Finance minister Nirmala Sitharaman’s Budget presented on February 1, 2022 has given a great deal of emphasis on infrastructure, digitisation and growth.

The four broad pillars of development focused upon are inclusive development, productivity enhancement, energy transition and climate action. While all sectors have been touched upon, special emphasis has been given on boosting infrastructure to achieve the vision of “AtmaNirbhar Bharat”.

Real estate & infra

The FM has stated 80 lakh houses will be completed for the identified eligible beneficiaries of PM AwasYojana , both in rural and urban areas. A sum of Rs. 48,000 crore is allocated for this purpose.

This move is expected to provide a near-term boom to the sector. Currently, tax is deductible @1 per cent on sum paid in case of transfer of an immovable property (other than agricultural land). It is proposed to amend and provide for deduction of tax @1% of such sum paid or credited to the resident or the stamp duty value of such property, whichever is higher.

Manufacturing

Adequate funds have been allocated towards infrastructure sector.

As a matter of providing stimulus to the new manufacturing industries, it is proposed to amend the existing provisions of the concessional tax regime by extending the date of commencement of manufacturing or production from March 31, 2023 to March 31, 2024.

Automobile

In order to mitigate the issue of space constraint in setting up charging stations of electronic vehicles (EVs) in urban areas, the government has introduced a battery swapping policy .

Important announcement has been made for promoting the use of public transport by introduction of clean and EVs in the commercial vehicle sector.

Digital economy

The current government has been at forefront to promote digital economy . The financial support for digital payment ecosystem shall continue . There will also be a focus to promote the use of payment platforms It is proposed to set up 75 digital banking units in 75 districts .

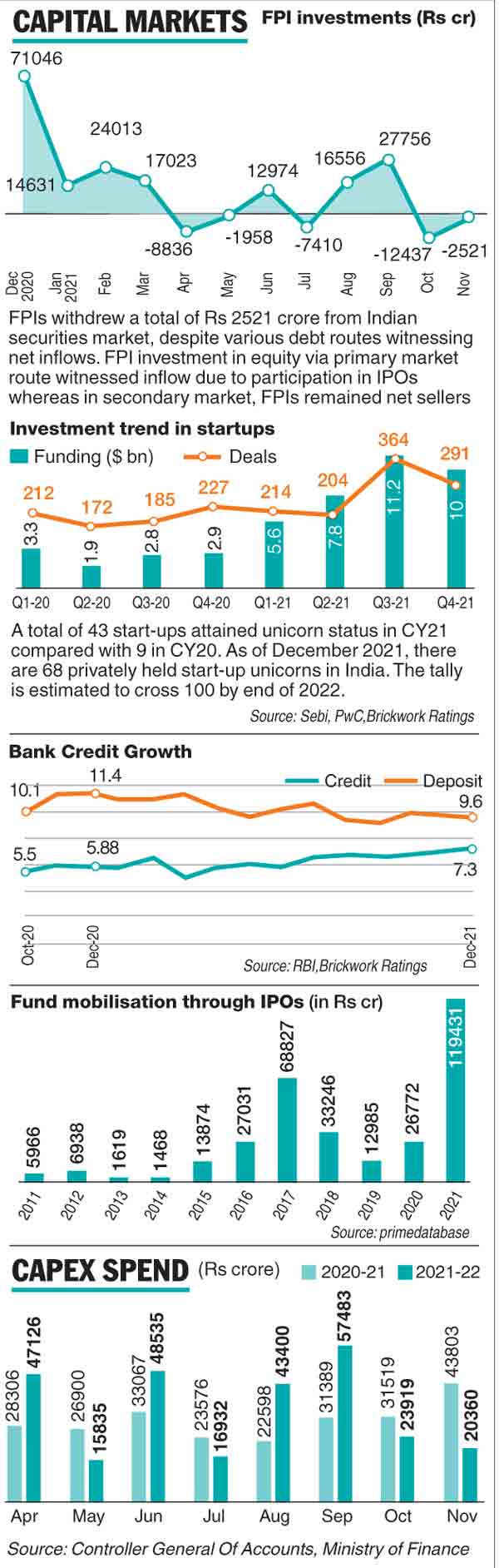

Start-ups

The sunset clause for the incorporation of eligible start-ups in order to claim exemption from income tax has been further extended to March 31, 2023. The tax incentives given to start-ups shall facilitate the growth of aspiring entrepreneurs in their initial phase of business.

