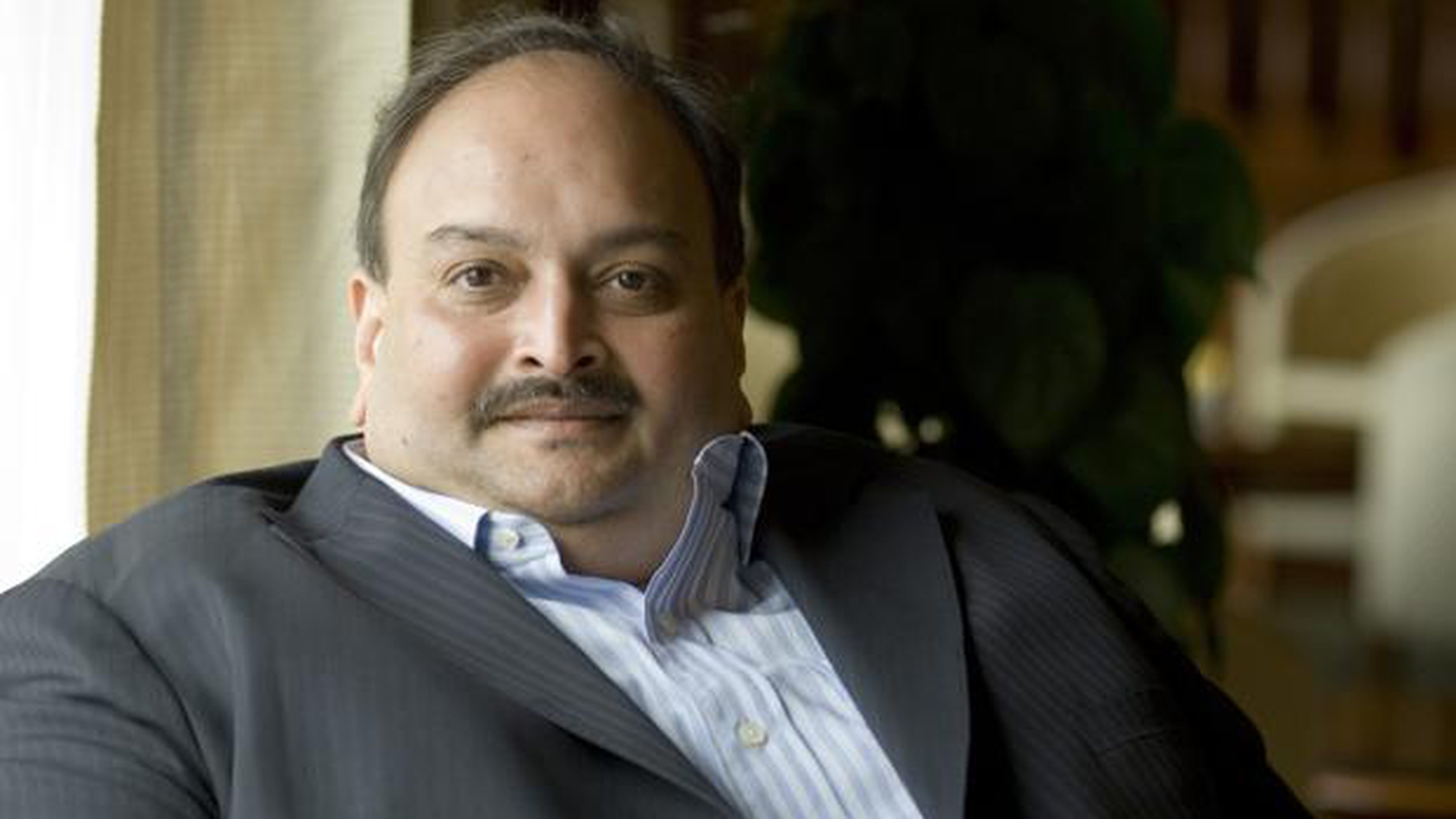

Mehul Choksi is not keeping well. Or so the absconding billionaire and uncle to the absconding diamantaire, Nirav Modi, told the Enforcement Directorate when he was asked to appear in a Mumbai court not long ago.

It is a pity, for had Choksi been in better health, he would have been able to enjoy his new country, Antigua and Barbuda, to its fullest. He would have been able to visit a new beach every day of his very first year as citizen — Antigua and Barbuda has, after all, 365 beaches.

According to the island country’s government, Choksi applied for its citizenship-by-investment programme in November 2017. Choksi, who along with Modi, allegedly cheated the Punjab National Bank of over Rs 13,000 crore, made an investment of $4,00,000 (nearly Rs 3 crore) in Antigua. By January 2018 he got a new passport. He went missing from India soon after; the Interpol issued a Red Corner Notice against him in December. He returned the Indian passport last month.

Neither Choksi nor his lawyer, David Dorsett, responded to repeated queries by The Telegraph, but it seems Choksi window-shopped for a new citizenship a good while before he zeroed in on Antigua and Barbuda. And he was not the only one with the bright idea. In 2017 and 2018, many of India’s ultra-rich either went around shopping for new passports or looking for a permanent residence outside India. Johannesburg-based wealth consultancy New World Wealth pegs the figure at 7,000 for 2017. The figures for 2018 are yet to be released.

