Tax burden remains same — that’s a letdown

Aranya (48) and Suparna Ray (47) live in Calcutta. Their daughter Ahana (17) is in twelfth grade. Aranya works for a footwear retail chain while Suparna runs her own start-up which deals in handloom and handmade products. Aranya and Suparna have a lot of expectations from the budget — reduction of income tax rates in different slabs will help reduce the overall tax amount, they feel. Basic exemption limit should be raised. Aranya feels considering the high mediclaim premiums, exemption under 80D should be increased. “We are already spending a good amount for our daughter’s education, says Suparna. “It is going to increase a lot at the undergraduate level. But the exemption under the education head is very low. It should be increased.” Deduction available for interest paid against home loan should be also increased, they feel. As a whole, the focus should be there on the healthcare and education sectors.

Budget reaction: Aranya: Direct tax part is not touched in the budget — tax slabs, standard deductions and exemption limits remain unchanged. The overall tax burden will be same.

Suparna: A positive for me is that tax incentives for start-ups established before March 31, 2022 for 3 consecutive years out of 10 years from incorporation have been extended for one more year.

Some cheer for hospitality

Urvika Kanoi

Urvika Kanoi (30) is a chef and restaurateur. The Covid pandemic has hit the food and beverages sector hard. Urvika recounts the lockdown months when she had to support her staff with full wages even though her restaurants were closed. Even after the restrictions were lifted the restaurants were asked to adjust to new timings. “Given the difficulties we have faced there is no exemption or sop for us. Another strange thing is in our industry we pay a much higher GST on inputs like chocolate but we can charge a very low GST from the customer for the end product where we use that chocolate. This is hitting us,” says Urvika. The issue of service charge in the Covid times needs a second thought. Our staff would benefit a lot if this was made mandatory. On the personal taxation front, she feels the little she can invest is also taxed. She hopes the Budget will make savings and investments more attractive.

Budget reaction: There is some relief for the hospitality sector. The emergency Credit Line Guarantee Scheme will be extended up to March 2023 and its guarantee cover will be expanded by Rs 50,000 crore to total cover of Rs 5 lakh crore, with the additional amount being earmarked exclusively for the hospitality and related enterprises. However, on a personal tax front, there is nothing to be excited about. While the finance minister had applauded the taxpayers for remarkable GST collection, some more changes could have been brought for their benefit.

Digital learning measures a big positive

Fatima Anwar.

Fatima Anwar (26) is a programmes manager at a foreign consulate in Calcutta. Fatima saves tax by investing in PPF and insurance. However, the high cost living and unforeseen expenditure makes it difficult to set aside as much as she would have liked in savings. “Personally my focus for this year is to buy my own house and while looking at tax saving options I realised that currently there is no rebate during the initial years for buyers who avail a loan above 30 lakh as the cap for deduction is set at Rs 2 lakh per annum under section 24(b). Increasing the cap could promote demand for homes and make housing more affordable.

Budget reaction: There are hardly any tax saving measures for the young and salaried. Nothing to encourage home buying. However, in the education field, which interests me as my work relates to the sector, there are some positive measures to provide education through electronic means. The number of TV channels under PM eVIDYA are being expanded from 12 to 200 TV platform channels. This will surely enable all states to provide supplementary education in regional languages for classes 1-12. E-content will be developed in all spoken languages and will be available for delivery via internet, mobile phones, television and radio through digital teachers — this is a positive goal to move towards a digitalised education system.

The salaried have been left out in the cold

Ananyo Chakraborty

Ananyo Chakraborty (39) is a banker. Ananyo feels the tax benefit on housing loan interest payment and principal repayment should be increased by at least Rs 50,000-60,000.

The current limit is too low considering the high price of properties in the city and even suburbs. The move will not only help the borrower but will also boost the real estate sector and bank lending. As a salaried individual, he expects the investment limit under 80C to be raised from Rs 1.50 lakh to Rs 2.50 lakh. More scope for investments will encourage people to save more while cutting their tax outgo. On a general note he adds that the budget should try to increase the reserves by attracting more foreign direct investment.

Budget reaction: Although the finance minister had started her speech stating that the government constantly strives to provide the necessary ecosystem for the middle classes, this year budget is not for the salaried class at all. There is nothing for us, no additional exemption or revision of existing ones. The tax slab will remain the same for the coming year. There is also no concrete announcement for the home buyer even though the finance minister announced targets under Housing For All.

