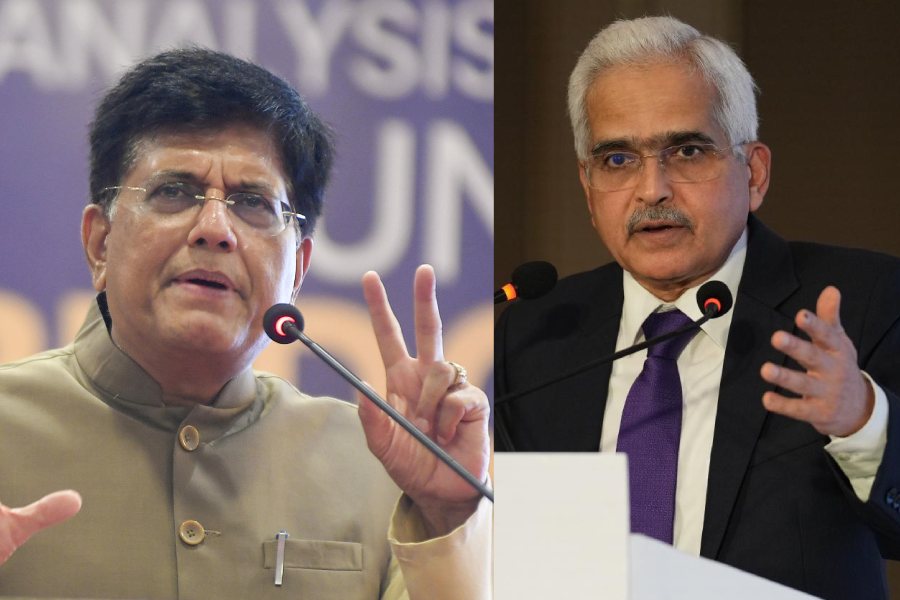

Union commerce minister Piyush Goyal has said the Reserve Bank of India should cut interest rates in order to crank up the economy – and stop using food inflation as the bogeyman to justify its inaction on interest rates.

High food inflation has acted as a trip wire for the central bank’s monetary policymakers with only one of its six members voting on October 9 for a cut in the policy-setting repo rate by 25 basis points from the current level of 6.5 per cent.

“I certainly believe they (RBI) should cut interest rates. Growth needs a further impetus,” Goyal said at an event organised by CNBC TV-18 on Thursday.

Goyal’s comments came just two days after retail inflation in October surged to a 14-month high of 6.21 per cent, largely driven by food prices.

Hopes of a rate cut appeared to recede as retail inflation flared above the 6 per cent upper limit of the RBI’s tolerance band. Food inflation has surged to 10.87 per cent.

RBI Governor Shaktikanta Das, who was also present at the event, refused to respond to the minister’s goad: “The next monetary policy is coming up in the first week of December. I will reserve my comments till then.”

Das and his fellow policymakers have adopted a hard line on the issue, rejecting appeals from industry to cut rates and head off a precipitate risk of falling behind the curve.

The RBI Governor has often said interest rates would be cut only when inflation hewed close to 4 per cent – the median of its inflation-targeting mandate. Many economists now expect a rate cut only in February or April next year.

Tussle looms

The significance of Goyal’s not-so-subtle nudge to the RBI governor ahead of the next MPC meeting in early December was not lost on the audience even though the minister claimed that his views were “personal…and not that of the government.”

Goyal’s comment also rekindled concerns about the independence of the central bank in deciding the country’s monetary policy, an issue that has flared several times in the past.

Former finance minister P. Chidambaram and then RBI Governor Duvvuri Subbarao had famously butted heads on the issue in 2013. Subbarao resisted pressure from the government to cut rates, prompting Chidambaram to petulantly remark that he would “walk alone” to face the “challenge of growth”.

“I have been asked several times if there was pressure from the government on setting interest rates. There certainly was, although the precise psychological mechanics of pressure would vary depending on the context, setting and personalities,” Subbarao had written in his book `Who moved my interest rate --Leading the Reserve Bank of India through Five Turbulent Years’’.

A row over RBI’s independence boiled over again in 2018 when Governor Urjit Patel resisted the government’s claim to a large slice of the central bank’s surplus on its books – which was one of the main reasons that triggered his resignation later that year.

At the height of the battle between the Centre and Urjit Patel, former deputy governor Viral Acharya also articulated his fears about the erosion of the RBI’s independence. “Direct intervention and interference by the government in operational mandate of the central bank negate its functional autonomy,” Acharya had said in a paper he presented in October 2018.

Change of guard

Goyal’s comments also come days after the finance ministry invited applications for the post of RBI deputy governor for a period of three years.

Dr Michael Patra, the current deputy governor who is in charge of monetary policy and an ex-officio member of the MPC, is due to retire on January 14.

Shaktikanta Das’s six-year tenure will also end in December. The buzz among bankers is that he could get another extension.

Goyal said that the RBI should look through food prices while deciding interest rates – a stand that is in sync with chief economic advisor V. Anantha Nageswaran who articulated his views in the Economic Survey earlier

this year.

“Food inflation has nothing to do with managing inflation. It’s time that policy makers and monetary policy authorities should sit together and decide if food inflation needs to be part of calculating headline inflation. There should be a serious discussion on this,” Goyal said.

Goyal’s view echoed the sentiment expressed in the Economic Survey: “India’s inflation targeting framework should consider targeting inflation, excluding food. Higher food prices are.. not demand-induced but supply-induced.”

Das and the other MPC members are resisting this view. “The MPC may look through high food inflation if it is transitory; but in an environment of persisting high food inflation…the MPC cannot afford to do so. It has to remain vigilant to prevent spillovers or second round effects from persistent food inflation and preserve the gains made so far in monetary policy credibility,” the Governor had said in August.

Stop margin fishing

Goyal dropped another bombshell when he suggested that the industry and businesses should start offering attractive prices to consumers in order to stoke demand.

“There is a huge competitive edge manufacturing in India gives you.

“So, I think if smart business people start offering better pricing, better value for money, I am sure the market will give them a boost. It is for them to decide whether they want to sit on high margins,” he said.

Several companies have been complaining about weakening demand in the economy to explain to their shareholders why profits were badly crimped in the quarter ended September 30.