Wipro on Friday posted a mixed set of numbers with net profits and margins for the third quarter ended December 31 beating estimates amid a strong order book. However, the mood was sullied as the country’s fourth-largest IT services firm dished out weak guidance even as revenues fell marginally short of expectations.

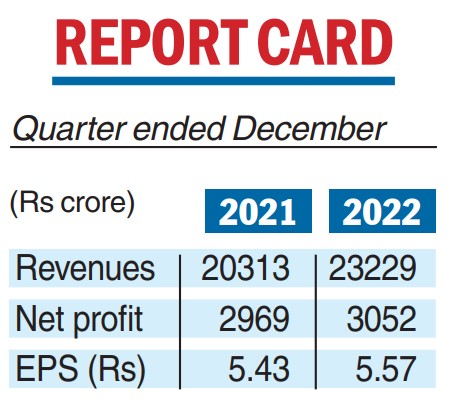

Wipro posted a consolidated net profit of Rs 3,052.9 crore — a rise of nearly 3 per cent over Rs 2,969 crore in the same period of the previous year.

Analysts had forecast a net profit of around Rs 2,900 crore.

Revenues during the period came in at Rs 23,229 crore compared with expectations of around Rs 23,400 crore. Revenues in the year-ago period were at Rs 20,313.6 crore.

IT services revenue showed an improvement of 10.4 per cent over the previous year period when it rose to $2.8 billion. However, the Street was disappointed by its guidance.

Wipro said revenues from the IT services business for the full year would be in the range of 11.5-12 per cent in constant currency terms, which according to analysts indicate that revenue growth during the fourth quarter of this fiscal will be between -0.6 and 1 per cent. This figure falls short of expectations of 1-3 per cent growth.

There were, however, some positives from the numbers. EBIT (earnings before interest and taxes) margins of the company’s IT services business showed an improvement of 120 basis points sequentially when it rose to 16.3 per cent from 15.1 per cent in the preceding three months.

Further, employee attrition moderated 180 basis points from the previous quarter as it declined to 21.1 per cent.

Moreover, Wipro also notched a strong order book. It clocked record total bookings of over $4.3 billion in total contract value (TCV) terms. Of this, it closed 11 large deals resulting in a TCV of over $1 billion.

Speaking to reporters, Thierry Delaporte, CEO and managing director, said that in an uncertain macro environment, the company is continuing to gain market share as a result of deepening client relationships and higher win rates.

He added that while tech spending remains robust, its clients are looking for value-driven transformation and improved returns on their investments.

He disclosed that cloud transformation continues to be the priority among its customers, even though there is a higher focus on returns.

At its board meeting on Friday, the directors recommended an interim dividend of Rs 1 per share. While the numbers were declared after market hours, the Wipro stock ended flat at Rs 393.65.