Nirmala Sitharaman may not have tinkered with the long-term capital gains tax but three announcements by the finance minister hit market sentiment with investor wealth eroding by Rs 2 lakh crore and the Sensex plunging by 394.67 points to close at 39513.39.

While the first budget of Sitharaman did not contain any bold measures, the proposals to raise the public shareholding threshold, impose tax on share buybacks and sharply increase the tax rates on high net worth individuals prompted operators to offload stocks in a market already worried about expensive valuations.

The key pain points were the twin steps of higher tax on the super rich and the 35 per cent minimum public shareholding, which will affect liquidity in the markets. The buyback tax is expected to constrain the plans of some IT companies to return surplus cash to their shareholders through this method.

Presenting the full budget for 2019-20, Sitharaman said it was the right time to consider increasing the minimum public shareholding to 35 per cent from the current 25 per cent. The fear is that if accepted, the proposal could lead to a huge supply of shares, not only affecting liquidity but also bringing share prices under pressure.

“From the capital markets’ perspective, the increase in minimum shareholding requirement from 25 per cent to 35 per cent, though required in a country with limited free float, could create supply in the markets, limiting the upside,” said Dhiraj Relli, MD and CEO, HDFC Securities.

The woes of the investor did not end there as the finance minister announced a higher tax on the super rich. According to Suresh Surana, founder of RSM Astute, a tax consultancy firm, for those earning above Rs 5 crore, the increase works out to nearly 7 per cent at 42.74 per cent.

Moreover, in a bid to plug the tax arbitrage between the buyback of shares by listed companies (it was not subject to tax) and dividend distribution, Sitharaman announced that listed companies will have to pay a tax of 20 per cent should they go in for a buyback.

“In order to discourage the practice of avoiding Dividend Distribution Tax (DDT) through buyback of shares by listed companies, it is proposed to provide that listed companies shall also be liable to pay additional tax at 20 per cent in case of buyback of share, as is the case currently for unlisted companies,” she said.

According to Amar Ambani, president and research head of YES Securities, these three measures contributed to the market crash on Friday. “The big surcharge tax on high-income groups and possible squeezing of secondary market liquidity because of disinvestment and increased public shareholding is causing the stock market to fall today,” he said.

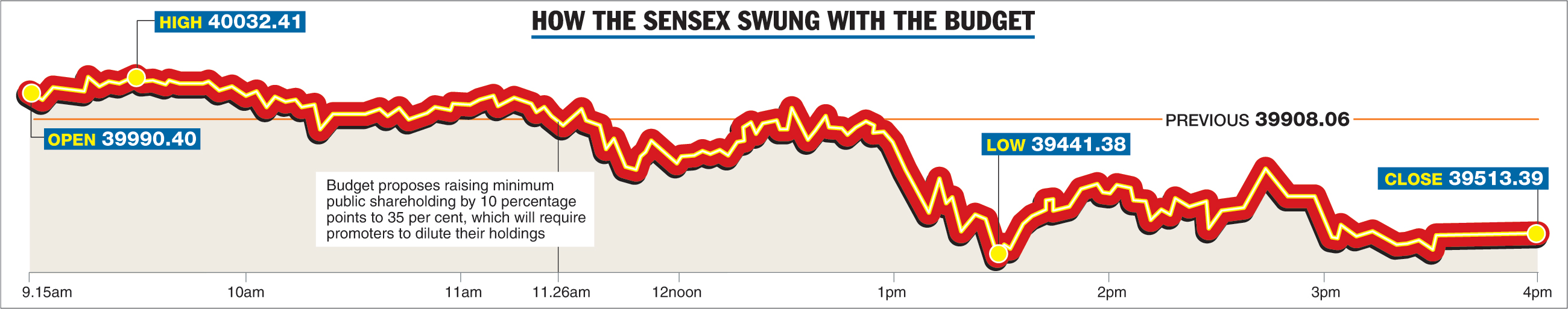

Ahead of the budget, while expectations were muted, the benchmark indices remained in the negative territory initially. However, they went for a tailspin when these announcements were made.

Although there was a small recovery from the intra-day lows, the key indices still ended with sharp cuts. Market circles said that with a key event now over, the focus would be on first-quarter earnings, which is set to commence in less than a fortnight.

While the Sensex, the 30-share index, began on a cautious note at 39,990.40 and touched the 40,000-mark in early trading, it hit a low of 39,441.38 — a drop of around 467 points, and finally finished 394.67 points, or 0.99 per cent, lower at 39513.39.

On similar lines, the broader NSE Nifty sank 135.60 points or 1.14 per cent, to 11,811.15.

Led by the fall in equities, the market capitalisation of BSE-listed companies plunged Rs 2,22,579.67 crore to Rs 1,51,35,495.86 crore.