The Government of India is set to become the largest shareholder of Vodafone Idea (VIL) as the loss-making telecom player has decided to exercise the option of converting the interest on spectrum instalments and adjusted gross revenue (AGR) dues into equity.

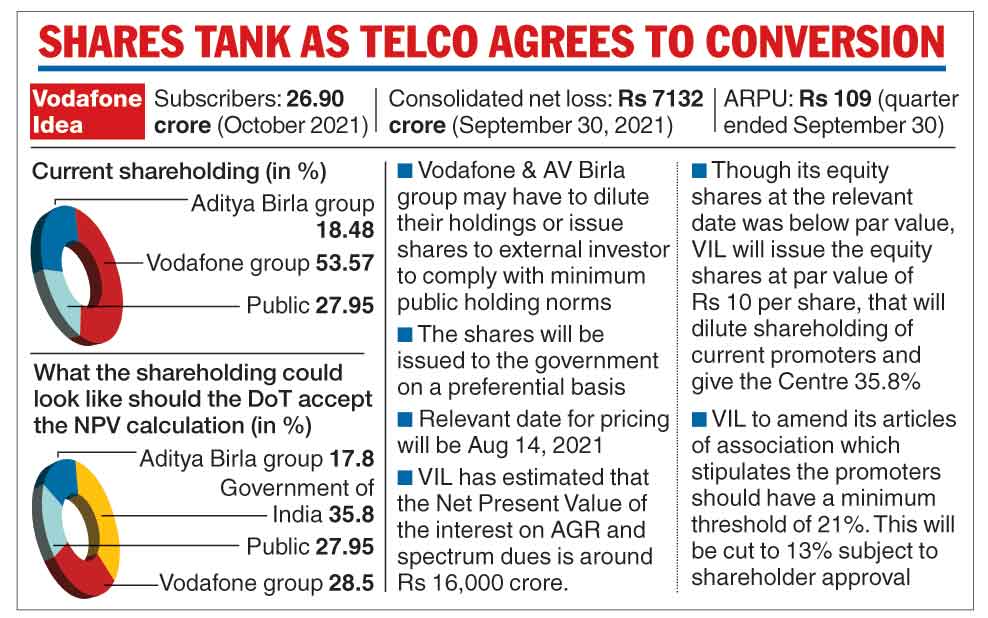

The Centre will hold around 35.8 per cent of VIL, subject to final confirmation by the Department of Telecommunications (DoT).

The government will also bag a stake of 9.5 per cent in Tata Teleservices which has chosen the same option.

Both these holdings are likely to be held through the statutory undertaking of the Unit Trust of India (SUUTI) or another arrangement to be announced in the near future.

Investors, however, reacted negatively to the VIL announcement with its shares plummeting around 21 per cent on the BSE to close at Rs 11.80.

Some analysts said the entry of the government as a shareholder would bring more stability into operations of the company and would enable VIL to raise funds from external investors.

However, they raised the possibility of a merger of state-owned BSNL and MTNL with VIL at a later date.

The Narendra Modi-government in September announced a mega rescue package for the telecom sector, including a four-year moratorium on dues arising from a Supreme Court verdict on AGR liabilities and the payment of spectrum instalments.

The second major part of the package was the option to convert the interest component on the dues into equity, with operators given time till January 12 to make the decision.

Recently, Bharti Airtel said it would pay the interest on deferred spectrum and AGR liabilities, ruling out the possibility of a share sale to the Centre.

The VIL board at a meeting held on Monday, approved the conversion of the full amount of the interest related to the spectrum and AGR moratorium into equity.

In a regulatory filing, the company said the net present value (NPV) of the interest component is expected to be about Rs 16,000 crore as per its best estimates, subject to confirmation by the DoT.

VIL added that since the average price of its shares on the relevant date of August 14, 2021 — that was set by the government — was at below par value, the shares will be issued to the Centre at par value of Rs 10, subject to final confirmation by the DoT.

It also disclosed the conversion will result in the dilution of the holdings of all the existing shareholders, including the promoters.

Post conversion, the government is expected to hold around 35.8 per cent, while promoter duo Vodafone and the Aditya Birla group will hold 28.5 per cent and 17.8 per cent, respectively

Vodafone at present holds 53.57 per cent, while the Kumar Mangalam Birla-led conglomerate has a stake of 18.48 per cent.

Analysts at Deutsche Bank said in a note that there would be price rises in the market as operators realise waiting out VIL's demise is now a much longer and less likely event.

They added that Bharti Airtel and Reliance Jio will need to be careful not to antagonise the government with fierce promotions that may undermine VIL.

Being the largest shareholder of VIL, The Centre would get more feedback on the economic impact of its policies and probably be more sensitive to policy impact.

However, the brokerage had a different take on the net present value given by Vodafone Idea. “The company suggests the debt saved has an estimated NPV of Rs 16,000 crore. We are surprised it is not more, as by our estimates, annual interest cost on these two items is above Rs 10,000 crore, but even should we assume Rs 40,000 crore in dues fades away, that is just one-sixth of debt, so it is more a good start than an end point, ’’ Peter Milliken & Bei Cao of Deutsche Bank said.

On the other hand, Credit Suisse analysts said VIL’s cash flow situation would remain stretched even after four-year moratorium with the company needing the frequent equity injections in the absence of sustained operational improvement.

Tata Tele follows suit

In a separate announcement, Tata Teleservices said the net present value (NPV) of the interest is expected to be around Rs 850 crore and that the average price of its shares at the relevant date of August 14 works out to Rs 41.50 per share.

Due to the conversion, the Centre will hold around 9.5 per cent in the company. At present, the promoters hold 74.36 per cent .