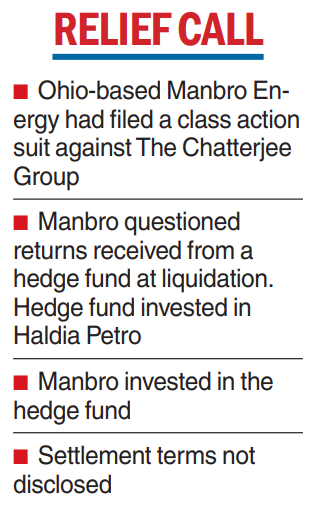

The Chatterjee Group has settled disputes with a US-based investor who had hit them with a proposed class action in the court of the southern district of New York about TCG’s investment in Haldia Petrochemicals Ltd (HPL).

Manbro Energy Corporation, an Ohio-based company, had filed the breach of contract and breach of the implied covenant of good faith and fair dealing complaint, among others, against Chatterjee Advisors and its related entities for gyping them out of returns on their investment in HPL.

Court records show parties settled soon after the jury trial following three years of legal disputes.

“The court has been informed that the parties have reached a settlement in this case. Accordingly, it is hereby ordered that this action is dismissed without costs and without prejudice to restoring the action to the court’s calendar, provided the application to restore the action is made within 30 days of the order,” District Judge Lorna G. Schofield, wrote in her order on July 19.

The terms of the settlement remained private and did not form part of the order, which is yet to be reported in the press. Questions sent to TCG remained unanswered while Manbro could not be reached for comment.

TCG is the majority shareholder in HPL.

The case

Manbro brought charges of ‘‘breach of contract, breach of the implied covenant of good faith and fair dealing, tortious interference with contract, and unjust enrichment,” against Chatterjee Advisors, Chatterjee Fund Management, Chatterjee Management Company, The Chatterjee Group and Purnendu Chatterjee.

The Telegraph was the first to report the same on May 30, 2020. The Chatterjee Advisors and its associates denied the claims made by Manbro and filed a motion to dismiss the complaints. Judge Schofield had denied the motion to dismiss in part and granted it in part during the proceedings over the last three years.

Manbro along with other investors had put money in a hedge fund Winston Partners Private Equity LLC which was being managed by Chatterjee Advisor in 1997. WPPE had invested in Haldia Petro through Chatterjee Petrochemical (Mauritius) Company. Investment services to the firm were provided by Chatterjee Management Company.

In May 2017, Manbro was informed that the fund was being dissolved and the investors would be getting a final cash distribution which would be equal to their respective fund net asset value as of March 31, 2017.

The hedge fund’s only significant investment at the time of dissolution was HPL shares, the complaint said, adding that the redemption price was based on HPL shares of Rs 10, representing the cost of the fund’s investment in HPL shares in the 1990s.

The complaint says HPL had gone on to make record profits in the year ending 2017. A credit rating exercise conducted by Icra had put the profit after tax of the company (audited) at Rs 863.4 crore for March 31, 2017, compared with Rs 119.8 crore recorded a year before.

“In 2017, following several years of reduced earnings and restructurings, HPL had reached a turning point, its value had substantially increased, and it was poised for further significant growth. Rather than maximising value for WPPE investors, including plaintiff who had been invested in the fund for nearly 20 years, defendants saw an opportunity to capture the full upside of this long-term investment for themselves,” the complaint read.

The complaint went on to say: “This (HPL) was an investment that had appreciated significantly since the initial investment two decades earlier. In fact, applying any reasonable multiple to that amount of EBITDA would result in a per-share value of HPL that is orders of magnitude higher than ten INR per share.”

Manbro claimed that CPMC, where WPPE was invested, maintained its shareholding in HPL during the period of dispute. “In other words, it became clear that by the final distribution and dissolution of the fund, defendants had effectively transferred the HPL shares to themselves at a severely discounted price at the expense of the fund’s investors.”