Telecom tariffs are likely to go up after the operators splashed out Rs 1.5 lakh crore in the spectrum auction, including 5G airwaves.

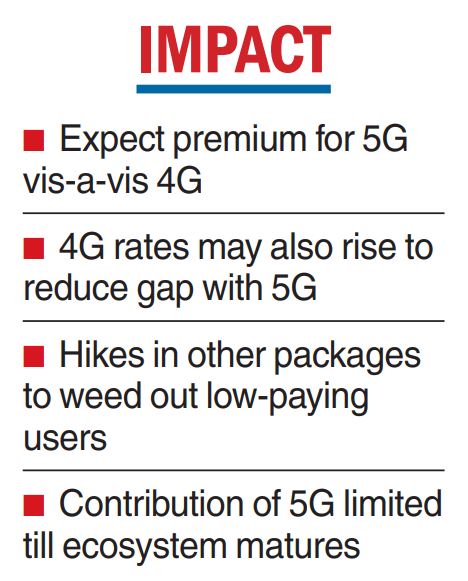

Analysts said the telcos could go in for a differentiated tariff for 4G and 5G and also increase charges on their other plans to improve their average revenue per user (ARPU) by getting rid of low-paying, inactive subscribers.

Nomura said as there was no spectrum usage charge (SUC) for the 5G spectrum, it expects an annual expenditure of Rs 7,500 crore on spectrum which will require a modest 4 per cent hike in tariff. The operators may also charge a 30 per cent premium on the 5G package vis-a-vis their 4G tariffs.

Bharti Airtel India and South Asia MD and CEO Gopal Vittal has said one more increase is required to reach the company’s target of Rs 200 average ARPU.All three telcos have reported an improved ARPU during the March quarter.

Airtel reported the highest ARPU of Rs 178 per user. Reliance Jio and Vodafone Idea reported an ARPU of Rs 167.6 and Rs 124, respectively.

“Adoption of 5G services will hinge on the extent of premium over 4G tariffs. In a bid to ensure mass adoption of 5G, telecom companies may raise tariffs for 4G services, too, despite two rounds of major tariff hikes effected in December 2019 and November 2021, respectively. We expect another tariff hike for 4G services in the second half of the current fiscal,” said Manish Gupta, senior director of Crisil Ratings.

“We have baked in 15 per cent tariff hike in our assumption along with SUC savings of Rs 800 crore and Rs 2,000 crore in FY24 and FY25, respectively. We believe that spectrum related payout and Adani’s potential entry in the B2C space is now behind and focus will shift towards tariff hike quantum and timeline,” Emkay said in a research report.

“We believe tariff hikes are likely by end-CY22, as telcos would focus on monetisation to offset the hefty spectrum commitments,” Jefferies said.

According to Goldman Sachs Equity Research, 5G rollouts have not resulted in any meaningful uptick in capex for telecom companies globally, and it foresees a similar trend in India. “We continue to expect a tariff hike before the end of calendar year 2022 and view that as a next catalyst for the sector.”

“We expect limited contribution from 5G revenues for the next two to three years until the ecosystem matures and widespread applications develop. We assume 5G revenue growth picking up from FY26,” BoFA said.