Cape Town-based law firm Henley & Partners, which aids scores of Indian citizens in similar matters, cites client confidentiality agreements when quizzed about names of Indians who have availed their services. “But we can confirm that there has been a growing interest from affluent and talented Indians and their families in investment migration programmes,” says Sarah Nicklin, spokesperson for Henley.

According to New World Wealth, since 2007, 38,000 high net-worth individuals or HNWIs — anybody whose networth is more than $1 million — have left India in search of residence and citizenship. Almost half of these migrations have taken place in the last four years.

Not everyone who opts for a new citizenship by investment wants to run away from the government authorities and the courts like Choksi. There are others who cite easier tax regimes, business-friendly climate and better lifestyles as their chief reasons.

One such individual, who has taken up a residence by investment programme but retains the Indian passport, speaks to The Telegraph. He is an heir to a large Indian conglomerate with interests in real estate and finance and does not wish to be identified. He says, “For every Choksi, Modi and Vijay Mallya, there are a hundred others like me who have left India without a single criminal or a civil case against us. But the fact is that many HNWIs are leaving because of a tough investment environment and tax terrorism. It is easier now to invest abroad and earn.” As against citizenship by investment, residence by investment programmes are for those who don’t want to surrender their Indian passports but can get residence rights by buying properties or making investments.

Sandeep Nerlekar is managing director and chief executive officer of Mumbai-based Terentia, which formulates succession plans for family businesses and provides advice on the best countries to conduct business in or settle down in. According to him, the reasons to settle abroad could be many. “It could be business interests or the fact that other family members are abroad or someone might want to stay in neutral jurisdiction where business and other opportunities are better and there is safety,” he says.

Nicklin agrees. “As the world economy has become increasingly globalised, the need for greater visa-free access has grown steadily. Across the economic spectrum, individuals want to transcend the constraints imposed on them by their country of origin and access business, financial, career and lifestyle opportunities on a global scale,” he says.

Anthony van Fossen of Australia’s Griffith University, who has studied various citizenship programmes across the world, says the reason for purchasing a new citizenship is not exclusively economic. “Many purchased passports offer enhanced visa-free travel and permanent residence in attractive countries.” This is precisely what at least 20 tiny island countries around the world, mostly in the Caribbean, offer. This means Choksi and nephew Modi can now travel to 150-plus countries without visas because of their new citizenship, something the Indian passport cannot offer.

Some European countries like Greece, Malta, Moldova and Cyprus also offer citizenships at $2,00,000 to 1 million (Rs 1.5 to 7 crore). And if you have more than $1,00,000 to spare, you can easily get citizenship of the Dominican Republic. The prices go up with the United States at the top of the ladder and costing a few million dollars.

But it is the Caribbean island countries that have taken a lead in granting citizenships by investment in recent years on a large scale. Thanks to more and more people becoming dollar millionaires in China and India, the business of selling passports is said to be worth tens of billions of dollars and is booming like never before. In fact, Van Fossen says selling nationalities for a profit is “an emerging industry” and it has generated an estimated $2 billion for several countries in the Caribbean in 2016 alone. It is so popular that Antigua and Barbuda’s Prime Minister, Gaston Browne, claimed in 2016 that the passport sales programme alone contributed to 14 per cent of the country’s gross domestic product. St. Kitts, for instance, earned as much as 40 per cent of its revenue in 2014 from selling passports.

But not every country remains as welcoming. Some are already revising their citizenship and extended residence programmes. The latest to do so is Great Britain, which recently decided to suspend its Tier 1 visas or “golden visas” that were allegedly being used by fugitives from other countries and even those involved in organised crime. All these years, foreign nationals could invest to the tune of £2 million in local bonds or make an investment in a company and be eligible for citizenship in five years. This could be hastened with a higher investment. Britain now says that it will reintroduce the golden visa but with stringent conditions and regulations. (None of this affects Vijay Mallya though as he has a UK residency permit since 1992, and doesn’t come under any of the residency or citizenship by investment programmes.)

Then there is the fact that not all these migrations end in success. While people like Choksi are on tenterhooks because of a possible extradition, those who went abroad in search of better opportunities also faced problems. Nerlekar of Terentia says many rich Indians who sought and obtained US citizenship through investment programmes surrendered their green card within a few years. He says, “Taxes in countries like the US are layered and when you take all of them into account, far higher than in India. We know many Indians who have returned.”

Some claim this trend may be detrimental in the long run as the Government of India may be losing revenue in terms of taxes that these people would otherwise pay if they lived and worked in India. And it is for this reason that the income tax department set up a working group in 2018 to study this phenomenon. One of the members of the working group says that the department is probing ways to make it tougher for people to transfer their assets abroad.

But does India need to worry about so many ultra-rich Indians going abroad? According to New World Wealth’s latest study, India currently has 3,30,000 HNWIs, of which around 20,700 are multi-millionaires or those with net assets of $10 million or more.

Assures Andrew Amoils, who is New World Wealth’s head of research, “In our view, these outflows are not particularly worrying as India is still producing far more new millionaires than it is losing. Also, once the standard of living in India improves, we expect several wealthy people to move back.”