The decline in cryptocurrency prices has prompted Singapore-based crypto firm Vauld to suspend all withdrawals, trading and deposits on its platform and seek legal steps amid financial challenges.

This may not be a blip as traders and industry observers anticipate a "crypto winter" in the following months prompting several firms to tighten their books and streamline operations.

In a statement on Monday, Vauld CEO Darshan Bathija said that the management is facing financial challenges due to volatile market conditions which has led to significant amount of customer withdrawals in excess of USD 197.7 million since June 12, 2022 when the decline of the cryptocurrency market was triggered by the collapse of Terraform Lab's cryptocurrency - Celcius and Singapore based cryptocurrency hedge fund Three Arrows Capital defaulting on their loans.

"We have made the difficult decision to suspend all withdrawals, trading and deposits on the Vauld platform with immediate effect. We believe that this will help to facilitate our exploration of the suitability of potential restructuring options, together with our financial and legal advisors," said the statement.

"We seek the understanding of customers of the Vauld platform that we will not be in a position to process any further requests or instructions in this regard. Specific arrangements will be made for customer deposits as may be necessary for certain customers to meet margin calls in connection with collateralised loans," the statement added.

The crypto firm has engaged Kroll Pte as its financial advisor and Cyril Amarchand Mangaldas and Rajah & Tann Singapore LLP as legal advisors in India and Singapore respectively.

"We intend to apply to the Singapore courts for a moratorium i.e, a suspension of the commencement of continuation of any proceedings against the relevant companies so as to give us breathing space to carry out the proposed restructuring exercise," said Bathija in the statement.

Last month, Vauld had announced a reduction in headcount by 30 per cent as market conditions turned worse.

In India too, some of the exchanges also had to suspend deposit and withdrawals, primarily due to incorporating compliance and KYC requirements as a TDS of 1 per cent comes into effect from July.

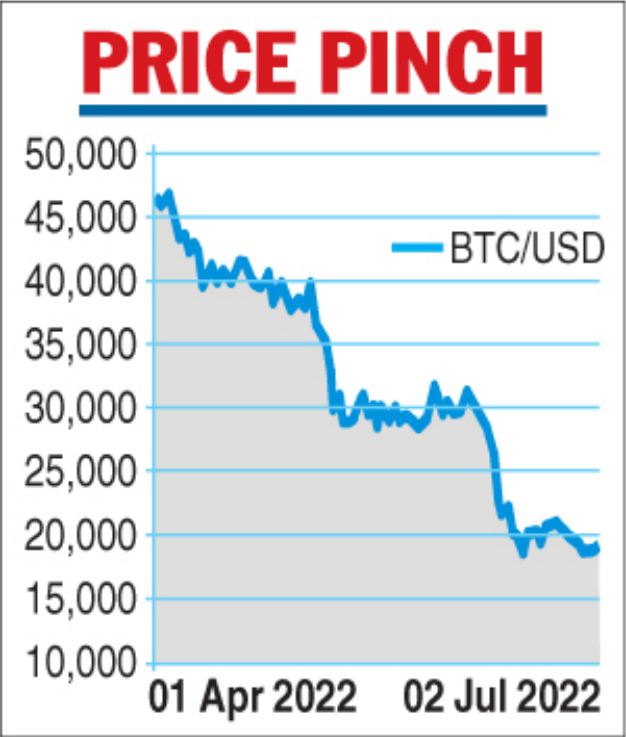

However, the new tax coinciding with the global decline in cryptocurrency prices has made it difficult for the cryptotraders.Bitcoin, the most prominent cryptocurrency globally has come down from a high of USD 46,301 on April 1, 2022 to below USD 20,000 in July (see chart).

For investors, a wait and watch approach is being professed by industry observers with a cautionary note on short-term rebounds.

"When a bear market - an inevitable economic cycle - arrives, the best move investors can make is to reevaluate existing strategies and identify new opportunities. Investors should also be wary of discounted selloffs, as short term market rebounds can be signals of an impending greater collapse," said Johnny Lyu, CEO, KuCoin.

But contrary to the layoffs seen in some of the global exchanges, the trend is not yet prominent in India.

"We are bullish on hiring this year and increase our team size from 500 to 1000," said Minal Thukral, executive vice president, growth and strategy, CoinDCX.