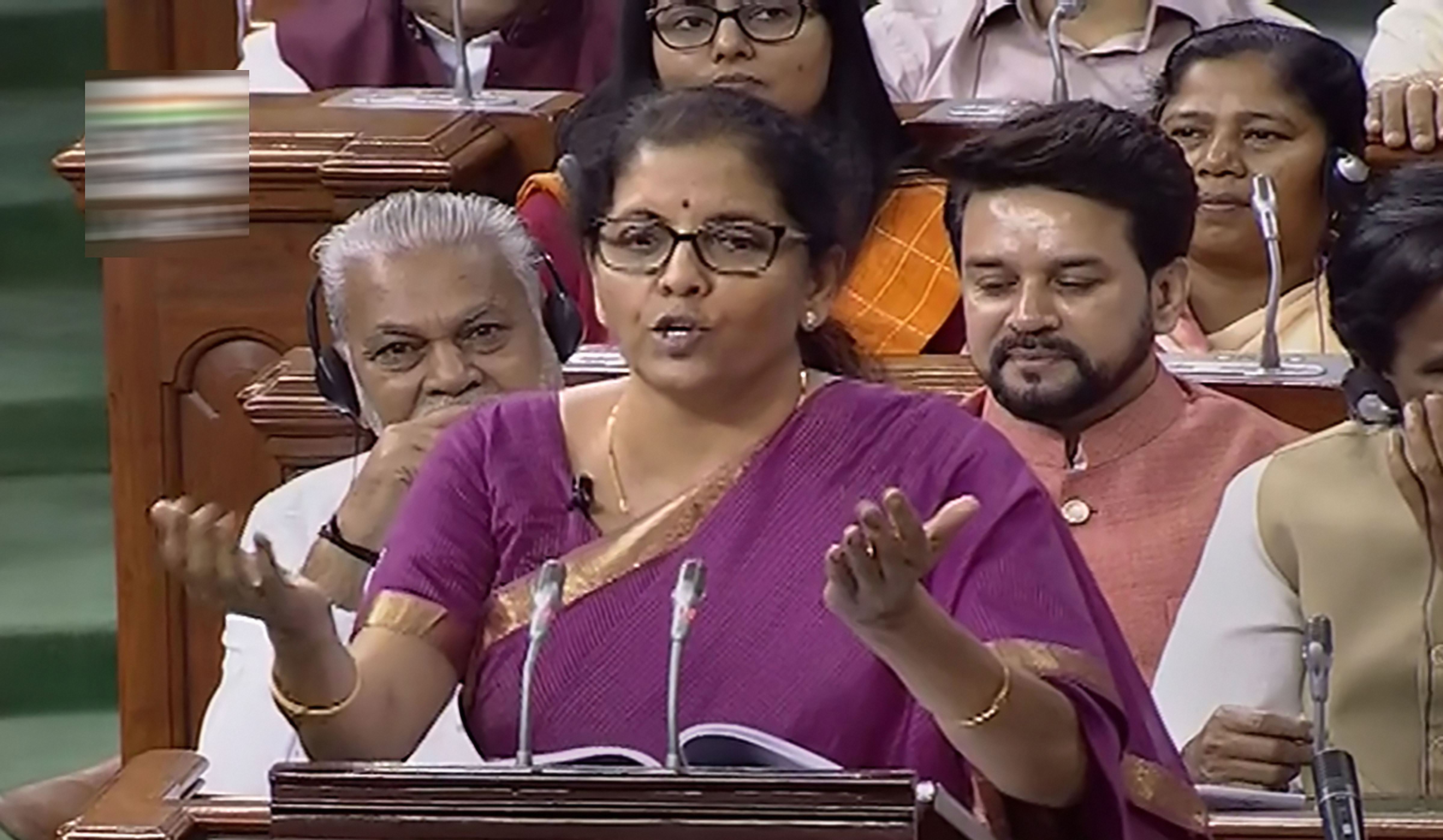

The finance minister has made an honest attempt to put the economy back on track, say students from IIM Calcutta. (Telegraph picture)

How do you rate the budget on a scale of 1-10?

What is the budget’s big idea?

Where has the FM scored?

Where has she failed?

Is the budget indicative of the majority the govt won in the general elections?

IIM Calcutta

(2) Zero Budget Natural Farming, which can catalyse government’s target of doubling farmers’ income by 2022. It needs a pan-India push so that an average farmer can be pulled out of the debt trap. Though there was substantial obscurity in numbers, the focus on long-run investment needs, infrastructure upgrade, mobilisation of foreign savings and electric vehicles is worth acknowledging.

