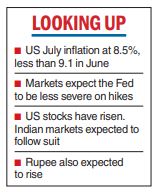

Equities are poised for a strong opening on Thursday as headline consumer price inflation (CPI) in the US was lower than estimates, easing the pressure on the US Federal Reserve to hike interest rates sharply at its next meeting.

CPI for July rose 8.5 per cent over the previous year but fell from 9.1 per cent in June and was also lower than estimates of an increase of around 8.7 per cent.

The data led to US shares staging a sharp rally with the Dow Jones Industrial Average trading with gains of 523 points or 1.60 per cent at the time of writing this report.

The SGX Nifty signalled a positive start to domestic equities as it was trading higher by 139.5 points.

Market circles said that the news could lead to the rupee appreciating against the dollar. The Dollar Index which tracks the greenback against a basket of six other units was trading lower by 1.31 per cent at 104.97. The rupee today closed 14 paise higher at 79.52 against the dollar.

Earlier during the day, benchmark indices closed on a flat note because of profit booking in IT and realty shares. The 30-share BSE Sensex ended 35.78 points or 0.06 per cent lower at 58817.29. Similarly, the broader NSE Nifty inched up 9.65 points or 0.06 per cent to close at 17534.75.

“Investors were in a cautious mode in anticipation of the release of US inflation statistics, which will set the tone for the next Fed policy meeting,” Vinod Nair, Head Of Research at Geojit Financial Services, said.

Correction fear

Brokerage Jefferies has warned that the gap between bond and earnings yield has widened to such an extent that bonds have become more attractive that stocks, which could lead a to a correction inequity values by as much as 15per cent.

Yields on the benchmark10-year bond is around 7.31 per cent, after breaching 7.50 per cent in June. However, this is more than the earnings yield of the Nifty which increases its allure over equities.

Earnings yield is the inverse of the price-to-earnings: if the P/E ratio goes up, the earnings yield will fall and vice-versa.

Delhivery sinks

Shares of Delhivery sank almost seven per cent as losses widened for the quarter ended June 30, 2022.

The counter slumped 11per cent to Rs 570, its biggest loss. The scrip settled at Rs599.90, a fall of Rs 42.90 or 6.67per cent.

The logistics company posted a net loss of Rs 399 crore for the period.