Mining conglomerate Vedanta’s second-quarter net profit plunged as it faced dual headwinds from falling commodity prices and rising energy costs, while the government slapped a windfall profit tax on oil.

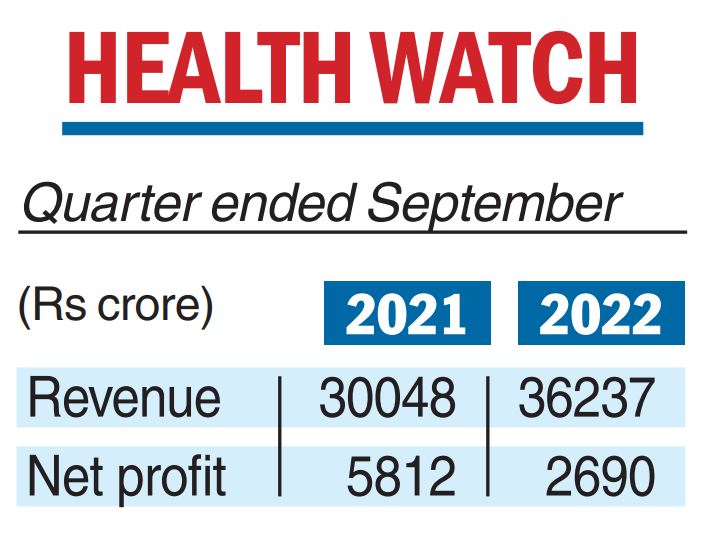

Consolidated net profit stood at Rs 2,690 crore, or Rs 4.88 per share, in July-September compared with Rs 5,812 crore, or Rs 12.46 a share, in the same period a year back, the company said in a statement.

The profit declined due to the unique scenario of input commodity inflation and lower output commodity prices as also high energy costs, company chief executive Sunil Duggal said.

The government took away gains accruing from higher oil prices through the windfall profit tax. The company paid out Rs 519 crore on the levy that was introduced on July 1.

Duggal said the situation has improved in the current quarter with moderation in inflation and adequate coal stocks.

Revenue was up 21 per cent at Rs 36,237 crore against Rs 30,048 crore. The firm achieved a consolidated EBITDA of Rs 8,038 crore with an EBITDA margin of 25 per cent, the best in the industry.

Gross debt decreased Rs 2,543 crore to Rs 58,597 crore. The company had Rs 26,453 crore cash at the end of September.

Operationally, Vedanta completed the expansion of the Jharsuguda aluminum plant to 2.4 million tonnes.

Aluminum production rose 2 per cent while it mined the highest-ever zinc.

Crude oil production declined to 1,40,471 barrels of oil equivalent per day from 1,65,000 boepd last year.

“We have generated strong free cash flow (pre capex) of Rs 8,369 crore underpinned by robust operational and financial performance,” Duggal said.

“Our growth and vertical integration projects, aimed to reduce market volatility impact and create shareholders’ value, are progressing well.”