The real estate market of Calcutta, long characterised as virtually moribund, was shaken out of its stupor earlier this month when the Mamata Banerjee government decided to turbocharge the industry with a timely vitality jab.

The state budget reduced the stamp duty payable at the time of registering a property by 2 per cent and slashed the circle rate by 10 per cent, providing the sector with a much-needed fillip to whip up demand.

The circle rate is the government-notified area-specific per square foot price, which is considered as the floor while calculating duties and taxes.

The limited period offer — the rebates end on October 30 — may translate into a 30-35 per cent savings for the buyer on account of lower stamp duty and registration fees. Moreover, it softens the income tax blow in certain cases for both the buyer and the seller.

Bengal is only the third state, after Maharashtra and Karnataka, to offer the homebuyer a window to close a deal, creating a demand pull for the real estate sector. This, in turn, can jump-start over 200 segments associated with construction, interior, home furnishing among others.

A property valued at up to Rs 1 crore used to attract 6 per cent stamp duty in the urban areas and 5 per cent in panchayat areas before the cut. Properties valued over Rs 1 crore attract an additional 1 per cent stamp duty in both the urban and rural areas.

Following the tweaks, stamp duty has come down to 4 per cent and 3 per cent in the urban and the rural areas for properties up to

Rs 1 crore and 5 per cent and 4 per cent for properties above that ceiling.

Stamp duty benefit

As an illustrative example, a property with a market value of Rs 50 lakh can save up Rs 1.20 lakh on account of the reduction in the stamp duty and circle rate and another Rs 5,550 due to fall in registration fees, translating into a gain of 35 per cent for the buyer.

The stamp duty before rebate on a property valued at Rs 50 lakh — going by the ongoing circle rate at 6 per cent — would have been Rs 3 lakh. On top of that, the buyer is liable to pay a registration fee at 1 per cent, translating into an additional expense of Rs 50,000. Cumulatively, a buyer had to shell out Rs 3.50 lakh on registration of a property worth Rs 50 lakh.

Let us look at the scenario that will play out at least till October 30. Given that the circle rate is coming down by 10 per cent across the board, the registrar will value the same property at Rs 45 lakh, irrespective of the sale value.

The stamp duty at 4 per cent on the same property would amount to Rs 1.80 lakh while the registration charge would work out to Rs 45,000, taking the cumulative expenditure on registration to Rs 2.25 lakh.

As a consequence, a homebuyer will stand to save Rs 1.25 lakh, or 35.71 per cent, which could well work out to be three-four months of monthly instalment of a home loan of Rs 45 lakh over a 20-year tenure.

Income Tax angle

If the official transaction value (the value mentioned in the deed of conveyance) is found to be more than 10 per cent of the circle rate (it was 20 per cent till June 30), the difference is treated as deemed income and taxed at the applicable rate.

Let us assume a property is valued at Rs 50 lakh going by the circle rate. If the market rate is more than the circle rate, there isn’t an issue. But if it is the reverse, the tax angle comes into play. The transaction value had to be at Rs 45 lakh or more to avoid being taxed under Section 43A of Income Tax Act.

Now that the circle rate itself is coming down by 10 per cent, the same property can be transacted at Rs 41 lakh. This will be particularly helpful when the market value is lower than the circle rate. There are many big ticket transactions, especially for land, which are stuck due to high circle rate valuations. The rebate may now incentivise buyer and seller to finally clinch the deal and register it.

Nandu Belani, president of Credai Bengal, the Calcutta chapter of the realtors body, says projects that are due to be handed over to the buyers in next one-two years will generate a lot of interest.

“The stamp duty cut has certainly created a buzz in the market. At least 30-40 per cent of the buyers of projects that are nearing completion may take the plunge and pay full registration fees now to take advantage of the rebate,” Belani said.

A buyer usually has the option to register a property during agreement for sale or while drawing up a deed of conveyance. An agreement of sale is drawn up between the buyer and seller at the initial stage, especially shortly after booking. This document is usually required to be registered if a buyer wants to take a home loan. At this stage, only a part of the stamp duty is payable.

In contrast, a deed of conveyance is drawn when the final payment is made and the property is handed over. At this point, the entire stamp duty is liable to be paid, adjusting for the part duty the buyer may have paid while registering agreement for sale.

Belani said some buyers appear to be willing to pay the entire stamp duty while registering an agreement for sale to derive the full benefit.

The incentive will also encourage some of the buyers who have still not registered the agreement.

“I had bought a garage space three years back but it wasn’t registered at that point. Now that there is an incentive, I have told my lawyer to complete the paperwork in time to avail the benefit,” Sajal Das, a Baghbazar resident, said.

Maharashtra Example

Maharashtra, which boasts of two top cities, Mumbai and Pune, in terms of real estate development, had cut stamp duty from 5 per cent to 2 per cent from September 1, 2020 to December 31 and to 3 per cent between January 1 and March 31 to boost demand.

The registration rate in Mumbai went up by112 per cent in September 2020 from the previous month and the momentum continued till March. As a result, Mumbai recorded nearly as many registrations in 2020 (65,272 units) as in 2019. In the first three months of this year, it had crossed the halfway mark of 2020, Knight Frank research shows. The government also earned 50 per cent more revenue on registration.

A section of realty experts say the developers should also incentivise the buyer as some of them did in Mumbai and Pune. These developers absorbed the remaining part of the stamp duty fee and sold apartments with a no-stamp duty tag.

Nevertheless, the rebate offered by the state government should encourage more buyers, especially fence sitters, to take the plunge and conclude a deal given the benign environment of property prices and lowest ever mortgage rate in history. Belani summed up: “The atmosphere is conducive. Let’s hope it all falls into place.”

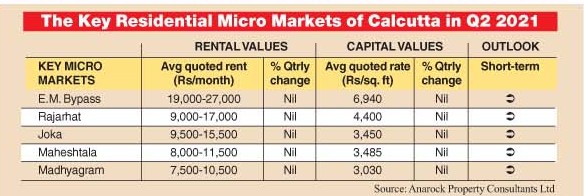

The Calcutta residential market snapshot for Q2 2021

Launches: 1,990 units (Up 10 per cent)

Sales: 1,520 units (Down 43 per cent)

Available inventory: 40,940 units (Up 1 per cent)

Avg. price: Rs 4,400/sqft (Quoted BSP on BUA)

Source: Anarock Property Consultants Ltd