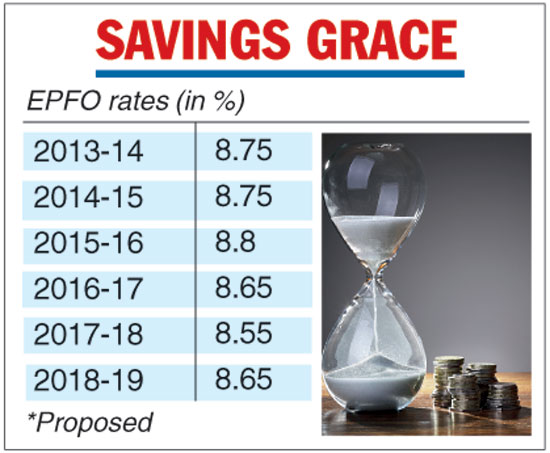

The state-run Employees Provident Fund Organisation on Thursday hiked the interest rate by 10 basis point to 8.65 per cent for 2018-19 — months ahead of the general election.

All the members of the Central Board of Trustees (CBT) of the EPFO at a meeting here agreed to give a higher interest, labour minister Santosh Gangwar said.

The proposal, which will benefit about 6 crore EPFO subscribers, will now go to the finance ministry for approval. The rates will be notified by the labour ministry after it gets the permission of the finance ministry. The EPFO manages a corpus of over Rs 11 lakh crore.

The board also discussed raising the minimum pension under the employee pension scheme (EPS) to Rs 2,000 from Rs 1,000. However, the decision has been deferred until the next meeting. Currently, the EPFO pays out a monthly pension of Rs 1,000 to Rs 7,500 depending on the contributions.

According to the proposal, doubling the minimum monthly pension would require an additional outgo of Rs 3,000 crore. Thus the decision can be taken only after the permission of the finance ministry. Sources said the government was in a fix to double the pension because it has already provided for assured monthly pension of Rs 3,000 to informal sector workers in the interim budget. The scheme has been opened for subscription from February 15, 2019

Source: The Telegraph

Analysts said the move was in line with a raft of populist announcements made by the Narendra Modi government ahead of the Lok Sabha elections in April-May. The government, in its interim budget, had announced an income support scheme of Rs 6,000 annually for farmers with up to 2 hectares of land. It has also increased the dearness allowance of central government employees and pensioners.

The rates had been cut for two consecutive years — from 8.8 per cent in 2015-16 to 8.65 per cent in 2016-17 and then to 8.55 per cent in 2017-18. The rates in 2013-14 and 2014-15 were the same at 8.75 per cent. It was 8.5 per cent in 2012-13.

Analysts said the Central Board of Trustees, which has representatives from the government, employers, and trade unions, revised the rates against the expectations of a status quo.

The rates are higher than the public provident fund (PPF) scheme, which offers 8 per cent, but lower than the senior citizens saving scheme, which provides 8.7 per cent interest.

ETF performance

The trustee also reviewed the performance of investments made by the body in the stock markets. The EPFO had started investing in ETFs (exchange traded funds) in August 2016. Presently, it invests 15 per cent of its Rs 1.5 crore investible deposits every year in ETFs. It has invested around Rs 50,000 crore in ETFs so far.