Ahead of the U.S. presidential election next week, investors in interest rate options are putting on trades that will pay off if rates remain elevated, suggesting that the market is pricing in a sweep by the Republican party.

The options market is also bracing for the biggest post-election swings in U.S. Treasury yields in more than 30 years.

If Republicans take both houses of Congress and the U.S. presidency, it likely would bring higher tariffs, and consequently higher interest rates, especially at the back end of the yield curve, due to inflation. Increased U.S. Treasury debt supply to finance a huge fiscal deficit also lifts longer-end yields.

Investors have been buying so-called long-dated payer swaptions, a trade where investors buy the right to pay a fixed rate and receive a floating one, benefiting when interest rates remain high.

"The options market is behaving as if it's expecting a higher probability of a Republican sweep," said Amrut Nashikkar, managing director, fixed income strategy, at Barclays. "This price action is what you would expect: rates moving higher and long-end rates increasing."

However, if Democrats prevail, it could bring higher taxes on corporations and higher-income households that could weigh on economic growth. Disinflation is likely and as such, more aggressive easing by the Federal Reserve would be possible. Interest rates are likely to decline in this environment, led by the front end of the curve.

Swaptions, which are options on interest rate swaps, are one segment of the more than $600 trillion over-the-counter rate derivatives market. Rate swaps measure the cost of exchanging fixed-rate cash flows for floating-rate ones, or vice versa, and are used by investors to hedge interest rate risk.

With the Secured Overnight Financing rate (SOFR) as reference rate, swaps generally reflect rate expectations.

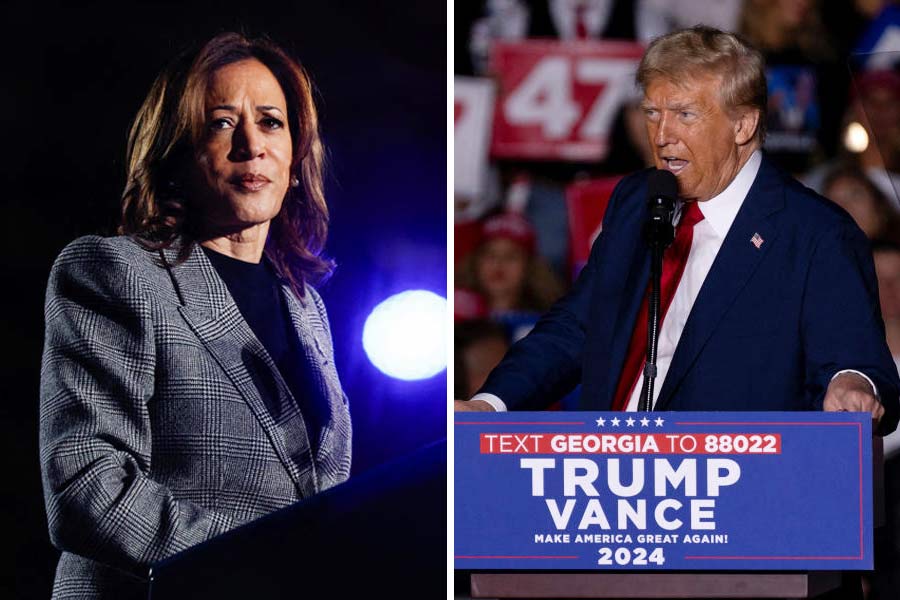

Payer swaptions were evident on longer maturities from five-year to 30-year swaps where the cost of implied volatility, a measure used to price these options, saw a surge a few weeks ago as online betting odds of Republican former president Donald Trump winning the election grew on platforms like Polymarket. It's a toss-up, however, in national polls.

The implied volatility on one-month at-the-money options on 30-year swap rates hit its highest for the year of 31.06 basis points (bps) on Oct. 21. It slipped on Friday to 30.5 bps.

"The long end is historically sensitive to fiscal policy because of the expected increase in Treasury issuance, which is typically higher on the long end of the curve," said Barclays' Nashikkar.

Higher vols for longer-dated maturities

Implied vols on one-month options on other longer-dated maturities from five to 10 years have also gone up.

"They have increased by an amount that is much higher than what we have seen in election cycles prior to the 2020 elections," said Bruno Braizinha, senior rates strategist, at BofA Securities.

As volatility climbed, investors are also betting on a move higher in longer-dated rates, such as those on 30-year swaps, about 50 bps higher, in one month.

The cost of longer-dated trades surged to an 18-month high on Oct. 22 of 33 bps, suggesting increasing expectation 30-year swap rates will end up 50 bps higher in a month. That is likely because 30-year Treasury yields will probably increase as well.

"The worst-case scenarios for bonds are the sweeps and investors are actively hedging right now, trying to hedge their portfolios for that," said BofA's Braizinha.

Aside from a Republican sweep, investors are also bracing for a jumbo move of 18 basis points in Treasury yields in either direction on Nov. 6 or 7, based on the MOVE index. That's about 2-1/2 times higher than what the current index is projecting on average daily moves over a period of one month.

The MOVE index, the benchmark for rate volatility, was 128.4 last Friday, reflecting expectations Treasury yields across most maturities will move an average of 8 bps per day in either direction over the next 30 days.

Harley Bassman, MOVE index creator and managing partner at Simplify Asset Management said option prices anticipate a sharp move in Treasury yields post-election, perhaps the largest since the 1991 Gulf War for a known event.

He noted that rate volatility has been a lot higher than in the stock market, which Bassman felt has become more complacent about the election.

U.S. stock volatility is more subdued because Bassman thinks equity markets do not care who gets elected. Both Trump and Vice President Kamala Harris have suggested significant increases in the budget deficit through increased fiscal spending, he noted, and that's good for the stock market and the economy.

"There will be huge deficit spending either way, creating a large fiscal impetus; ultimately a tailwind pushing the economy."