Mining giant Vedanta has undertaken an evaluation of its steel business which may also include a potential exit from the sector.

The company, one of the largest producers of zinc and aluminium in the world, does not want to remain a fringe player in the steel business which is dominated by big boys such as the Tatas, the Jindals and the Mittals.

The evaluation of the future of the steel business also includes growing the capacity in multiples from the present level to be a “force to reckon with” or potentially exit from this segment.

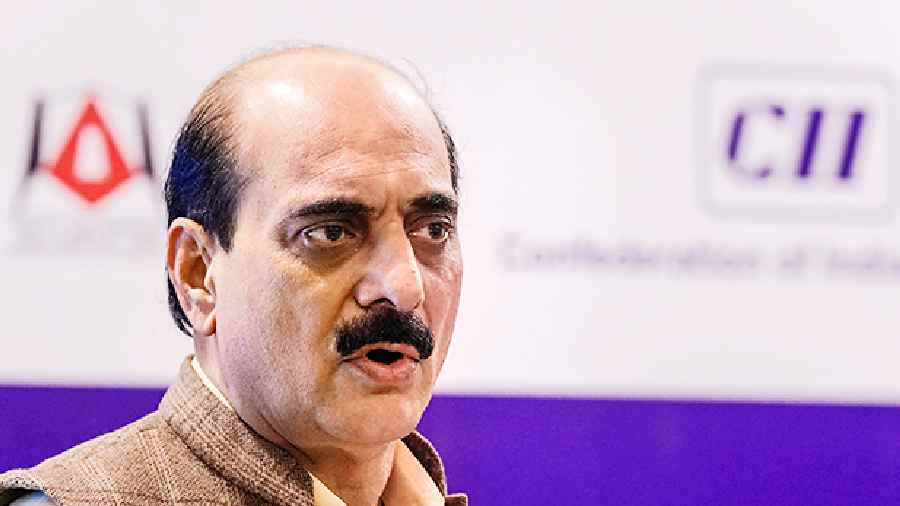

“The question is going on in the mind,” Sunil Duggal, group CEO of Vedanta Ltd, said when asked by The Telegraph if the company wants to remain in the business or not.

Vedanta entered the steel sector with the acquisition of Electrosteel Steel Ltd from the insolvency court in 2018, outbidding Tata Steel. It marked one of the first successful resolutions of 12 non-performing assets which were sent for corporate insolvency resolution process by the RBI.

The Bokaro-based company, later renamed ESL Steel Ltd, is doubling capacity to 3 million tonnes by 2023. The unit produces ductile iron pipe, TMT and wire rod, among others. Vedanta also has a 1 million tonne pig iron unit in Goa where the company has iron ore mines under the Sesa division.

“If we want to be in the steel business, we should be a force to reckon with. The 4-5 million tonnes are not a small capacity either but ultimately we would like to convert Electrosteel into a mega location of 10 mt. We also have a site in Bellary. We may like to put up a plant there. So we may be on a path of 10-20 mt steel player in the next 3-5 years if we want to stay,” Duggal explained the choices before Vedanta.

There are multiple factors which may help the company remain in the sector. It has a few metallurgical coke plants, ferroalloy units and iron ore mines completing the steel value chain. Duggal, however, was clear about the roadmap of the iron ore business which Vedanta will take to 40-50 million tonnes in the next 2-3 years. It has mines in Odisha, Karnataka and Liberia.

Expansion

The Anil Agarwal family-promoted mining behemoth is in the process of expanding and strengthening the zinc, aluminium and oil and gas businesses which together contribute about 90 per cent of Vedanta’s EBIDTA.

It will spend about $1 billion to develop six coal mines as vertical integration to support the power-intensive aluminium business. On top of that, it is expanding its alumina refinery and smelter capacity apart from putting up value-added aluminium product lines at an additional cost of $1.2 billion.

Duggal, who is in Calcutta to attend a mining conference organised by the CII, said Vedanta’s oil and gas production will double in 2-3 years with a capex of $1.2 billion. Moreover, the zinc business, especially the international operations in Namibia and South Africa, will see $0.5 billion capex in capacity expansion.