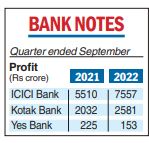

ICICI Bank on Saturday topped Street estimates to post a 37 per cent growth in standalone net profit for the second quarter ended September 30 on higher loan growth and lower provisions. The lender reported a net profit of Rs 7,557.84 crore against Rs 5,510.95 crore a year ago.

Analysts had projected a net profit of around Rs 7,300 crore for the lender.

This rise in its bottomline came on the back of a 26 per cent jump in net interest income (NII-interest paid minus interest earned). The core income shot up to Rs 14,787 crore from Rs 11,690 crore in the year-ago period.

The robust performance in its NII was on account of a solid 24 per cent growth in domestic advances during the period which rose to Rs 9,00,572 crore from Rs 7,26,236 crore in the year-ago period.

At a meeting on Saturday, the board of directors of ICICI Bank re-appointed Sandeep Bakhshi as its managing director and CEO for a period of three years, subject to approval from the RBI and its shareholders.

Retail loan portfolio grew 25 per cent over the corresponding period in the previous year, and comprised 54 per cent of the total loan portfolio on September 30. The business banking portfolio grew 43 per cent over the year-ago period while the SME business, comprising borrowers with a turnover of less than Rs 250 crore shot upby 27 per cent over the previousyear. Domestic corporate portfolio also rose by 23 per cent.

Kotak Bank

Kotak Mahindra Bank also posted better-than-expected numbers, when it reported a 27 per cent rise in net profit at Rs 2,581 crore for the quarter ended September. The lender had posted a net profit of Rs2,032 crore in the same quarter of the previous fiscal year.

NII increased to Rs 5,099crore from Rs 4,021 crore in the corresponding quarter of the previous year, up 27 per cent.

On the assets front, there was an improvement when the bank’s gross NPAs stood at2.08 per cent of gross advances at the end of September, down from 3.19 per cent a year ago, while net NPAs dropped to 0.55per cent from 1.06 per cent.

Yes Bank net dips

Yes Bank on Saturday reported a 32 per cent dip in September quarter net profit at Rs153 crore as legacy bad assets come to haunt the private sector lender, resulting in higher provisions. The bank had reported a post-tax profit of Rs 225 crore a year ago.