Dear Investor,

This letter comes to you at a juncture when a crisis is unfolding right before your eyes. Whether you like it or not, one of the biggest drawdowns in recent times is being played out. The reference is not to standing armies or nuclear arsenals but to the withdrawals from the average retirement kitty. The reason: Covid-19 and the resulting economic paralysis, supply disruptions, business closures and pay cuts.

A lot of people who have painstakingly nurtured their retirement nest-eggs for years, are being forced to dip into this very corpus. Worse, however, is the realisation that they will have to make do with much less once they reach the retirement age.

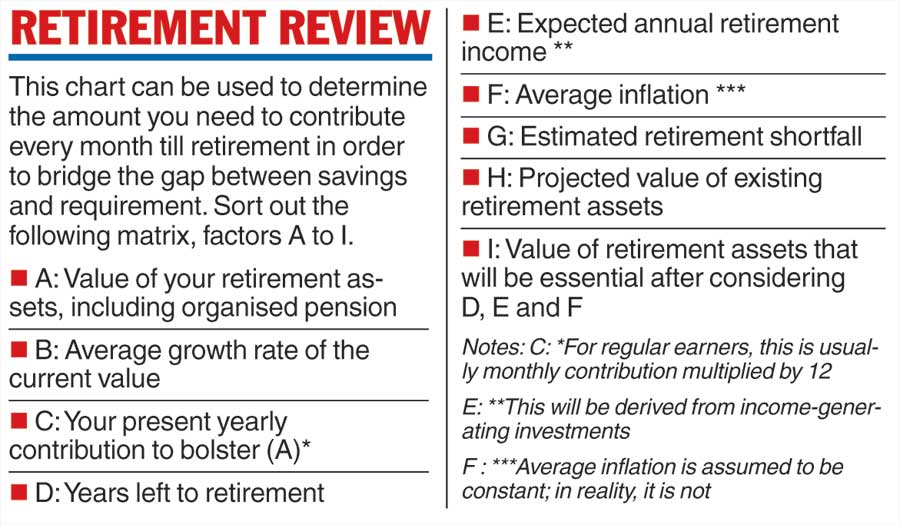

Yes, the situation is very challenging. The gap between the resources you will require in your retired years and the money that you have actually saved for the same is increasing. The gap, a dreaded one even in advanced nations where social security is more than a mere buzzword, is likely to be wider if this crisis persists. For a country such as India, where poverty is rife, the consequences are more severe.

Remember, our retail inflation numbers have lately advanced, a trend that gets captured adequately in the prices of everyday goods and services. The July figure is close to 7 per cent. For the record, the annual interest that is being generally offered by most of the popular banks is approximately 5.5 per cent. And that clearly falls short of inflation.

A common product like detergent worth Rs 100 will cost Rs 107 next year, assuming inflation stays constant at 7 per cent. However, at the current rate, your deposit of Rs 100 with a local bank will merely become Rs 105.50 next year. The imbalance is apparent; the earning versus expenditure battle becomes difficult for you by the minute.

What now?

When a drawdown is imminent, the following pointers can be considered:

- A rational withdrawal strategy is essential. You may be tempted to quickly liquidate a part of your retirement corpus to meet an emergency. However, a step-by-step withdrawal will make more sense during this crisis.

- A strategic drawdown can be effected in various forms. Just as you stashed away regular amounts when you enjoyed an active income, a methodical withdrawal is now necessary. Take out, for instance, a uniform Rs 20,000 per month (not more, not less) to meet the gap between revenue and expense. You will need to set your own limits to match your circumstances.

- Alteration of your asset allocation may be necessary. Perhaps you should consciously move away from riskier assets like equity; instead, you may increase your exposure to debt. The latter will fortify your portfolio by providing stability, liquidity and income.

Not without risk

However, an added focus on debt may potentially slow down your portfolio. Traditional debt instruments (which offer somewhat predictable returns) are low-yielding when compared to their equity counterparts; the latter, despite all the risk can act be powerhouses.

Here’s a list of to-do’s for you:

- Look for assured returns — guaranteed-income products are getting rare, but they are still not very hard to find

- Reduce expenses. While healthcare costs are non-negotiable, there is no point in spending a lot on entertainment, food and transportation

- Delay gratification as you deem fit. Instead, focus on products such as annuities, the efficacy of which of course lies in what you have actually done in your income-generating years.

- Beware of financial fraud. Remember, retired folks are often targeted by glib-talking scammers, especially those who can leverage technology to their advantage.

- Explore the possibility of monetising assets such as real estate and art. Sell that small apartment you had purchased 20 years ago, the one that no one in the family will need anytime soon. Or dispose of your second vehicle, the one that is lying in the garage because you travel less anyway.

And finally...

The last word in a stern letter like this can be forbidding too. You need to save and invest as much as possible while you are still working. If you haven’t done it, or if you have ignored the need to build your own pension scheme, adverse conditions in the market will leave you panting for air.

Resorting to drawdowns in normal circumstances is bad in itself — the “new normal” led by Covid-19 and marked by serious challenges will be a lot worse. So expect less from your allocations, pare your assumptions, learn to live with limited resources. You will still need to pay taxes, remember.

Your retired life may be a long one, thanks to advanced medical science. Imagine living in retirement for two whole decades or more. Living a healthy life after 65 is often an enormous challenge. Staying close to liquid assets is an easy solution, but chances are there will be a lot of sacrifices. However, with some careful planning and financial discipline you can give yourself a comfortable old age. Take care.

Yours sincerely...

The writer is director, Wishlist Capital Advisors