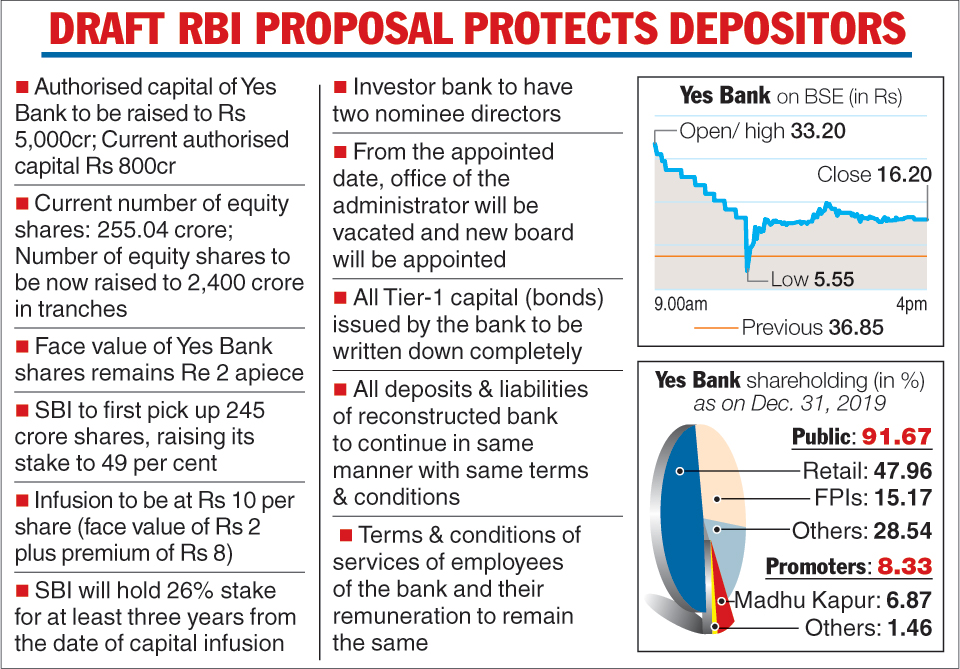

The Reserve Bank of India (RBI) has proposed a draft reconstruction scheme for Yes Bank that could see the State Bank of India (SBI) picking up 49 per cent in the troubled private sector lender.

The draft said depositors of the bank will not lose their money even as the current restrictions on withdrawals will continue for some time. The scheme has specifically said the deposits and liabilities with the bank will continue in the same manner after the restructuring.

The apex bank last evening had replaced the Yes Bank board and said depositors could withdraw a maximum of Rs 50,000 till April 3.

Existing shareholders of the bank may have to suffer a huge dilution of their holdings, while mutual funds who had subscribed to the additional Tier 1 bonds, will be left with nothing as the draft scheme said they would be written down permanently and in full.

An RBI statement said SBI has expressed its willingness to invest in Yes Bank and participate in its reconstruction scheme.

On Thursday, the board of SBI had given its in-principle approval to explore investment opportunity in Yes Bank.

Soon after the RBI announcement on Friday, SBI disclosed in a regulatory filing that the reconstruction scheme would be placed before its board for approval.

The RBI revival scheme said the strategic investor would have to remain with the bank for at least three years.

The draft —Yes Bank Ltd. Reconstruction Scheme, 2020 — said the strategic investor bank would have to pick up a 49 per cent stake and it cannot reduce its holding to below 26 per cent before three years from the date of capital infusion.

At present, the authorized capital of Yes Bank stands at Rs 800 crore. This will be raised to Rs 5,000 crore. Similarly, the number of equity shares will be raised to 2,400 crore shares.

While the equity investment to be made by SBI could not be ascertained, sources said it would bring in around Rs 2,450 crore. They did not rule out the possibility of more investors after the arrival of SBI.

The draft plan said from the appointed date, the office of the bank’s administrator will be vacated, and a new board formed.

The investor bank shall have two nominee directors. The board members will continue in office for a period of one year, or until an alternative board is constituted through a procedure laid down in the Memorandum and Articles of Association.

Employees of Yes Bank will have the same remuneration as before and enjoy the same terms and conditions of service at least for a period of one year.

Ratings blow

Moody’s Investors Service on Friday downgraded Yes Bank Ltd’s rating following the RBI imposing a 30-day moratorium that prevents the lender from making payment to its creditors.

“The ratings remain under review, with the direction uncertain,” Moody's said, downgrading Yes Bank’s long-term foreign currency issuer rating to Caa3 from B2.

Moody's has also downgraded the bank’s long-term foreign and local currency bank deposit ratings.

Icra has also downgraded Yes Bank's bonds worth Rs 52,612 crore. The downgraded bonds are Basel III-compliant Tier-II instruments and include Rs 10,900 crore worth hybrid bonds, which have been lowered to negative.