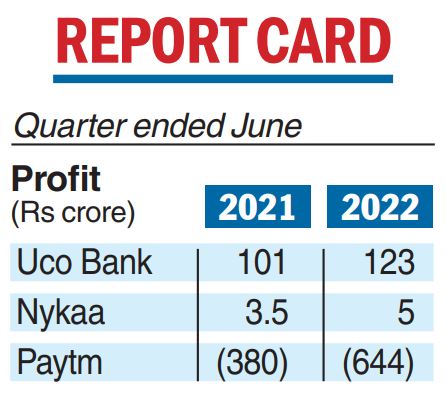

State-owned Uco Bank on Friday posted a 22 per cent rise in its net profit at Rs 123.61 crore for the first quarter ended June 30, helped by a fall in bad loans. The bank had reported a net profit of Rs 101.81 crore in the same quarter of 2021-22.

However, total income declined to Rs 3,796.59 crore from Rs 4,539.08 crore in the first quarter of the previous fiscal, Uco Bank said in a regulatory filing.

Interest income during the quarter under review increased to Rs 3,851.07 crore from Rs 3,569.57 a year ago.

The Calcutta-based lender trimmed its gross non-performing assets (NPAs or bad loans) to 7.42 per cent of the gross advances as of June 30 against 9.37 per cent in the first quarter of FY 2021-22.

In value terms, gross NPAs fell to Rs 9,739.65 crore from Rs 11,321.76 crore.

Net NPAs too declined to 2.4 per cent in the quarter under review from 3.85 per cent a year ago.

The bank’s provisions for bad loans and contingencies came down to Rs 246.83 crore in the reported quarter from Rs 1,127.11 crore in the year ago period.

Of this, the provisions for NPAs also decreased to Rs 267.56 crore in the first quarter of this fiscal, from Rs 844.76 crore a year ago.

Uco Bank officials on Friday indicated that lenders are likely to jointly explore the possibility of transferring the accounts of Srei group companies, currently under insolvency, to asset restructuring companies for faster resolution.

Nykaa net up 42%

FSN E-commerce, which operates under the Nykaa brand, on Friday said its consolidated net profit rose nearly 42 per cent to Rs 5 crore in the April-June quarter of FY2023.

The company had recorded a net profit of Rs 3.52 crore in the same period a year ago.

The consolidated revenue from operations of Nykaa increased by 41 per cent to Rs 1,148.42 crore during the reported quarter from Rs 816.99 crore in the June 2021 quarter.

Paytm loss widens

One97 Communications, which operates under the Paytm brand, on Friday said its consolidated loss widened to Rs 644.4 crore in the first quarter ended June 30 against a net loss of Rs 380.2 crore a year ago.

Consolidated revenue from operations increased 89 per cent to Rs 1,680 crore during the reported quarter from Rs 891 crore in the June 2021 quarter.