Only those under NPS stand to benefit

Prantik Banerjee and Rupa Mukherjee.

Prantik Banerjee (34) and Rupa Mukherjee (32) live in Calcutta. Prantik is a state government employee while his wife Rupa is a teacher. The duo have invested in a new home but Prantik feels the deduction on the interest component of his home loan should be increased. The current limit of Rs 2 lakh is too low he feels given the buying am apartment. Investment exemption limit under section 80C should be higher.The same applies for standard deduction. Rupa feels the budget should also review the tax slabs.

Budget reaction: Prantik: As an individual taxpayer, there is nothing in the budget that we can be happy about. The government could have considered measures to put money in the hands of the consumers. While I have not opted for NPS, it is a good move for the government to provide equal treatment to both central and state government employees by increasing the tax deduction limits to 14 per cent.

Rupa: There is a thrust on improving education through digital means, which is a positive. Particularly for children in the government schools and provide electronic content in regional languages through internet, mobile phones, TV and radio. It needs to be seen how the proposed digital university takes shape.

I was hoping for a WFH allowance

Debarghya Debnath

Debarghya Debnath (23) is a software developer at a global car manufacturer. Debarghya wants lower I-T rates for the old tax regime as this will give more disposable income in people's hands because the highest rate of 30% actually translates into 42% outgo when surcharge and education cess are added. Increase in the standard deduction limit would be a much-needed relief in these difficult times. Standard Deduction in the New Tax Regime in the form of HRA and LTA would be a welcome move too. “Instead of tax being deducted for annual contributions to PF exceeding Rs 2.5 lakh, I would expect this limit to be raised." Introduction of 'work-from-home' allowance and keeping it tax-free would be a big help for employees who have to bear high internet charges and furniture costs to set up a work space at home.

Budget reaction: This budget has no joy for the salaried and the tax paying group. Lower tax rates or higher exemptions would have been much appreciated at a time when prices of commodities are rising. Being an employee in the IT sector, I was rooting for the introduction of ‘WFH Allowance’, which according me is again a major letdown considering the current scenario. The introduction of 5G technology might lead to the opening of new jobs in the IT and communication sectors which might play an important role in solving the unemployment crisis.

No relief for the retired is a disappointment

SatyaRanjan Datta

Satya Ranjan Dutta (73) is a chartered Accountant. He retired from a public sector undertaking in 2008. He lives in Calcutta with his wife Mita Dutta (64). Satya feels the reduced interest rates on savings have affected the returns from his retirement corpus. Moreover, to save on taxes he has to invest in schemes like fixed deposits which have a five-year lock-in.

“Retired people depend on interest and pension. I would like to see the budget raising the basic exemption limit, standard deduction should be enhanced to Rs 1 lakh from Rs 50000 at present. “The lock-in period for tax saving FD should be limited to three years (same as ELSS). This will help the seniors to live well and meet unforeseen medical needs as well.”

Budget reaction: This budget has not considered any relief for retired people and middle class, which is very disappointing. However, the enhanced budget for capital and infrastructure expenditure will increase the purchasing power and thereby overall development. I am a bit unhappy that there is not much in the budget to get a Covid-ravaged economy back on track

