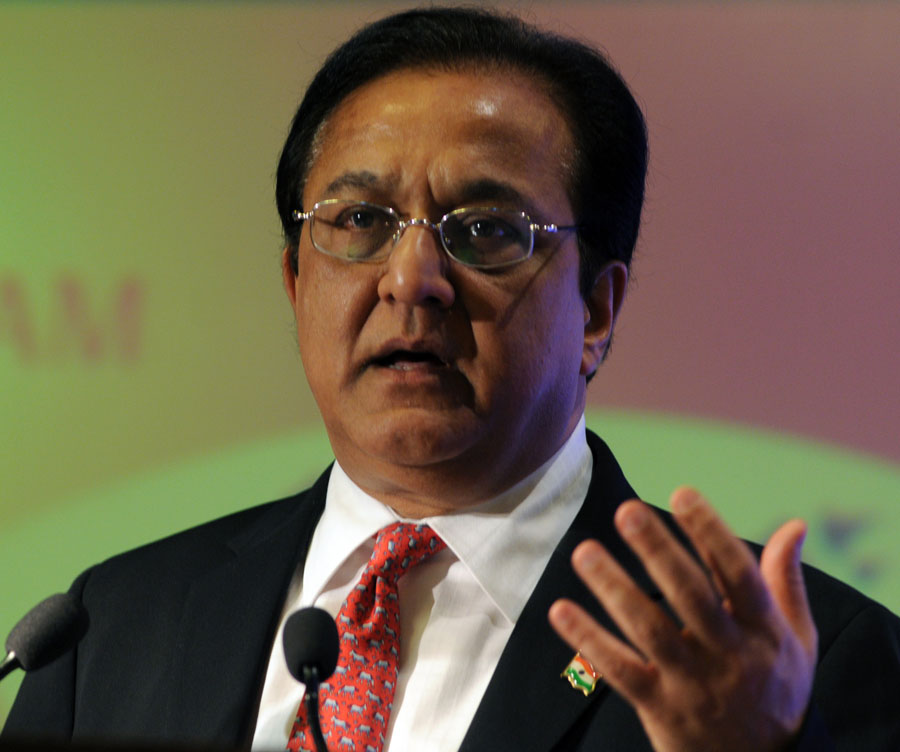

A day before a crucial board meet, Yes Bank on Monday said the lender and its CEO Rana Kapoor will be guided by the directors, the Reserve Bank of India and other relevant stakeholders.

The board of India’s fourth-largest private sector bank will meet on Tuesday to decide on the next course of action after the central bank directed the lender’s current CEO and managing director Rana Kapoor to step down by January.

The bank had sought a three-year extension for Kapoor till August 31, 2021. However, the RBI told the bank that Kapoor can continue only till January 2019.

While Tuesday’s board meeting could initiate the process of selecting a successor, there are reports that the lender may have to take the approval of both its promoters — Rana Kapoor and Madhu Kapur — after zeroing in on a candidate.

Madhu Kapur is the wife of Yes Bank co-founder Ashok Kapur.

The name will then be sent to the RBI for final approval. The buzz is that Rajat Monga, senior group president-financial markets, and Pralay Mondal, head of retail and business banking, are the front-runners.

Ahead of the board meeting on Tuesday, Yes Bank said in a statement it has performed consistently under the leadership of Kapoor.

“The bank has demonstrated a track record of consistent delivery of business and financial outcomes over the last 14 years since the commencement of its operations in mid-2004, across all critical parameters such as capital adequacy, credit risk, profitability, operating efficiency, growth,” it said in a communication to stock exchanges after market hours.

