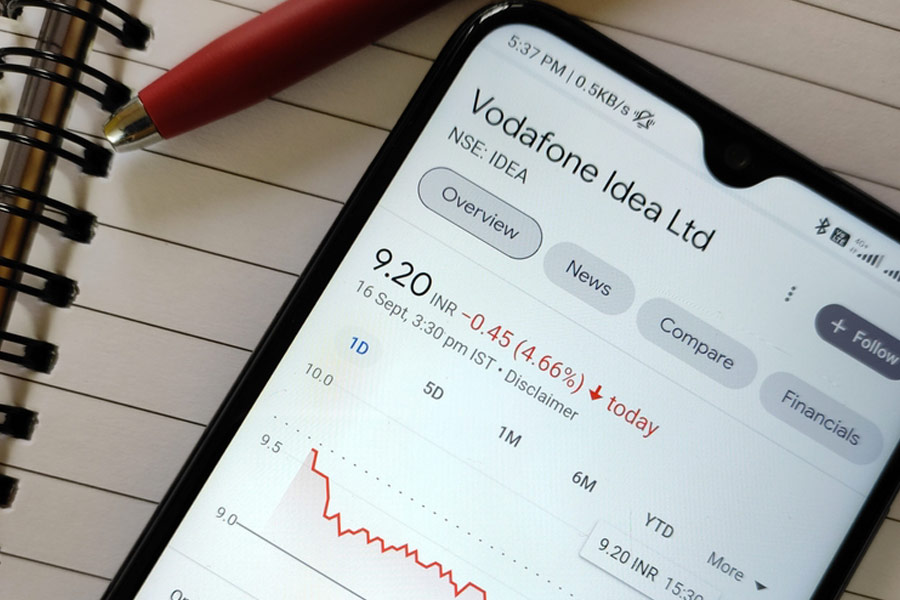

Telecom operator Vodafone Idea's (VIL) board has fixed the FPO offer price at Rs 11 per equity share, according to a regulatory filing.

The anchor investor offer price of Rs 11 per equity share has also been greenlit by the board.

"... Following resolutions were also passed... determined and approved the offer price of Rs 11 per equity share... approved the anchor investor offer price of Rs 11 per equity share," VIL informed.

Debt-laden telecom operator Vodafone Idea Ltd has raised Rs 18,000 crore pulling off India's largest-ever follow-on public offering (FPO) as the issue got subscribed nearly seven times after institutional investors poured in money, stock exchange data showed on Monday evening.

The fundraise will arm VIL with an ammo to improve its competitive positioning in the Indian telecom market, where it trails Reliance Jio and Bharti Airtel, by a wide margin.

"Further to our letter dated 17 April 2024, intimating you about the meeting of the board of directors of the company to be held on 22 April 2024, in respect of the offer, we wish to inform you that the Board, at its meeting held today that is 22 April 2024 has approved and adopted the prospectus dated 22 April 2024 in connection with the offer," VIL said.

The prospectus has been filed with the Registrar of Companies, Gujarat at Ahmedabad, and submitted to the Securities and Exchange Board of India, BSE Limited and National Stock Exchange of India Limited, it added.

Except for the headline, this story has not been edited by The Telegraph Online staff and has been published from a syndicated feed.