An accused cannot seek default bail on the grounds that the probe is pending against other accused or the charge sheet filed by the probe agency is incomplete, the Supreme Court has said while cancelling the bail granted to former DHFL promoters Kapil Wadhawan and his brother Dheeraj in the multi-crore bank loan scam case.

The top court said the benefit of proviso appended to sub-section (2) of Section 167 of the CrPC would be available to the offender only when a charge sheet is not filed and the investigation is kept pending against him.

However, once a charge sheet is filed, the said right ceases, it said.

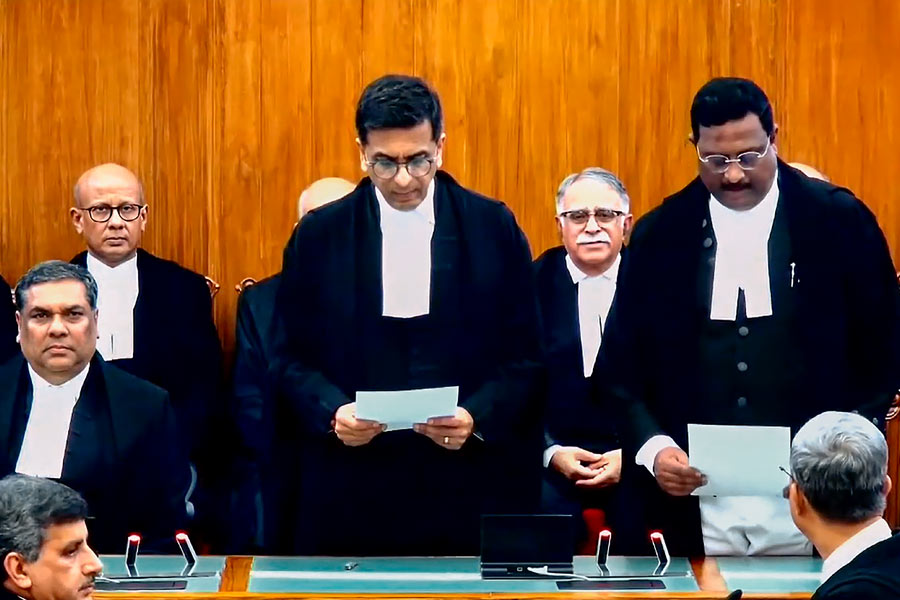

A bench of Justices Bela M Trivedi and Pankaj Mithal said once from the material produced along with the charge sheet, the court is satisfied about the commission of an offence and takes cognizance of the offence allegedly committed by the accused, it is immaterial whether further investigation is pending or not.

"The pendency of further investigation qua the other accused or for production of some documents not available at the time of filing of charge sheet would neither vitiate the charge sheet, nor would it entitle the accused to claim right to get default bail on the grounds that the charge sheet was an incomplete charge sheet or that the charge sheet was not filed in terms of Section 173(2) of CrPC," the bench said.

The apex court said both, the Special Court as well as the Delhi High Court committed serious error of law in disregarding the legal position and granting bail to Wadhawans.

"In view of the afore-stated legal position, we have no hesitation in holding that the charge sheet having been filed against the respondents-accused within the prescribed time limit and the cognisance having been taken by the Special Court of the offences allegedly committed by them, the respondents could not have claimed the statutory right of default bail under Section 167(2) on the grounds that the investigation qua other accused was pending," the bench said in its judgement uploaded Thursday.

The top court said there cannot be any disagreement with the well settled legal position that the right of default bail under Section 167(2) CrPC is not only a statutory right but is a right that flows from Article 21 of the Constitution.

"It is an indefeasible right, nonetheless it is enforceable only prior to the filing of the challan or the charge sheet, and does not survive or remain enforceable on the challan being filed, if already not availed of. Once the challan has been filed, the question of grant of bail has to be considered and decided only with reference to the merits of the case under the provisions relating to grant of bail to the accused after the filing of the challan," the bench said.

Under the Code of Criminal Procedure (CrPC), an accused becomes entitled for grant of statutory bail if the probe agency fails to file the charge sheet on conclusion of the investigation in a criminal case within 60 or 90 days period.

In this case, the CBI filed the charge sheet on the 88th day after registration of the FIR and the trial court granted default bail to the accused and the Delhi High Court upheld the order.

The Wadhawan brothers were arrested in this case on July 19 last year. The high court, however, had clarified it did not go into the merits of the case.

The charge sheet was filed on October 15, 2022 and cognisance was taken.

The FIR in the case was based on a complaint made by the Union Bank of India.

It had alleged that DHFL, its then CMD Kapil Wadhawan, the then director Dheeraj Wadhawan and other accused persons entered into a criminal conspiracy to cheat the consortium of 17 banks led by the Union Bank of India, and in pursuance of the criminal conspiracy, the accused and others induced the consortium to sanction huge loans aggregating Rs 42,871.42 crore.

Much of that amount was allegedly siphoned off and misappropriated by alleged falsification of the books of the DHFL and dishonest default in repayment of the legitimate dues of the consortium banks, the CBI has claimed.

The complainant has alleged that a wrongful loss of Rs 34,615 crore was caused to the consortium of banks in as much as such was the quantification of the outstanding dues as on July 31, 2020.

Except for the headline, this story has not been edited by The Telegraph Online staff and has been published from a syndicated feed.