The BJP and the Congress have started a slugfest over the GST, which has become unpopular after its chaotic introduction last year, clearly indicating the taxation measure would be a major election issue.

Former finance minister P. Chidambaram of the Congress, who had initially worked out the design for the GST, gleefully tweeted on Wednesday morning: “Until yesterday a single standard rate of GST was a stupid idea. Since yesterday, it is the declared goal of the government!”

He was responding to a blog written by his successor Arun Jaitley on Christmas eve, where he defended the changes in the GST and indicated the nation would head towards a single standard tax rate of between 12 per cent and 18 per cent.

The Congress party has been pointing out that after the ruling BJP ridiculed their idea that the GST rate be capped at 18 per cent and the standard rate should be below 18 that, the government has been working on those very lines. Chidambaram’s tweet went on to say: “Until yesterday, the Chief Economic Adviser’s report to fix the standard rate at 15 per cent was in the dustbin. Yesterday it was retrieved and placed on the FM's table and was promptly accepted!”

Sources said the Congress is planning a simplified version of the GST and make that a showpiece of how their administration could work better for businesses and the common man.

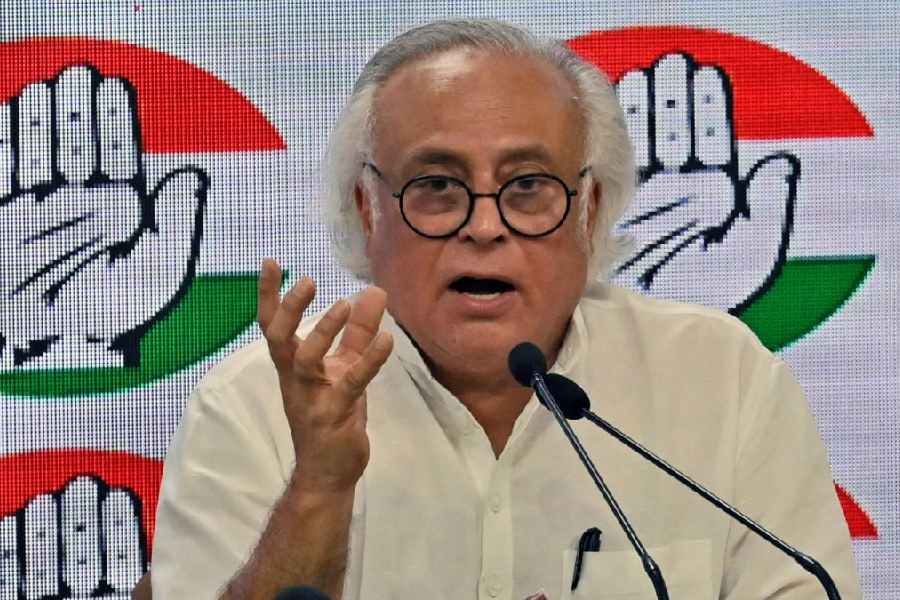

Several Congress politicians, who have an economics or revenue background, including former minister Jairam Ramesh, have been brought into the team working on this measure.

Ramesh on Tuesday tweeted “BM(Bluff Master) NaMo on Jul 1 2018: How can Mercedes & Milk be taxed at same rate? BM(Blog Mantri) Jaitley on Dec 24 2018: India must work towards a single rate GST.” Sources said several top independent economists and taxation experts have been consulted on the Congress’s GST plan, which the party wishes to unveil in its manifesto for the 2019 elections.

The GST is a taxation reform measure which replaced numerous central and state taxes and levies such as excise, VAT, luxury tax, octroi with one single tax from July 1, 2017. Though the tax measure was planned by the previous Congress-led UPA government and at that time opposed by the BJP, it was eventually rolled out last year under the BJP-led NDA government. However, the introduction saw multiple rates, heavy handed bureaucratic rules and a poorly designed internet architecture to support the tax measure, causing chaos and uncertainity among small businesses.

Consequently, since its launch 18 months ago, the GST has undergone several rounds of drastic changes such as bringing down the number of slabs, reducing taxes on hundreds of goods and changing the rules of the game after protests by traders and small manufactures who have been hit by the complex tax rate.

After losses in three Hindi heartland states earlier this month and with the general election looming next year, the Centre had sought to bring in changes once again by reducing the tax on as many as 34 items at a GST Council meeting last week.