The Economic Survey 2022-23 on Tuesday underlined the need for close monitoring of the current account deficit which may continue to widen because of elevated global commodity prices.

The country's current account deficit widened to 4.4 per cent of the GDP in the quarter ending September, from 2.2 per cent of the GDP during the April-June period due to a higher trade gap, according to the latest Reserve Bank data.

"...a downside risk to the current account balance stems from a swift recovery driven mainly by domestic demand, and to a lesser extent, by exports," the Survey said, adding "CAD needs to be closely monitored as the growth momentum of the current year spills over into the next".

The rate of growth in imports has been faster compared to that of exports in 2022-23 so far, leading to the widening of the trade deficit.

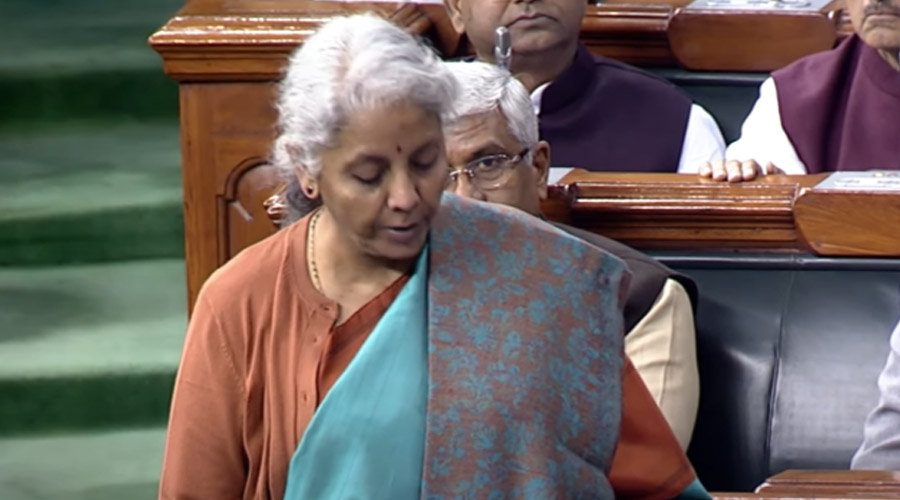

Sounding a note of caution, the key government document, which was tabled in Parliament by Finance Minister Nirmala Sitharaman, said the challenge of the depreciating rupee, although better performing than most other currencies, persists with the likelihood of further increases in policy rates by the US Federal Reserve.

"The widening of CAD may also continue as global commodity prices remain elevated and the growth momentum of the Indian economy remains strong. The loss of export stimulus is further possible as the slowing world growth and trade shrinks the global market size in the second half of the current year," the Survey said.

On the other hand, the Survey said the subdued global growth presents "two silver linings" -- crude oil prices will stay low, and India's CAD will be better than currently presented.

Except for the headline, this story has not been edited by The Telegraph Online staff and has been published from a syndicated feed.