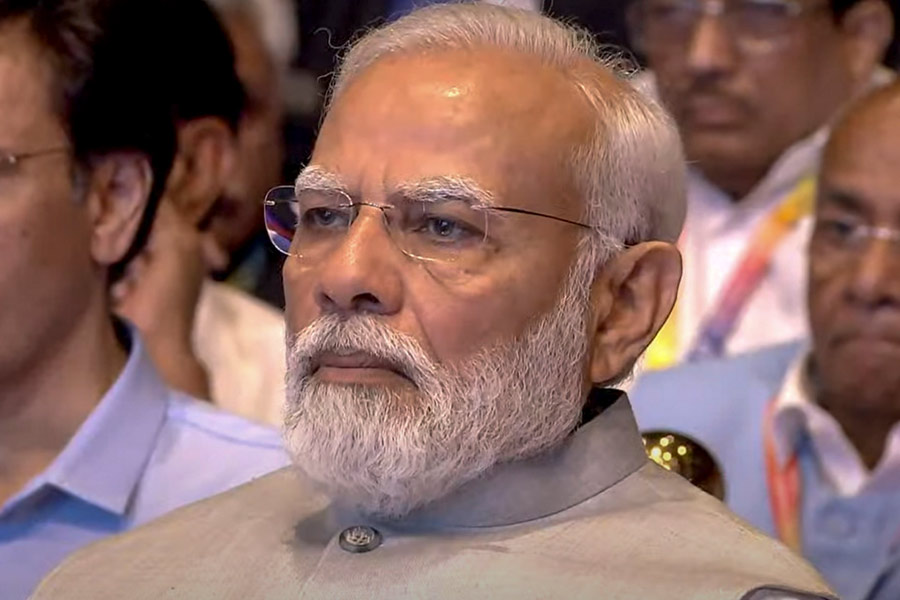

The Congress on Monday objected to Indian firms using the Chinese currency yuan to buy Russian crude oil, wondering whether the Narendra Modi government was helping the Chinese project of replacing the US dollar as the preferred currency for international trade.

“Apart from some private refiners, even the public-sector giant Indian Oil is reported to have made payments in the yuan. While the Indian consumers have not received any benefit from the cheap import of crude oil — not even a rupee’s benefit — the Chinese economy is being boosted,” Congress spokesperson Gourav Vallabh said.

“We need to understand the chronology: Modi meets Chinese President Xi Jinping 18 times. China grabs our land and renames our villages. The Prime Minister says there is no intrusion. Chinese soldiers kill 20 of our soldiers but the trade with China soars.

“We withdraw from our own territory where the Indian army used to traditionally patrol. Now we see Indian companies helping the Chinese internationalise their currency.”

While the information about some Indian refiners providing part of the payments in yuans has been in the public domain for some time, what may have provoked the Congress to raise the issue now is an endorsement of the move from the Chinese State-run newspaper, Global Times.

“Indian refiners have begun paying for some oil imports from Russia in the Chinese yuan as an alternative to the US dollar for settling payments,” the Chinese daily wrote.

“Experts highlighted the move as a forward step in the de-dollarisation process of the three major economies amid the yuan’s increasing internationalisation.”

It added: “The reported move will enhance the yuan’s international influence and increase the market share of the yuan in the global circulation and settlement, while facilitating the advancement of the yuan’s internationalisation process, Pan Helin, director of the Research Center for Digital Economics and Financial Innovation affiliated with Zhejiang University’s International Business School, said.”

Quoting another expert, Dong Dengxin, director of the Finance and Securities Institute at the Wuhan University of Science and Technology, Global Times said: “It will speed up the de-dollarisation process in China, India and Russia amid the accelerated de-dollarisation push. It will further expand the use of the yuan in international trade.

“As India and Russia are both BRICS members, their use of the yuan in settlement will also inspire more emerging economies and developing countries to follow the path.”

The RSS-BJP ecosystem had tried to whip up an anti-China frenzy as the Modi government banned some Chinese apps in the aftermath of the May 2020 border transgressions, and some Indians had begun boycotting certain Chinese products. But trade with China continued uninterrupted and reached new heights.

While Prime Minister Modi clammed up on China after his “no one has entered our territory” remark, the foreign and defence ministers kept talking about tense situations and disengagement processes.

Accusing the Modi government of duplicity, Vallabh said: “Why can’t we pay in rupees? While the rupee is falling continuously, we are helping the yuan. Why did the government not prefer other currencies?”

Reports suggest that only a portion of the payments, around 10 per cent, were made in yuans on the demand of the Russian companies. Sanctions imposed by the US on Russia after the start of the Ukraine war have made dollar payments untenable.

The US dollar has always been the main global currency but the yuan is now playing an increasingly important role in Russia’s financial system because of the sanctions.

Russia has a robust trade partnership with China while its trade deficit with India is huge, making transactions in rupees less lucrative. Russian companies prefer the yuan, which can be used for purchases with China.