Covid concerns

The central government has ratified the reliefs earlier announced for non-taxability of any sum paid by employer in respect of any expenditure actually incurred by the employee on his medical treatment or treatment of any member of his family in respect of any illness relating to Covid-19. This shall not form part of perquisites in the hands of employees. Problems of sectors such as tourism and hospitality which have been hit by the pandemic may have not been appropriately addressed.

The common man may feel dissatisfied on non-grant of incentives like standard deduction hike, reduction in personal income tax slab rates. However, with the proactive measures taken by the government, India is soon moving towards an economy leading to transparency and greater accountability.

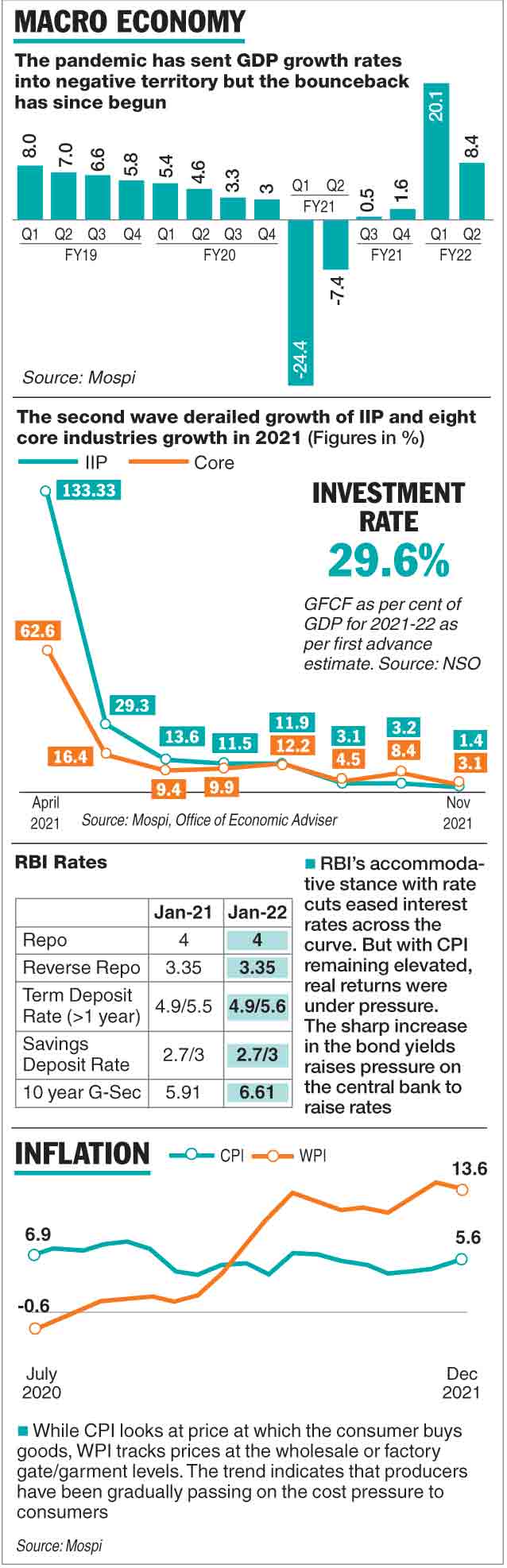

Macro-economic stability indicators also suggest that the economy is well placed to take on challenges of fiscal year 2022-23 and the current union budget seems to take positive steps to achieve this.

(Analysis by Dinesh Agarwal, tax partner, EY, with inputs from Chetan Mehta-senior tax professional, EY. Views expressed are personal)

A look at the numbers: