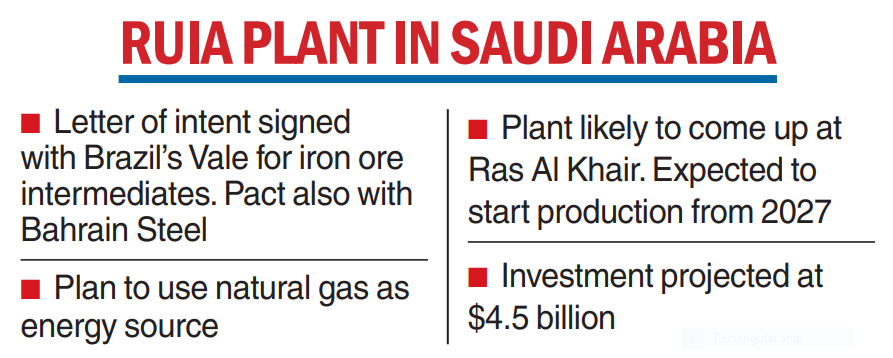

The Essar group has signed a letter of intent with Vale SA of Brazil to procure iron ore intermediates for the company’s proposed steel plant in Saudi Arabia, signalling the Ruia family’s attempt to return to the steel business.

The plant, which may entail an investment of up to $4.5 billion, is proposed to be located in Ras Al Khair. Through this partnership, Vale will supply Essar with 4 million tonnes (mt) per annum of iron ore agglomerates (DR grade pellets and briquettes).

The plant hopes to use the abundance of natural gas in Saudi Arabia as the source of energy to make steel with a lower carbon footprint. It will consist of a direct reduced iron (DRI) capacity of 5mt, comprising two modules of 2.5mt each.

Additionally, the project will include a hot strip capacity of 4mt, along with 1mt

of cold rolling capacity as well as galvanising and tin plate lines.

The plant is projected to start production from 2027, which is contingent upon it receiving the gas linkage. When completed, it will mark the Ruia family’s return to the steel sector after being routed in bankruptcy.

Essar Steel India Ltd, operated an 8.6mt plant at Hazira, Gujarat, and a pellet plant in Paradip, Odisha, featured among the large 12 non-performing assets which were sent to insolvency as part of the Reserve Bank of India’s direction in 2017.

In 2019, a joint venture of ArcelorMittal and Nippon Steel of Japan acquired Essar Steel after a protracted legal battle in insolvency courts for Rs 42,000 crore, raking in the moolah for financial creditors. In 2022, the Ruias sold a clutch of infrastructure assets — port, power plants — linked to the Essar Steel plant to ArcelorMittal-Nippon Steel for over $2 billion directly.

The change in the liquidity position of the Essar group, which at present earns majority of revenues from its Stanlow Refinery in the UK, appears to have emboldened it to place big bets in the steel business again. The group is also pursuing iron ore pellet complexes in Odisha and Minnesota in the US.

However, it is the KSA (Kingdom of Saudi Arabia) project which appears to be making a headway at present.

In August, Essar signed a letter of intent with Bahrain Steel to obtain iron ore pellets for the Green Steel Arabia (GSA) project.

Commenting on the development, Naushad Ansari, country head for the Essar group in KSA, said that through this LoI with Vale, and the previous one with Bahrain Steel, the project would secure 100 per cent of the raw material supply of iron ore feed for the Saudi Steel Plant.

“Our plan is to start production in the year 2027, and are confident of replacing the flat steel imports into Saudi Arabia and the GCC region with our bouquet of products,” Ansari said in a statement.

Vale’s regional director Andre Figueiredo added: “Vale International’s LoI with Essar for the annual supply of 4mt of high-grade iron ore agglomerated products signifies our long term commitment to meet the growing demand for raw material by the steel industry; especially in the Middle East.”

Vale’s portfolio of high grade iron ore agglomerates will have a direct positive impact in terms of added value, price competitiveness and potential lower carbon footprint, Figueiredo added.

Essar’s attempt to build a steel plant also aligns with KSA’s plan to diversify from an economy overly dependent on fossil fuel as the world transitions to decarbonise to achieve net zero target.