Puny midgets do sometimes win even when they are pitched against mighty giants. The rationale of under-sized entities battling powerful players — and recording convincing victories — has found resonance in the stock markets time and again. Witness the most recent surge in small cap stocks, view them in the light of the modest advances recorded lately by large caps, and you will know the truth. Indeed, a range of small caps have gained significantly, while many large caps have remained sluggish in comparison.

Let us stretch the point with a trend worth mentioning. It pertains to folios in small cap funds. Their numbers might just surprise you. In keeping with the inclination seen over the last couple of years, small cap folios have not only beaten past records but they have also nearly equalled the number of their large cap counterparts. Some sections have also pointed out that they have now actually surpassed that of mid cap folios.

The scenario can be explained in the context of market cap stacks and recent developments concerning such rankings. It can also lead to two important questions. One, will current small cap valuations actually sustain and even advance further? Or are they already over-bought and this is just the right time for retraction? Two, how should common investors react to the phenomenon? How should they strategise in these circumstances? Here, we will assume that a very sizeable number of common investors have already commited heavily to small caps.

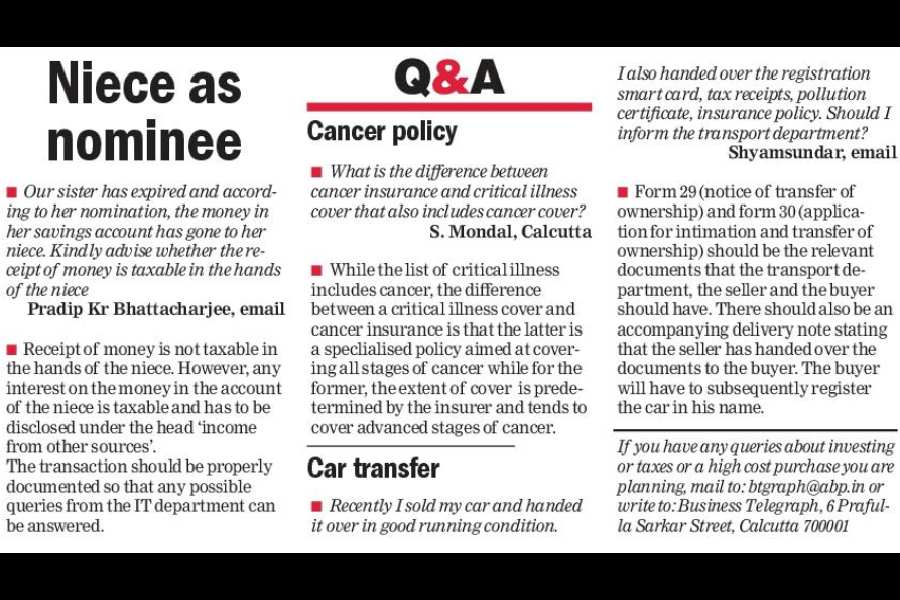

Let us also try to arrive at solutions, after considering the functional aspects of the small caps space (and, well, mid caps as well to some extent). Both market cap classifications are swayed constantly and massively by market trends. To pinpoint small caps exclusively, we will zero in on the major small cap benchmarks and take a quick look at their recent performance. Here we have sourced our data from the NSE. The indices we have chosen are (see chart):

- Nifty Small Cap 50; Nifty Small Cap 100; Nifty Small Cap 250; Nifty MidSmall Cap 40

The attached table portrays the stark movements in the indices across their 52-week lows and highs.

Moreover, it underscores the crux of our premise as well. The Nifty Small Cap 250, for instance, has advanced roughly 50 per cent between the two relevant data points. Remember, given the sheer number of small cap stocks being traded on the bourses, a broadbased benchmark (with 250 constituents) is sometimes preferred. Concurrently, a narrower index such as the Nifty Small Cap 50 is considered too one-sided for the purpose of surveys.

The fact of the matter is that small caps have relentlessly demonstrated great potential. And now the classic problem of plenty has emerged once again, leading investors to ask whether valuations are already too stretched.

Strategise or perish

The issue has already prompted the market to look inwards at valuations. Perhaps the average participant is right now far too deeply invested in risky small cap equities, not to mention their mid cap brethren. The fact that many small caps have lost valuations over the past few trading days is indicative in the context of volatility. So a reassignment of allocations may be considered necessary.

If you are an average investor who has piled up on small caps, you may pause a while at this juncture. You will have several questions to consider. Here is a small list.

- What is your best way out if, say, your allocation on account of small caps is way above 50 per cent of the total?

- If this is indeed time to prune your exposure, how will you proceed?

- There will be tax implications (capital gains, after all, will be recorded) if you sell outright. Are you aware of such obligations? Mind you, as for redemptions of small cap funds or exits from small cap stocks — a sale is a sale. Gains will be taxed no doubt.

- If not small caps, what? This is, you will agree, the most serious question at this point. As the investor who intends to pare his position, an alternative must be found without delay.

Yes, think large

To that very critical poser, we have a bespoke answer. Since there will be no perfect replacements, and comparisons between small and large will certainly not be accurate, as large caps will make an obvious choice for the risk-averse investor. You will, of course, argue that large can never substitute small, and you will be completely right.

The narrative, however, will turn to different direction if you weigh the relative merits of large caps. The latter are often considered as steadfast anchors in very volatile market conditions. Large caps, for the uninitiated, are stocks ranked between the first and the hundredth. The reference here is obviously market capitalisations.

Here are two pertinent points worth considering.

- As large cap fans will tell you, these constituents of the market are comparatively less swayed by uncertainties. Ergo, some quarters urge investors to look at them as “core” assets. The latter, it is frequently argued, should account for a very heavy part of one’s portfolio. It is not right for us to suggest anything specific here, but many conservative investors are often known to routinely assign 50 per cent weightages to large caps. Of course, there can be no hard and fast rule in this regard.

- Just as large can act as the core, small and mid can bring up the rear as “satellite”. Small caps can serve as dependable and strategic fits. Ideal as supports, right for investors who have already formed their core portfolios.

At the end, let us devise a functional plan for small cap followers. This can be summed up thus: start systematic investment plans in select small cap funds. The latter should be open-end and diversified. In fact, diversification will be greatly needed for the ordinary investor. No decent investment stratagem can function well over the long term (and across market cycles) if it is not sufficiently broad based and inclusive. We rest our case — may both small and large find their champions and cheerleaders.

The writer is director of Wishlist Capital Advisors