(3) Big boost for the housing sector, infra and liberalisation of norms for FPI (foreign portfolio investment) and NRI investments. We were particularly impressed by the importance given to higher education with the announcement of the National Research Foundation.

(4) The major disappointment came from the agriculture sector and in personal taxation. No relief for farmers despite a bad monsoon. In taxation, additional taxes and surcharges were introduced, making it 42% effective tax for the highest income group, also making cash payments costlier with 2% TDS. A detailed roadmap on job creation was needed. The budget also remained largely silent on the health sector.

(5) The finance minister has made an honest attempt to put the economy back on track. The policymakers don’t seem too perturbed by the furore over growth numbers and have instead focused on long-term development parameters.

Unemployment in India has been at a record high of 6.1%. Yet, there has been no substantial push to employment generating programmes, say students from IIM Bangalore. (Telegraph picture)

IIM Bangalore

(2) In light of the agrarian distress, the FM has focused on farmers’ plight. Zero Budget farming will reduce the capital and operating expenditure of farmers, thus optimising cost of production. The creation of 10,000 Farmer Producers Organizations will help increase the collective bargaining power of small and marginal farmers. However, the numbers need to be scrutinised in greater detail to understand the commitment behind the claims and promises.

(3) India is a $3 trillion economy. To grow it to $5 trillion, the government has tacitly marked a shift from a “consumption-driven economy” to “investment driven economy”. We see a shift towards LPG (Liberalisation, Privatisation and Globalisation) 2.0.

(4) Unemployment in India has been at a record high of 6.1%. Yet, there has been no substantial push to employment generating programmes.

(5) The budget ticks all major boxes, but scarcely ventures away from the tried and tested programmes of lowering the tax burden on the poor, increasing burden on the rich and somehow promising a fiscal deficit of 3.3%. Issues which require immediate attention like employment find no prominent mention. The FM has lost a golden opportunity to use the budget as a decisive policy document and has merely presented a statement of financial outlay.

The budget might help reap long-term benefits but in the short run it’s lukewarm, say students from IIM Shillong. (Telegraph picture)

IIM Shillong

(2) Bank recapitalisation, the significant discount on affordable housing in taxes and disinvestment. The relative importance towards infrastructure and housing was quite high compared to earlier budgets. A move towards a more progressive taxation system; taxation for the wealthy has increased. Also, the decision to reduce stake in PSUs and borrowing money from the overseas market.

(3) Ease of doing business by streamlining of KYC norms for foreign portfolio investors to make it investor-friendly. The crunch that NBFCs were facing seems to be easing with increase of credit lines and guarantees by banks and mutual funds to the extent of Rs 70,000 crore. Liberalisation of FDI in aviation, media, animation and insurance intermediaries will also ensure a better business environment.

(4) No mention of fiscal deficit target, which the market eagerly looks forward to, was a huge disappointment. On one hand the KYC norms for foreign portfolio investors are easier and on the other, high level of corporate and income tax is a move towards a more uncompetitive economy. Another low was the excise duty increase in petrol and diesel.

(5) The budget might help reap long-term benefits but in the short run it’s lukewarm.

Despite the huge majority, the government has eschewed big bang reforms in land, labour and the financial sector where reforms are long overdue, say students from XLRI Jamshedpur. (Telegraph picture)

XLRI Jamshedpur

(2) The government is finally focusing on promoting environment-friendly electric vehicles through subsidy, reduced GST and additional I-T deduction for interest on loan up to Rs 1.5 lakh. Bringing NBFCs under RBI could mean higher confidence in the system. Government borrowing from foreign markets, infusion of low-cost foreign funds and reduction in domestic interest rates could result in reduced bond yields and higher private sector capital expenditure on account of reduced interest rates.

(3) Boost to MSMEs through loans of up to Rs 1 crore and inclusion of retail traders and shopkeepers in pension benefits; subsidies for advanced technologies and the electric vehicle sector would help in manufacturing of advanced technology products.

(4) The budget is high on optics, but for instance, I-T exemption to middle class and surcharge for the rich are there to please the electorate. No health reforms announced, and allowing foreign direct in media is not a very progressive step given the need for transparency.

(5) Despite the huge majority, the government has eschewed big bang reforms in land, labour and the financial sector where reforms are long overdue.

Compiled by Subhankar Chowdhury, K.M. Rakesh, Roopak Goswami and Animesh Bisoee