A fresh controversy engulfed Zee Enterprises Ltd (ZEEL) after reports suggested that the market regulator had unearthed evidence of fund diversion amounting to $241 million (roughly Rs 2,000 crore) — a charge that the Zee group denounced as “incorrect, baseless and false”.

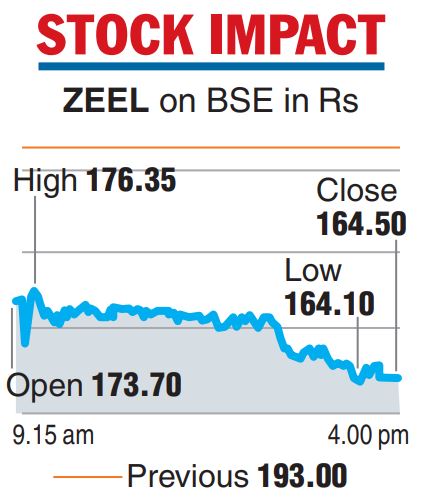

The ZEEL shares sank almost 15 per cent in a skittish market already edgy over rumours that the Securities and Exchange Board of India (Sebi) was planning to widen the investigation by summoning former directors of the company for questioning over transactions with various entities in recent years.

The ZEEL stock closed at Rs 164.50 on the BSE, down 14.77 per cent; on the NSE, it fell 14.02 per cent to Rs 165.65. The stock hit a low of Rs 163.75 and Rs 164.10 — its lower circuit limit — on the NSE and the BSE, respectively.

The Zee group has been lurching from one crisis to another after Sony Corp of Japan announced last month that it had decided to abandon plans to merge their media operations in the country in a deal valued at $10 billion — apparently frustrated that ZEE had failed to comply with the terms of merger.

The market regulator is already investigating allegations of fund diversion by the Zee promoters and it had barred ZEEL CEO Punit Goenka from holding key managerial posts within the four group firms. This was, however, set aside by the Securities and Appellate Tribunal (SAT).

Last August, Sebi had passed the confirmatory order under which it also restrained Goenka from holding the post of director or key managerial personnel in the merged entity until further directions.

While passing the order, Sebi chairperson Madhabi Puri Buch had said the investigation into charges of fund diversion “shall be completed in a time-bound manner and in any event, within a period of eight months”.

A Bloomberg report said Sebi had found that about Rs 2,000 crore may have been diverted from the company, which was roughly 10 times more than the regulator’s initial estimate.

Sebi has reportedly called founder Subhash Chandra, Punit Goenka and some board members, including past directors, as part of its probe.

A Zee spokesperson said the company was co-operating with the regulator and had been providing all information and explanations that had been sought.

On Tuesday, the ZEEL share had ended 8 per cent higher on reports that the group and Sony were working to salvage the merger. This was, however, denied by ZEEL. “The company has not been involved in any negotiations, or any other event...and we categorically confirm that the... news item is incorrect,” Zee had said.