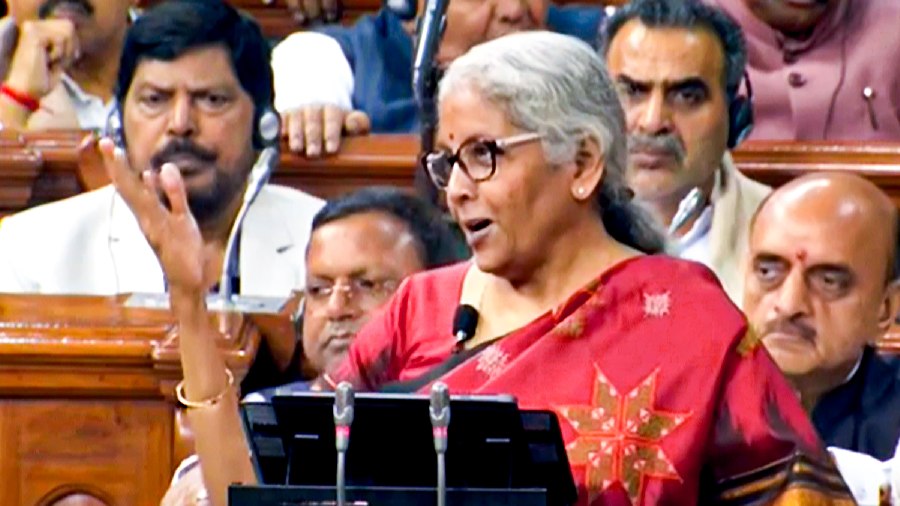

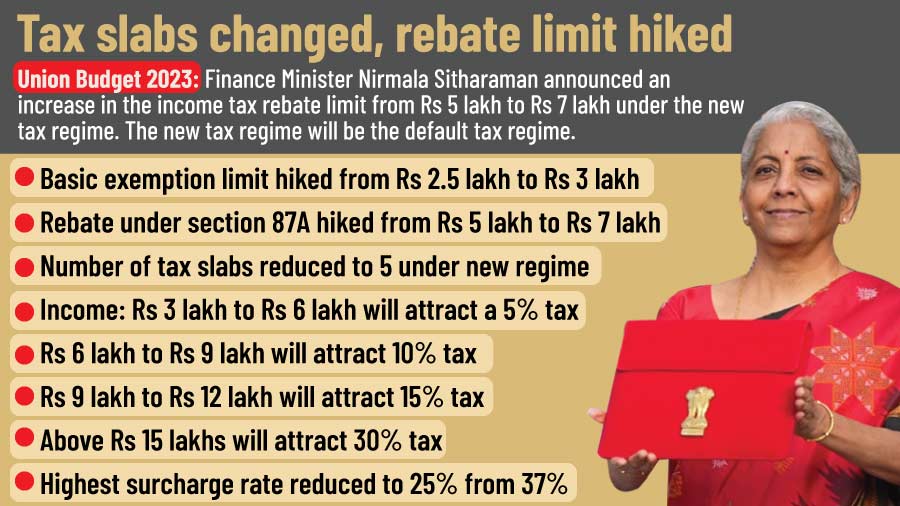

Finance Minister Nirmala Sitharaman announced an increase in the income tax rebate limit from Rs 5 lakh to Rs 7 lakh under the new tax regime, adding that the new tax regime will now be the default tax regime.

While presenting the Union Budget 2023-24 in Parliament on Wednesday, the FM also reduced the number of tax slabs in the new tax regime.

These are: Tax for income of Rs 0-3 lakh is nil; income above Rs 3 lakh and up to Rs 5 lakh to be taxed at 5%; income of above Rs 6 lakh and up to Rs 9 lakh to be taxed at 10%; income above Rs 12 lakh and up to Rs 15 lakh to be taxed at 20%; and income above Rs 15 lakh to be taxed at Rs 30%.

The government estimated the fiscal deficit for 2023-24 at 5.9 per cent of the GDP, the FM said.

Announcing the “highest-ever outlay, nine times the outlay made in 2013-14”, the finance minister said that Rs 2.40 lakh have been allocated for Indian Railways. She said this was the “highest-ever outlay”, nine times the outlay made in 2013-14.

The capital investment outlay has been increased by 33 per cent to Rs 10 lakh crore, which will account for 3.3 per cent of the GDP. In a boost for states, Sitharaman said that the 50-year interest-free loan to state governments will continue for a year more. The NITI Aayog’s state support mission will be continued for three years, she added.

The Union Budget 2023 focused on seven priorities, which the Finance Minister called the “Saptrishis guiding us through Amrit Kaal”. These are: inclusive development, reaching the last mile, infrastructure and investment, unleashing the potential, green growth, youth power and financial sector”.

Here are the highlights of the Union Budget 2023-24

- New tax regime to be default, said Sitharaman, but old regime remains

- Green hydrogen mission will facilitate transition of economy: FM

- National Digital Library will be set up for children, adolescents: FM Sitharaman

- FM announces 100 labs for developing apps using 5G

- Fiscal deficit at 6.4 per cent of GDP

- Fiscal deficit for 2023-24 fixed at 5.9 per cent: FM

- PAN to be common business identifier, likely to ease compliance burden

- Government to introduce 5 per cent compressed bio-gas (CBG) mandate

- Credit guarantee for MSMEs: New scheme with allocation of 9000 crore

- Government to set-up 30 Skill India International Centres

- Agriculture credit target to be raised to Rs 20 lakh crore

- FM push for transport, infra projects

- Taxes on cigarettes hiked by 16 per cent: Sitharaman

- Basic customs duty hiked on articles made from gold bars: Sitharaman

- Govt proposes to reduce customs duty on import of certain inputs for mobile phone manufacturing: FM

- States to be allowed 3.5 per cent of GDP as fiscal deficit: FM Sitharaman

- Govt to bring National Data Governance policy: FM Sitharaman

- National Data Governance Policy will enable anonymised data; KYC process will be simplified by adopting risk-based system: FM

- Capital outlay of Rs 2.4 lakh cr provided for Railways; highest-ever allocation since 2013-14: FM

- Mahila Samman Savings Certificate for women for 2 years, deposits of up to Rs 2 lakh at 7.5 per cent interest rate

- Centre to provide Rs 5,300cr assistance to drought-prone region of Karnataka

- 50-year interest-free loans to states extended for 1 more year: FM

- Budget 2023 focuses on seven priorities, called the 'Saptrishis guiding us through Amrit Kaal': Sitharaman These are: inclusive development, reaching the last mile, infrastructure and investment, unleashing the potential, green growth, youth power and financial sector

- PM Awas Yojana being enhanced by 66 per cent to Rs 79,000 crore, capital expenditure increased 33 per cent to Rs 10 lakh crore, which would be 3.3 per cent of GDP

- PM Primitive Vulnerable Tribal Group scheme to benefit 3.5 lakh tribals: FM

- Govt to launch a Rs 2,200 crore Aatmanirbhar clean plan programme: FM Sitharaman

- Govt implementing scheme to supply free grains to poor under PMGKAY with expenditure of Rs 2 lakh cr from Jan 1: FM Sitharaman

- Finance minister says this budget hopes to build on foundation of previous budget and blue print for India@100

- In 75th year of Independence, world has recognised India as a bright star: FM