Investors clobbered Adani group stocks on Friday, spooked by the welter of accusations levelled against India’s richest tycoon by US short-seller Hindenburg Research which also sapped enthusiasm for the Rs 20,000-crore follow-on public offer of shares in group flagship Adani Enterprises.

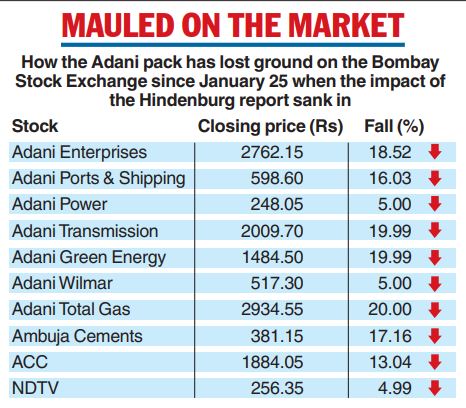

In a frenzied bout of trading, Adani Enterprises tumbled below the FPO floor price of Rs 3,112 per share and closed the day at Rs 2,762.15, down 18.5 per cent from Wednesday’s close.

The other group stocks battered in Friday’s mayhem included Adani Transmission, Adani Green Energy, Adani Total Gas, and Adani Ports and Shipping.

Analysts said the listed Adani firms lost more than Rs 3 lakh crore in market capitalisation on Friday and more than Rs 4.10 lakh crore since Wednesday.

The three companies recently acquired by the Adani group — Ambuja Cement, ACC and NDTV — also wilted. The tycoon has seen over $7 billion of his personal wealth wiped out since the start of the year, according to the Bloomberg Billionaires’ Index which has yet to factor in Friday’s meltdown.

At 5pm, data showed that the cumulative subscription on the BSE and the NSE to Adani Enterprises’ FPO was a piffling 1 per cent of the 4.55 crore shares on offer. The issue received bids for just 470,160 shares.

Earlier in the day, the Adani group held a conference call with global bondholders during which it tried to soothe their concerns by rebutting the Hindenburg report’s accusations of financial and accounting shenanigans involving at least 32 entities in various tax havens along with serious corporate governance lapses.

The investor call was arranged by Barclays Plc, Deutsche Bank AG, Mitsubishi UFJ Financial Group Inc. and Standard Chartered Plc.

Myths: Adanis

Late in the evening, the Adani group released the 18-page presentation titled “Myths of Short Seller” which made two key assertions: first, it said, eight of the nine public listed entities were audited by one of the Big Six auditors, including Ernst & Young and Walter Chandiok & Co. The unlisted Mumbai International Airport Ltd (MIAL) is audited by Grant Thornton, it added.

Auditor

But it did not specifically deny the Hindenburg charge that the statutory auditor of Adani Enterprises -– the group flagship -– was Shah Dhandharia & Co, a newbie chartered accountant firm run by a couple of auditors in their late twenties.

Last year, Shah Dhandharia & Co LLP was reappointed as Adani Enterprises’ statutory auditor for five years till 2027.

Second, the group said that less than 4 per cent of promoter group holding was encumbered by way of pledge for loans against shares.

But the presentation did not provide straight answers to the 84 questions that the Hindenburg report had lobbed at the Adani group. The Adani presentation said 21 of these questions were linked to related party transactions –- termed questionable by Hindenburg -– that were disclosed in various public documents since 2015.

Suit dare

The Adani group has already indicated that it is planning to sue Hindenburg Research for putting out “maliciously mischievous” claims just ahead of Adani Enterprises’ FPO. The US short-seller has dared the Adanis to file its suit in the US as that will enable it to gain access to a stack of documents under the American judicial process which, it believes, will buttress its accusations.

Price revision

If the Adani Enterprises stock continues to fall in the days ahead, the promoters have the option to revise the FPO price.

The share float comes in a price band of Rs 3,112-3,276 per share. There is a small bait for retail shareholders who stand to win a discount of Rs 64 per share from the issue price.

“With the AEL share trading over Rs 513 lower than the FPO price cap of Rs 3276, it is natural to ask ‘why would one subscribe to the FPO’? The Adani group has to come up with a Plan B over the weekend, else the issue will fail. The only option for the company is to reduce the price band. If this is done, the overall proceeds will get reduced to that extent and AEL may not be able to raise Rs 20,000 crore,” Arun Kejriwal, director, KRIS, an investment research firm, told The Telegraph.

There have been several instances in the past when companies have revised the FPO price band after a poor response. In January 2020, ITI extended its FPO by three days and lowered the price band as it had not obtained full subscription. This was done on the last date of the bidding.

Under Sebi rules, the issuer will have to extend the subscription date by at least two days if it revises the price. If AEL does this midway (and not on the last day which is January 31), it will probably be the first company to do so.

Other market pundits, however, believe that the issue will sail through as the investors need to pay only 50 per cent of the price upfront. If investors take a medium to long-term view of the company, they might be prepared to acquire the stock.

However, the Hindenburg report has said the stock price has been pumped up to unsustainable levels -– and added that the fundamentals of the company’s performance bear no relation to the sky-high valuation of the stock.

The latest quarterly results show that the consolidated earnings per share (EPS) of Adani Enterprises is Rs 7. Even at Friday’s closing price of Rs 2762.15, the price-toearnings (PE) ratio works out to an astounding 394. Before the stock fell, it had a PE of over 500 — which means the stock was running far ahead of current performance by betting on a distant tomorrow. Incidentally, most of its peers have a PE closer to 30.

The Hindenburg report has claimed that seven of the Adani group companies run the risk of losing 85 per cent of their current valuations.