Australian entities that put money into Gautam Adani’s companies because they believed they were investing in the very positive India growth story are now facing heavy losses, a UK newspaper report has claimed.

“Adani stock rout leaves tens of millions in Australian retirement savings exposed,” says a report written by Michael Barrett, the senior business reporter for the Australian edition of The Guardian newspaper in the UK.

The report said: “Tens of millions of dollars worth of Australian retirement savings have been exposed to the beleaguered Adani Group as the Indian conglomerate faces a stock rout after allegations of fraud.

“Several major superannuation funds, including those that cater for government workers in Queensland and employees at the Commonwealth Bank (CBA), invested in the company after allocating money to emerging markets to boost returns.”

The report went on: “Australia’s $243bn Future Fund, which was set up to strengthen the commonwealth’s long-term financial position, also has an exposure to two Adani companies that are now worth a fraction of the original investment.”

According to Barrett, “the large size of the Adani conglomerate... meant its shares found their way into the portfolios of many fund managers around the world seeking to profit from the rise of the Indian economy”.

Barrett’s report stated: “The $70bn Hesta fund, primarily catering for health and community service workers, had one of the larger exposures to Adani among Australian funds in recent years.... Following a freedom-of-information request..., the Future Fund recently disclosed it had a $33.1m investment in two Adani companies before the share price collapse.”

“One of those companies, Adani Total Gas, has so far in 2023 lost 75 per cent of its value,” the report added.

Of particular concern is what might happen to pension funds. That has the potential to become a political scandal. Successive Indian governments have been inviting, indeed encouraging, foreigners to invest in India on the grounds these would be both profitable and safe.

Barrett revealed: “The Australian Retirement Trust, a Brisbane-headquartered manager with more than $200bn in assets, was exposed to at least six Adani entities worth several million dollars before the report was released.

“The investment was part of a ‘passive’ allocation, whereby the fund appoints external fund managers to invest on its behalf in a particular country or sector, often tracking an index.

“The fund, which offers products to Queensland government employees and their families as part of its service, did not respond to questions.”

Will van de Pol, a Market Forces asset management campaigner, told Guardian Australia: “Any super fund investing in Adani Group companies has failed its members on climate action and due diligence.”

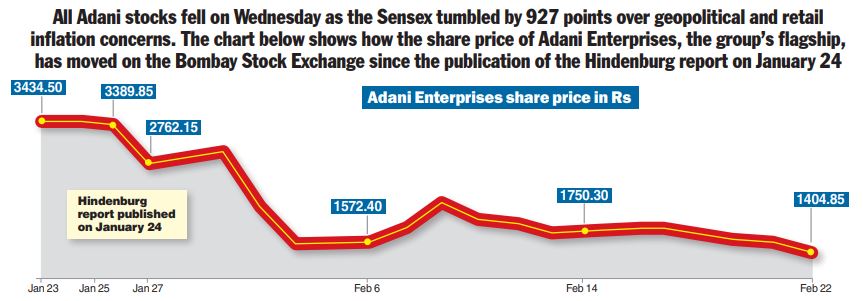

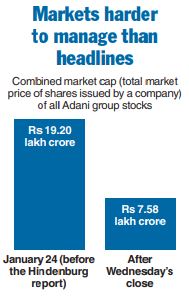

By way of background, the report said that “Adani companies have been subject to relentless selling since a 24 January report by US investor Hindenburg Research accused the conglomerate of stock manipulation and accounting fraud.

“Adani Group published a 413-page rebuttal of the allegations, likening the US short-seller’s report to an attack on India, but it has been unable to arrest a relentless slide in the value of the company.”

There was a further comment from van de Pol: “These funds have used members’ money to prop up Adani’s unacceptable coal expansion plans, including the disastrous Carmichael mine, and failed to see glaring investment risks that existed for years before being outlined in the Hindenburg report.”