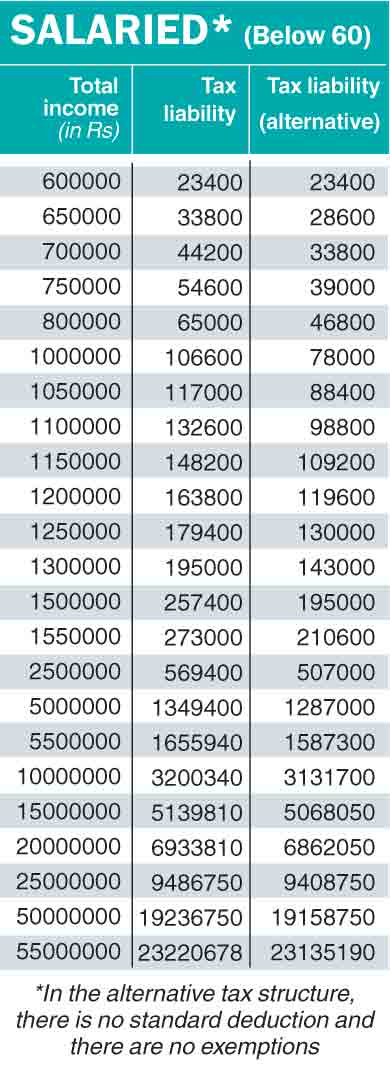

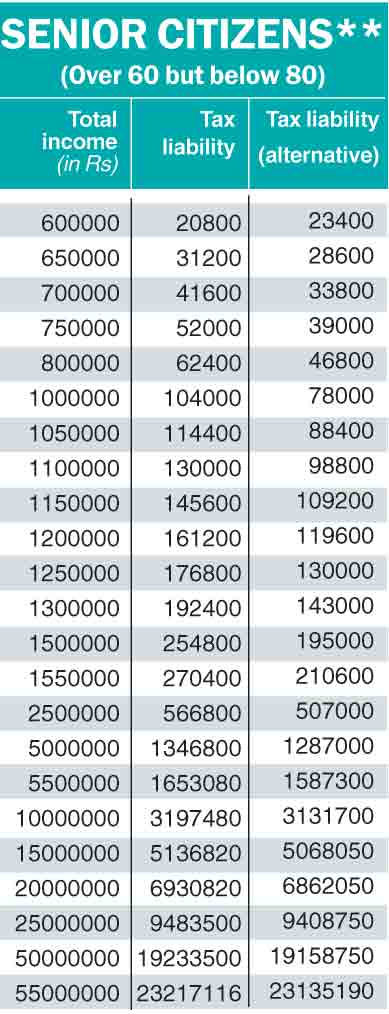

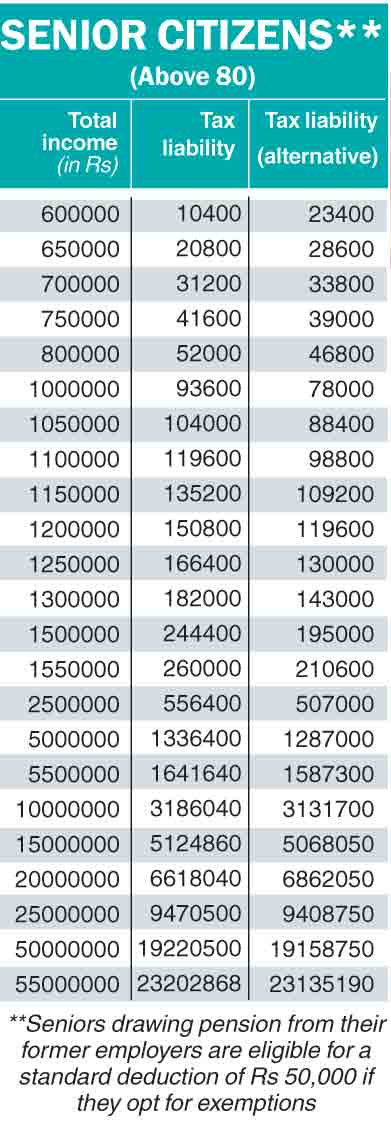

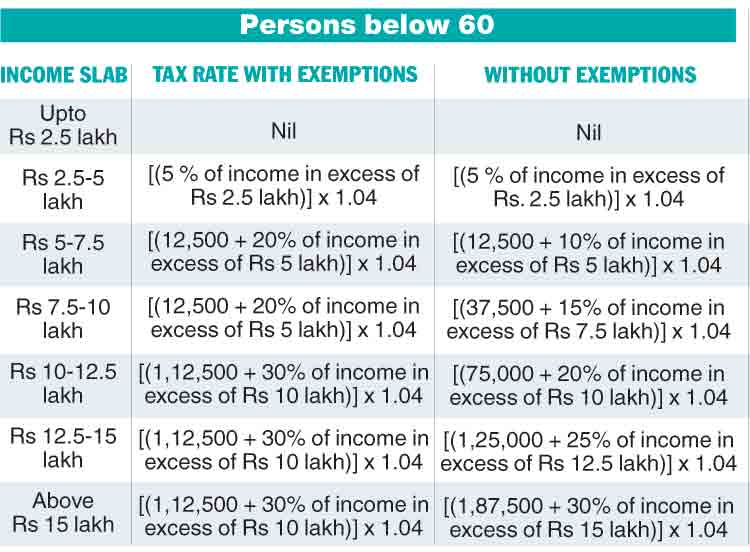

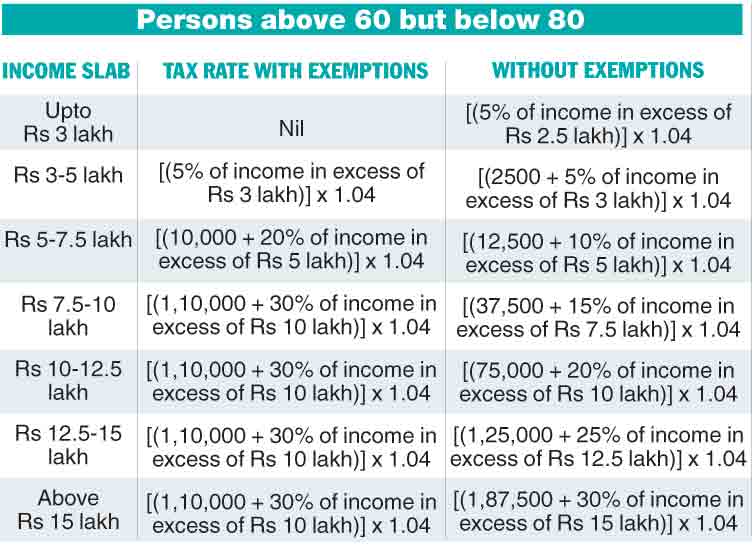

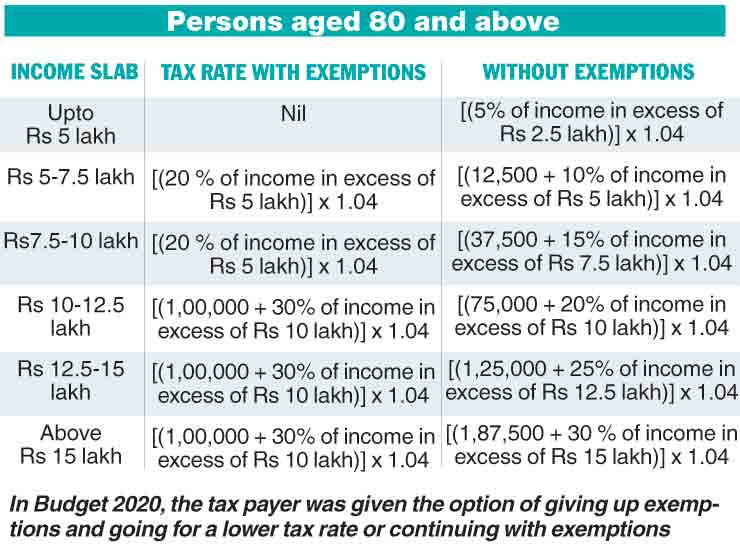

A look at the numbers:

Age categories and income slabs:

PS: Standard deduction is not available for individuals opting for the alternative tax regime. Surcharge of 10 per cent is applicable in case income is above Rs 50 lakh; 15 per cent in case income is above Rs 1 crore; 25 per cent in case income is above Rs 2 crore and 37 per cent in case income is above Rs 5 crore.

How tax changes affect me

• There is no change in income tax slabs or income tax rates or exemptions in this union budget. Standard deduction remains at Rs 50,000 and exemptions are available of up to Rs 1.5 lakh under section 80C

• The optional income tax regime without exemptions remain

• Option has been given to file updated income tax return and make corrections within two years from the end of relevant assessment year

• Section 80DD offers a deduction of Rs 75,000 to a resident individual on expenditure incurred for medical treatment, training and rehabilitation of a disabled dependant or amount paid to an insurer in respect of scheme for maintenance of a disabled dependant. But the deduction is only allowed in the event of the death of the individual or the member of the HUF in whose name subscription to the scheme has been made. Now deduction under this section will also be allowed during the lifetime, i.e., upon attaining age of 60 years or more of the individual in whose name the subscription to the scheme has been made

• New clause under section 56(2) allowing income tax exemption on any sum of money received by an individual, from any person, in respect of any expenditure actually incurred by him on his medical treatment or treatment of any member of his family, in respect of any illness related to Covid-19 subject to such conditions

• Limit of deduction under section 80CCD increased from 10 per cent to 14 per cent in respect of contribution to NPS made by the state government in order to bring parity with central government employees

• Investment in cryptocurrencies or cryptocurrency gifts is no longer outside the ambit of taxation. Any income from transfer of any virtual digital asset shall be taxed at the rate of 30 per cent. There will be TDS of 1 per cent on transaction of virtual assets.

(By Pinak Ghosh)