Kumar Mangalam Birla is set to own the lasting legacy of his grandfather — the late Basant Kumar Birla.

UltraTech Cement, India’s largest cement maker led by Kumar Birla, is going to take over the cement business of Kesoram Industries, the flagship of B.K’s empire, in an all-stock deal, at an enterprise value of Rs 7,600 crore.

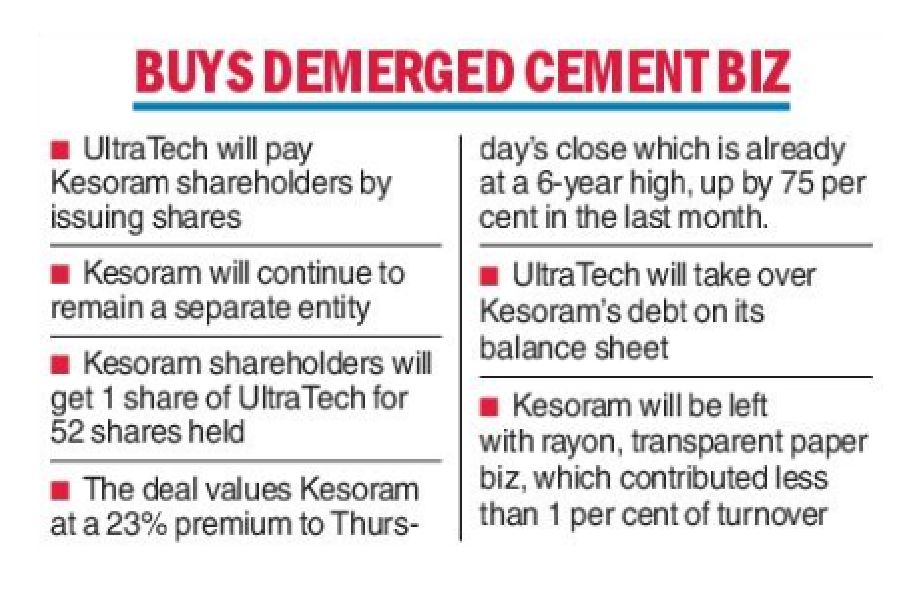

As reported by The Telegraph on Wednesday, Kesoram shareholders will get UltraTech shares as the value of the cement business, after factoring in the debt on Kesoram’s balance sheet.

Kesoram will remain an independent company with rayon, transparent paper and chemicals businesses which contributed less than 1 per cent to the company’s turnover of Rs 3,517 crore in FY23.

Kesoram shareholders will get one share of UltraTech for every 52 shares held, translating to a value of Rs 173 per share, which is a 23 per cent premium to the closing price of Rs 139.45 on Wednesday.

Analysts said the deal is good for Kesoram shareholders, which includes multiple entities controlled by Kumar Birla, as the plants are old.

In a statement to the bourses, UltraTech said the board considered the proposal of Kesoram and approved a composite scheme of arrangement between Kesoram, UltraTech and their respective shareholders and creditors.

The scheme provides for the demerger of the cement business which consists of two plants in Telangana and Karnataka with an installed capacity of 10.75 million tonnes and the reduction and cancellation of the preference share capital of Kesoram.

After the scheme becomes effective which could take 9-12 months as it requires various statutory approvals, including the NCLT and Competition Commission of India, fully paid-up equity shares and non-convertible redeemable preference shares of UltraTech shall be issued to the eligible shareholders of the demerged company.

UltraTech says the transaction will provide it with the opportunity to extend its footprint in the competitive and fast-growing western and southern markets in the country.

UltraTech’s cement capacity will stand augmented to 149.14mt including its overseas operations.

In a separate statement to the bourses, Kesoram said the scheme will assist the company in deleveraging the balance sheet including the reduction of debt and outflow of interest.

Additionally, the non-convertible debentures of the company, listed on BSE Limited, will be transferred to UltraTech. It also informed that there shall be no change in the equity shareholding pattern of Kesoram as a consequence of the effectiveness of the scheme.

The journey of the company began with a cotton textile mill in Calcutta in 1919. The rayon business was added in 1959 and the cement business in late 60s. The company was led by Basant Kumar Birla, son of Ghanashyam Das Birla, the founder of the Birla empire, till his death in 2019, even though Manjushree Khaitan, younger daughter of BK and aunt of Kumar Birla, was in active management of the company as the vice chairman for years.

Even though Khaitan led management, with support from Kumar Birla companies, tried to turn around Kesoram, it did not work out. A series of restructuring began with sale of Haridwar tyre uint to JK Tyre in 2015, demerger of the residual tyre business in 2020, refinance of bank debt with costly NCD from the likes of Goldman Sachs and Edelweiss at a rate of 19-20 per cent interest. The company has been trying to refinance the NCDs again but it was not to be.