The bidding for 5G spectrum begins on July 26 amidst policy uncertainty over the scope of captive private networks, with the entry of the Adanis spicing up the auctions. With a little over a week for the sale, a much needed clarity awaits the operations of the private network players — which band they will get, the price they will have to pay for the spectrum that will be allocated to them as opposed to auctions and the period over which they will be allowed to hold the spectrum.

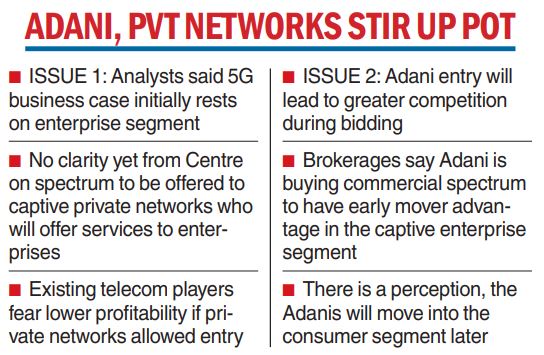

Analysts said the entry of Adani will impact the bidding strategies of Reliance Jio, Bharti Airtel and Vodafone. The DoT plans to release the earnest money deposited by the four bidders this week, which will give some idea about the bids. However, there is little clarity on the band and the amount of spectrum to be allocated to the private networks.

The telco industry body represented by the COAI and private network body BIF are engaged in ferocious a war of words as the allocation of spectrum for private networks would rob away the business case for 5G services in the country. “The 5G spectrum would be focussed on enterprises in the initial two to three years. Retail customers in select circles will probably be next. The entry of Adani in the fray is best seen in that context. Adani seems not to want to wait for clarity on the rules for private networks which could take up to a year,” Mahesh Uppal, telecom analyst said. Uppal said the Adanis would increase the intensity of competition. “Without the enterprise play, 5G does not yet have a strong business case. The 5G auction will tell us how the industry sees the 5G opportunity.”

The four players who have entered the bidding arena are: Adani Data Networks Ltd, Reliance Jio Infocomm Ltd, Vodafone Idea Ltd and Bharti Airtel. Adani Data Networks has a net worth of Rs 248.35 crore. The net worth of promoter firm Adani Enterprises — Rs 4,730.66 crore — will be used for determining the eligibility of the bids. Adani’s entry will create uncertainty over spectrum pricing, brokerage firm CLSA said. “The question is why would Adanis bid in auction versus awaiting a direct spectrum assignment? Adani’s entry will create uncertainty over spectrum pricing in the 5G auctions which was expected to see bidding competition primarily between Bharti Airtel and RJio,” it said in a report.

Goldman Sachs said, “We believe if Adani Group does end up buying spectrum in the upcoming auction, it could potentially increase competition in enterprise 5G, in addition to opening the doors for the group to expand into consumer mobile services over time.”

Adani has said that it will use the 5G network to create a private network to support its businesses — from airports and power to data centres.