Union finance minister Nirmala Sitharaman had offered India Inc generous tax breaks last September. On Saturday, a sizeable section of around 7 per cent of working-age adults, who fall within the tax net in India, were given the option of a new deal as her budget proposals included a slash in the personal income tax rate for individuals for fiscal year 2020-21.

The first move by the JNU alumnus was based on a hope that the cuts would increase investments, result in jobs and spur growth, creating broader prosperity.

The new tax deal — lower rates for those earning up to Rs 15 lakh a year and no tax on annual income up to Rs 5 lakh, albeit without any exemptions — is aimed at leaving more money in the hands of people so that they loosen their purse strings, spend more and help the economy come out of the slowdown.

The other motivation behind the twin cuts must have been Sitharaman’s faith in Arthur Laffer, the Chicago University economist who had contended that high taxes would at some point discourage effort and reduce growth.

There have been debates over Laffer’s prescription for years as the Ronald Regan administration in the US didn’t reap the benefits that it had expected by slashing tax rates. In recent years, French economist Thomas Piketty and his colleagues concluded — after analysing economic data of over three decades from the developed world — that they found no meaningful correlation between cuts in tax rates and economic growth.

The Indian experience since the corporate tax slash also confirms the findings of Team Piketty as companies — despite enjoying higher earnings — have been reluctant to invest amid weak consumer demand, and the slowdown has only worsened since then. That the deceleration in growth is an economy-wide phenomenon has become clear in recent months with the poor show in key segments like agriculture, electricity, gas and water supply, hotel and transport, financial, real estate sectors and professional services.

Against this backdrop, an obvious question is why Sitharaman chose the path of offering tax breaks to the small group of tax-paying individuals at a time India’s growth is seen dipping to an 11-year low of 5 per cent in the current financial year and joblessness of youths has become a talking point across the country. Besides, ordinary people, who live mostly in rural areas, have cut spending even on food as real rural wages have contracted.

Over the past few months, economists have been discussing how the government can induce higher consumption in the economy, especially in rural areas, to revive demand and hence growth.

(The Telegraph picture)

In January, Sitharaman had indicated possibilities of cuts in income tax rates in her budget proposals. But several economists had suggested that she should give direct benefits to the lower-income deciles in rural areas to push consumption so that the economy chugs out of slowdown.

Such direct benefits to the poor — with higher spending propensity than the tax paying class who have higher savings propensity — would have helped the economy, besides leaving a welfare impact on rural and agrarian India.

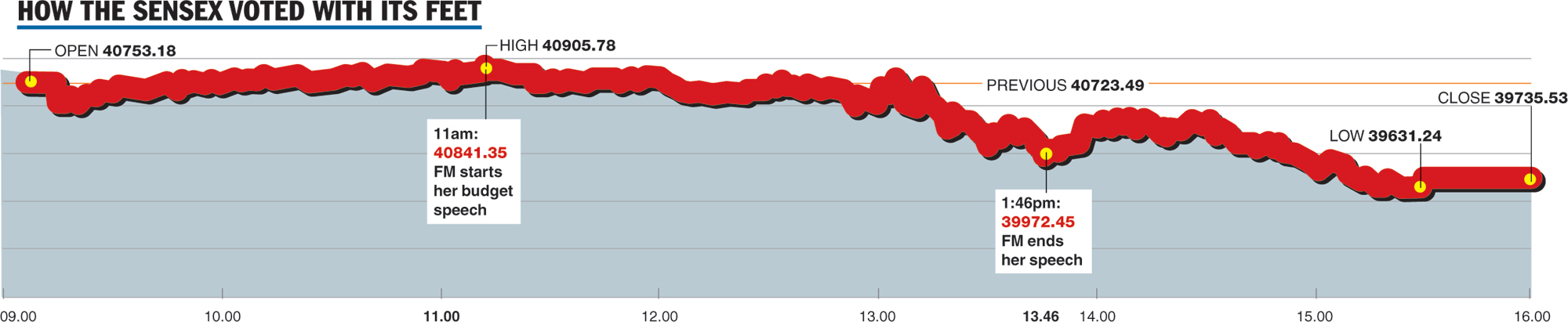

Although Sitharaman said in her speech that it was the budget to increase the purchasing power of the people, her proposals suggest she chose a different path, which can further compound the problems facing the Indian economy.