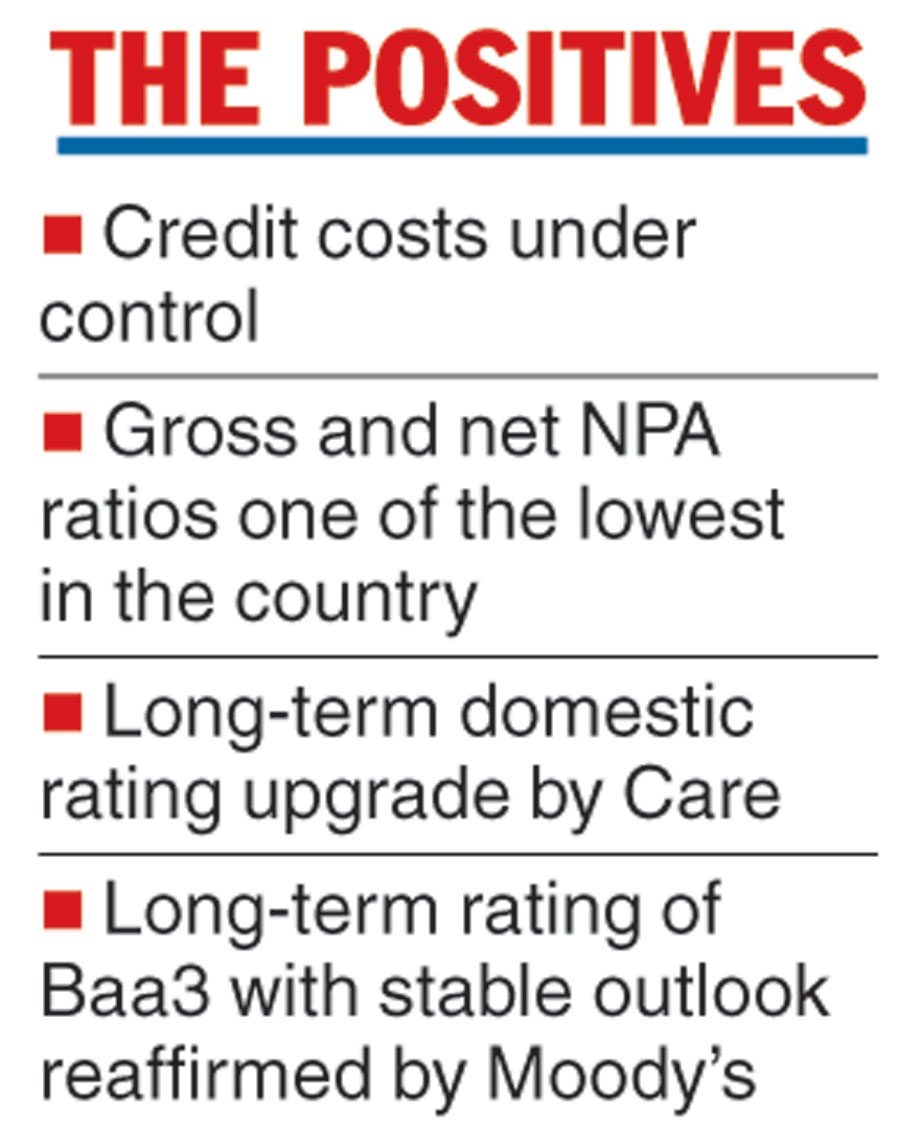

The private lender pointed out that its credit costs were contained at 50 basis points, 53 basis points and 76 basis points for 2015-16, 2016-17 and 2017-18, respectively.

Further, the gross non performing asset (NPA) and the net NPA ratios which stood at 1.31 per cent and 0.59 cent, respectively, as on June 30, 2018, remain one of the lowest across banks in the country.

“The bank would like to inform its stakeholders that the bank and its MD & CEO will be fully guided by its board of directors (meeting scheduled on September 25, 2018), the RBI and other relevant stakeholders. The bank’s management remains committed to protect the interests of all of its stakeholders,” it added.

Yes Bank further pointed out that the inherent strength in its financial performance, strategy and execution has been reflected through the recent upgrade of its long-term domestic rating by Care even as international ratings agency Moody’s reaffirmed its long-term rating of Baa3 with a stable outlook.

The Yes Bank scrip slipped 0.35 per cent to settle at Rs 226.25 on the BSE on Monday.

The Telegraph