Two promoter group entities of Ajanta Pharma on Thursday offloaded almost 54.93 lakh shares accounting for 4.28 per cent of its equity, in a transaction worth Rs 637 crore.

The shares were sold in block deals on the NSE at an average price of Rs 1,160.10 per share, a discount of a little over 1 per cent to the closing price of the Ajanta Pharma scrip on the BSE on Wednesday.

The shares were picked up by ICICI Prudential Mutual Fund and Nippon India Mutual Fund.

The Ravi Agrawal Trust — a promoter entity — sold 16.3 lakh shares, while the Aayush Agrawal Trust sold 38.5 lakh shares.

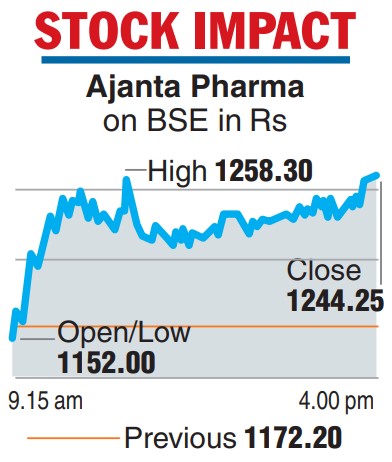

The deal led to the shares of Ajanta Pharma ending in the green: the scrip finished at Rs 1,244.25 on the BSE — a gain of 6.15 per cent over the previous close.

More than one lakh shares were transacted, much above the two week average quantity of 1,957 shares.

Ajanta Pharma closed at Rs 1,233 on the NSE, a rise of 5.22 per cent over the previous close.

The company has seven manufacturing facilities in India.

During the second quarter ended September 30, 2022, the company posted revenues of Rs 938 crore, a rise of 6 per cent over the same period in the previous fiscal.

The profit after tax came in at Rs 157 crore against Rs 196 crore a year ago.

During the quarter ended September 30, 2022, the promoters holding stood at 70.48 per cent.