The majority of the Reserve Bank of India’s monetary policy makers support the measures that the central bank has adopted to tamp down on inflation which is expected to cool to 4.5 per cent this year.

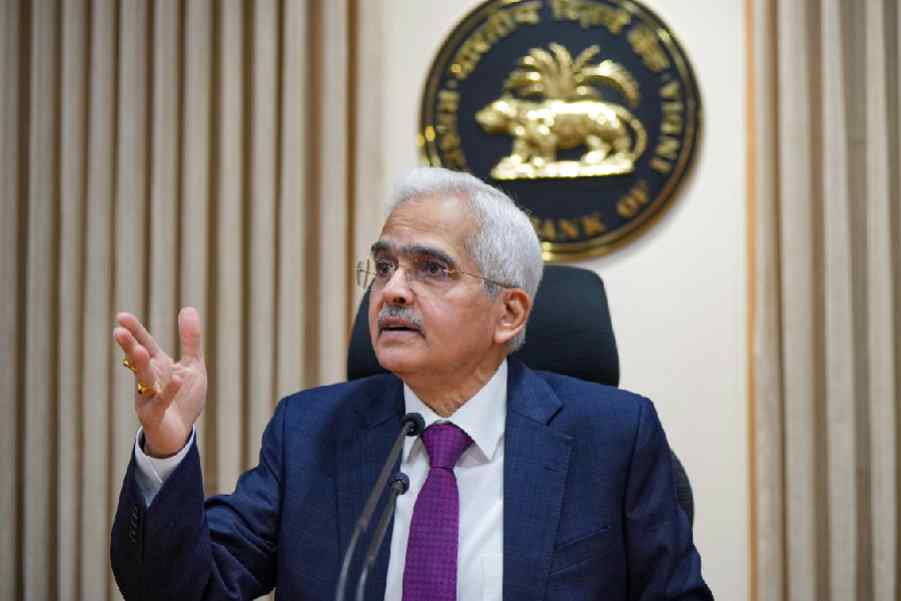

“The baseline projections show inflation moderating to 4.5 per cent in 2024-25 from 5.4 per cent in 2023-24 and 6.7 per cent in 2022-23. This success in the disinflation process should not distract us from the vulnerability of the inflation trajectory to the frequent incidences of supply side shocks,” said RBI governor Shaktikanta Das according to the minutes of the meeting held earlier this month.

“Overlapping food price shocks …(and) lingering geo-political tensions and their impact on commodity prices and supply chains are adding to uncertainties in

the inflation trajectory. These considerations call for monetary policy actions to tread the last mile of disinflation with extreme care,” Das added.

On April 5, the MPC had retained the policy repo rate at 6.5 per cent for the seventh time in a row.

Barring Prof Jayanth Varma who called for a reduction of 25 basis points, the other five members had voted in favour of keeping the benchmark rate unchanged.

As he has done in the past, Varma had also voted to change the stance on liquidity to neutral — a situation that harks back to June 2019. Most members are in favour of a gradual withdrawal of accommodation.