The earnings season may kick off on a muted note as IT firms are expected to report flat numbers, weighed down by the economic churn in the West that has affected client spending in key verticals.

Tata Consultancy Services (TCS) will announce its results for the fourth quarter of the fiscal ending March 31, 2023, on Wednesday. Rival Infosys will follow on Thursday.

The tech giants will submit their scorecards — in what is considered as a lean quarter — at a time the global banking turmoil has created fresh challenges.

The failures of Silicon Valley Bank and Signature Bank in the US, and the rescue of Credit Suisse by UBS have raised concerns over the health of global banking.

The sector is already feeling the heat of a global slowdown and a possible recession because of interest rate hikes by various central banks.

In an environment of high inflation and slowdown, IT clients have resorted to cost optimisation that will impact their spendings.

With the BFSI sector expected to underperform, the revenues of IT firms will feel the pinch and what is more, the finacial turmoil is expected to impact other verticals, brokerages said.

“Worsening macro conditions and recent banking crisis in the US and Europe indicate slowing down of tech spends by enterprises globally. BFSI, telecom, retail, and hi-tech verticals are expected to be impacted by the slowdown, thus weakening the first half 2023- 24 growth outlook. We expect even those verticals not impacted will have cautious outlook,’’ analysts at IDBI Capital said in a note.

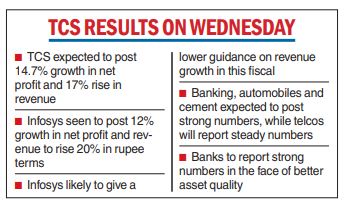

The brokerage expects TCS to post a 14.7 per cent growth in net profit for the quarter ended March 31, 2023 at Rs 11,388 crore against Rs 9,926 crore in the same period of the previous year. Revenue growth is forecast to rise a little over 17 per cent at Rs 59,356 crore.

Analysts at Kotak Institutional Equities expect Infosys to declare a 12 per cent year-on-year growth in net profit at Rs 6,379 crore while its revenues in rupee terms are projected to rise nearly 20 per cent at Rs 38,693 crore.

It expects the Bangalore-based firm to guide revenue growth of 5-7 per cent in 2023-24.

This is a sharp comedown from the full-year revenue growth of 16-16.5 per cent for 2022-23 given by the company when it declared its third quarter results.

While IT services are expected to post muted numbers, banking, automobiles and cement sectors are forecast to do well.

The telecom sector is projected to report steady numbers.

Domestic banks hailed as being resilient amid the global turmoil are set to declare good numbers on the back of better asset quality and buoyant credit growth.

Analysts said the PSU banks will also put in a good performance because of healthy margins and lower credit costs, even though wage revision could impact the show.

A Motilal Oswal report expects banks from its coverage universe to post a 44 per cent growth in net profit.

The total profit of public sector banks is expected to touch a record high of Rs 1 lakh crore in FY23, aided by the decline in bad loans and healthy loan growth, adds PTI.

According to a senior bank official, the country’s biggest lender State Bank of India (SBI) is expected to earn a profit above Rs 40,000 crore in the financial year ended March 2023.

In the first nine months of the previous financial year, the bank’s bottom line stood at Rs 33,538 crore, higher than Rs 31,675.98 crore recorded in FY22.