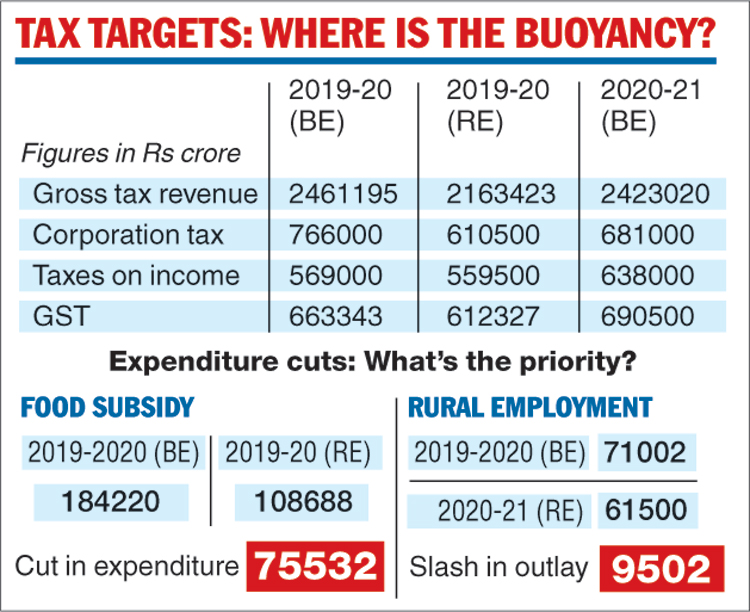

There is little doubt that the decision to lower the tax rate would cost the government dear on the income side. The budget numbers show that the projected gross tax revenue for the next fiscal would be around Rs 38,000 crore less than the target she had set for this fiscal. Given the record of tax collections — the difference between budget and revised estimates in this fiscal is around Rs 3 lakh crore — questions on whether the target can be met cannot be wished away.

(The Telegraph picture)

If Sitharaman misses the tax mop-up target, her budget arithmetic for the next fiscal will go awry with the likelihood of she missing the fiscal deficit target of 3.5 per cent of the GDP. Fiscal deficit is the difference between the government’s revenue receipts plus non-debt capital receipts and the total expenditure and that’s why is reflective of the total borrowing requirements.

Thanks to the largesse to the corporate sector, the finance minister has missed this year’s target as the revised estimate has pegged it at 3.8 per cent of the GDP while she had plans to contain it at 3.3 per cent of the GDP when she had presented her first budget last July. Her fiscal deficit target will also critically hinge on meeting the divestment target, pegged at Rs 2,10,000 crore. In view of the Centre’s experience while trying to sell off Air India, this target also seems suspect.

All these discussions on fiscal deficit do not mean that the finance minister has to be a fiscal purist. Given the state of the economy and the need for measures to revive it, eyebrows would not have been raised had she pressed a pause button on fiscal consolidation and tried to give a better deal to the people living in rural areas.

Instead, she tried to be within the limits of Fiscal Responsibility and Budget Management (FRBM) Act by spending Rs 75,000 crore less on food subsidy than the budget estimate for this fiscal. The note on variations between the budget and the revised estimates linked the slash to “lower requirements”.

This two-word explanation captures the priority of the government, which has also lowered outlay on rural employment for the next fiscal by over Rs 9,500 crore. The budget documents reveal “lower requirement under Mahatma Gandhi National Rural Employment Guarantee programme”.

So, the story of the budget in a poor country with highest ever unemployment rate is “lower requirement” of food subsidy and jobs in rural areas.