Singapore-based private equity firm Xander Investment Management has bought a 30-acre logistics park on National Highway 6 near Bagnan for a little over Rs 200 crore, marking the entry of a top-notch investor in the fast growing warehousing space in Bengal.

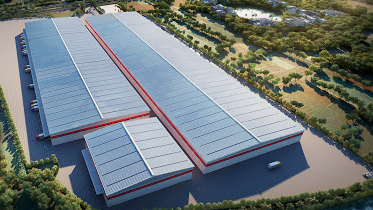

Previously owned by city-based Jalan Builders, the park offers Grade A warehousing space of 800,000 square feet. However, half of the area has already been leased out to Walmart-backed e-commerce giant Flipkart.

Xander bought the property along with the long-term lease with Flipkart. The other half of the park is under development and slated to be completed by the first quarter of next year.

The transaction underscores the interest of bulge-bracket investors into the fast growing warehousing space in Bengal, which has emerged as one of the top five markets in India, especially after the implementation of the GST.

According to a study by international property consultant JLL, which facilitated the Xander-Jalan deal, Bengal has 24 million square feet of Grade A and B logistics space, which is projected to grow to 32 million square feet in five years.

Surekha Bihani, managing director of JLL East, said, ‘‘We are seeing huge interest in investment in warehousing by private equity players and HNI investors. The growth story in this sector accompanied by low capital value makes this a very interesting investment option apart from commercial office and retail.’’

NH-6 and NH-2 (Calcutta-Delhi) are two of the most important micro markets within the state, which is catching the fancy of investors.

The warehousing sector is being driven here by e-commerce, third-party logistics providers and FMCG players looking for seamless connectivity to other parts of the city and the country.

Warehousing demand in Bengal is growing 8-10 per cent, accounting for 10-12 per cent of national demand. Despite the pandemic in 2020, the city still logged demand for 2 million square feet space, like Pune and Hyderabad.

A statement from a Xander official points out how the Bengal story in warehousing may unfold going forward.

“As an emerging markets investor, we have always been focused on early identification of strong growth markets with great fundamentals… The acquisition of our first logistics asset in this part of India reflects our continuing commitment to emerging markets and our asset class focus at this point in the market cycle,’’ said a Xander spokesperson.

‘‘East India is becoming a logistical hub and shall emerge as a strong consumption market and trade corridor. We thus want to provide excellent industrial assets which act as catalysts to rapid economic development,’’ the spokesperson added.

Prior to Xander, Blackstone-backed Allcargo Logistics and ESR have acquired warehousing assets in the state.